Region:Middle East

Author(s):Dev

Product Code:KRAD7659

Pages:91

Published On:December 2025

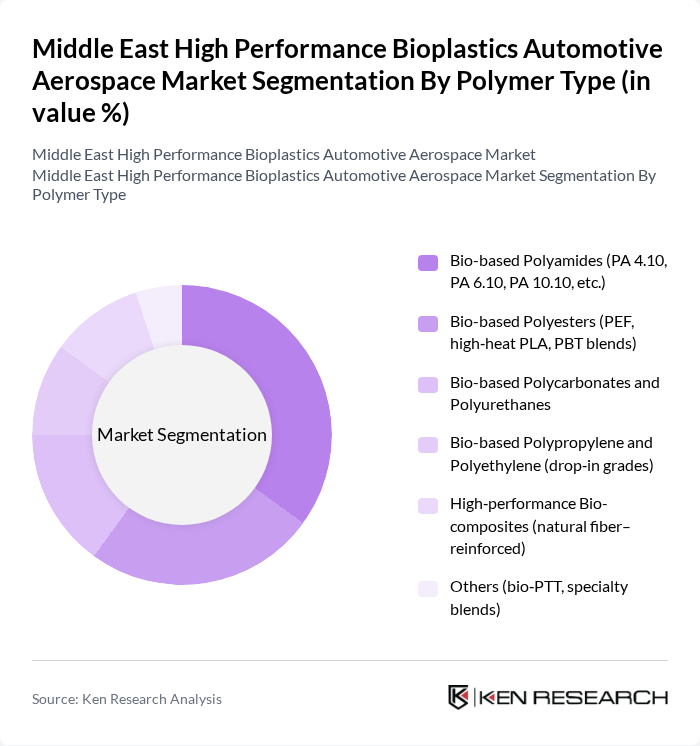

By Polymer Type:The polymer type segmentation includes various bioplastics that are utilized in automotive and aerospace applications. The dominant sub-segment is bio-based polyamides, which are favored for their high performance and durability. Bio-based polyesters and bio-based polycarbonates are also gaining traction due to their versatility and eco-friendly properties. The market is witnessing a shift towards high-performance bio-composites, driven by the demand for lightweight materials that do not compromise on strength.

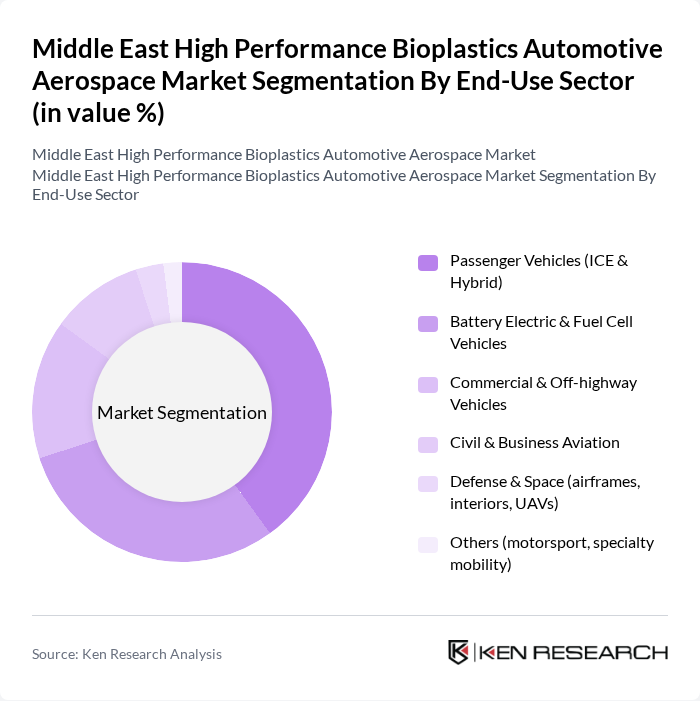

By End-Use Sector:The end-use sector segmentation highlights the various applications of bioplastics in the automotive and aerospace industries. The passenger vehicles segment, including both internal combustion engine (ICE) and hybrid vehicles, is the largest consumer of bioplastics, driven by the need for lightweight materials to improve fuel efficiency. Battery electric and fuel cell vehicles are also emerging as significant contributors, reflecting the industry's shift towards sustainable transportation solutions.

The Middle East High Performance Bioplastics Automotive Aerospace Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, NatureWorks LLC, Novamont S.p.A., Braskem S.A., DuPont de Nemours, Inc., TotalEnergies Corbion PLA, Mitsubishi Chemical Group Corporation, Covestro AG, Arkema S.A., SABIC (Saudi Basic Industries Corporation), QatarEnergy (Polymers & Sustainable Materials Division), Ecoway Biopolymers LLC (UAE), Emirates Biotech Polymers FZ-LLC, FKuR Kunststoff GmbH, Biome Bioplastics Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East high-performance bioplastics market in automotive and aerospace sectors appears promising, driven by increasing investments in sustainable technologies and a growing emphasis on reducing carbon footprints. As manufacturers seek to comply with stringent regulations and consumer demand for eco-friendly products rises, the adoption of bioplastics is expected to accelerate. Furthermore, collaborations between bioplastics producers and automotive manufacturers will likely enhance innovation, leading to the development of advanced materials that meet industry standards while promoting sustainability.

| Segment | Sub-Segments |

|---|---|

| By Polymer Type | Bio-based Polyamides (PA 4.10, PA 6.10, PA 10.10, etc.) Bio-based Polyesters (PEF, high?heat PLA, PBT blends) Bio-based Polycarbonates and Polyurethanes Bio-based Polypropylene and Polyethylene (drop?in grades) High?performance Bio-composites (natural fiber–reinforced) Others (bio?PTT, specialty blends) |

| By End-Use Sector | Passenger Vehicles (ICE & Hybrid) Battery Electric & Fuel Cell Vehicles Commercial & Off?highway Vehicles Civil & Business Aviation Defense & Space (airframes, interiors, UAVs) Others (motorsport, specialty mobility) |

| By Application | Interior Components (dashboards, door panels, seat parts, trim) Exterior & Body Components (panels, mirror housings, wheel covers) Under?the?hood & Structural Components Electrical & Electronic Components (connectors, housings, cable insulation) D?Printed & Additive Manufacturing Parts Others (prototypes, tooling, brackets) |

| By Feedstock Source | First?generation (corn, sugarcane, sugar beet) Second?generation (agricultural residues, non?food biomass) CO??based & Advanced Biotechnological Routes Others (waste oils, municipal bio?waste) |

| By Performance Attribute | High Heat & Thermal Stability Grades High Mechanical Strength & Stiffness Grades Flame?retardant & Low?smoke Emission Grades Chemical & Fuel?resistant Grades Lightweight & Density?optimized Grades Others (UV?stable, low?VOC, low?noise) |

| By Certification & Compliance | Automotive OEM Specifications (e.g., VW, Stellantis, Toyota, Hyundai Group) Aerospace Standards (e.g., FAR 25.853, RTCA DO?160) Environmental & Sustainability Certifications (ISCC+, ASTM D6866, EN 16785?1) End?of?life & Circularity Compliance (recyclability, compostability, EPR schemes) |

| By Country | Saudi Arabia United Arab Emirates Turkey Qatar Egypt Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Bioplastics Usage | 120 | Product Managers, Material Engineers |

| Aerospace Bioplastics Applications | 90 | Design Engineers, Compliance Officers |

| Supply Chain Sustainability Practices | 100 | Supply Chain Managers, Sustainability Directors |

| Market Trends in Bioplastics | 80 | Market Analysts, Business Development Managers |

| Regulatory Impact on Bioplastics | 70 | Policy Makers, Regulatory Affairs Specialists |

The Middle East High Performance Bioplastics Automotive Aerospace Market is valued at approximately USD 1 billion, reflecting a significant growth trend driven by environmental regulations, demand for sustainable materials, and advancements in bioplastics technology.