Region:Middle East

Author(s):Dev

Product Code:KRAA8401

Pages:83

Published On:November 2025

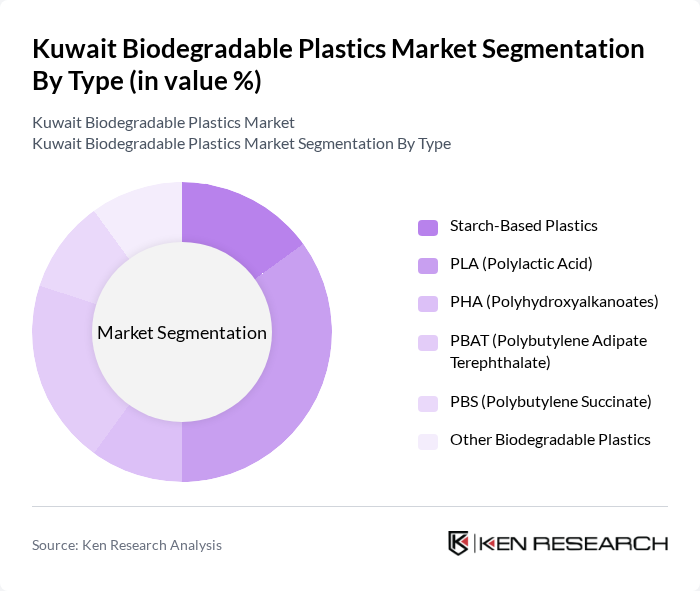

By Type:The biodegradable plastics market in Kuwait is segmented into starch-based plastics, PLA (Polylactic Acid), PHA (Polyhydroxyalkanoates), PBAT (Polybutylene Adipate Terephthalate), PBS (Polybutylene Succinate), and other biodegradable plastics. PLA continues to gain significant traction due to its versatility, cost-effectiveness, and broad application in packaging and consumer goods. The preference for sustainable materials in food packaging and disposable items is driving demand for PLA, making it the leading subsegment. Starch-based plastics are also prominent, benefiting from compatibility with existing processing infrastructure and favorable regulatory support.

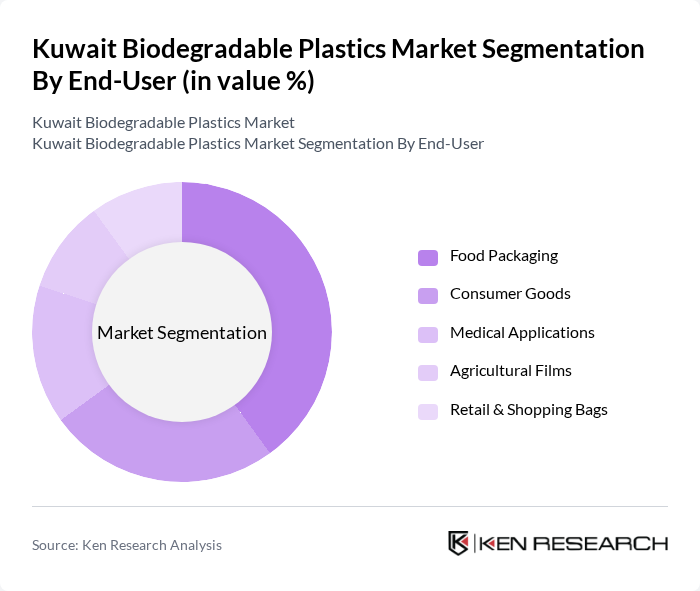

By End-User:The end-user segmentation includes food packaging, consumer goods, medical applications, agricultural films, and retail & shopping bags. Food packaging is the largest segment, reflecting strong demand for sustainable solutions in the food industry. Increasing consumer environmental consciousness and regulatory requirements are prompting food manufacturers to adopt biodegradable materials. The consumer goods and retail & shopping bags segments are also expanding, supported by government mandates and growing sustainability initiatives in Kuwait.

The Kuwait Biodegradable Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as BioBag International AS, BASF SE, Novamont S.p.A., NatureWorks LLC, Biome Bioplastics Ltd, Green Dot Bioplastics Inc., TIPA Corp Ltd., Eco-Products, Inc., FKuR Kunststoff GmbH, Cardia Bioplastics Limited, Earthpack, Vegware Ltd, BioLogiQ, Inc., AIMPLAS (Instituto Tecnológico del Plástico), Biofase, Gulf Bioplastics Company W.L.L., Kuwait Polyurethane Industry (KPI), Al Enma'a Biodegradable Plastic Factory, United Waste Management Company (UWMC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the biodegradable plastics market in Kuwait appears promising, driven by increasing environmental consciousness and supportive government policies. As more consumers demand sustainable products, manufacturers are likely to innovate and expand their biodegradable offerings. Additionally, the collaboration between businesses and eco-conscious brands will enhance product visibility and acceptance. With ongoing investments in research and development, the market is expected to evolve, addressing challenges and capitalizing on emerging trends in sustainability and eco-friendly materials.

| Segment | Sub-Segments |

|---|---|

| By Type | Starch-Based Plastics PLA (Polylactic Acid) PHA (Polyhydroxyalkanoates) PBAT (Polybutylene Adipate Terephthalate) PBS (Polybutylene Succinate) Other Biodegradable Plastics |

| By End-User | Food Packaging Consumer Goods Medical Applications Agricultural Films Retail & Shopping Bags |

| By Application | Packaging (Flexible & Rigid) Disposable Tableware Agricultural Products (Mulch Films, Seed Coatings) Textiles & Nonwovens Other Applications |

| By Material Source | Renewable Resources (Corn, Sugarcane, Cassava, etc.) Recycled Materials Fossil-Based Biodegradables Other Sources |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Industrial/Institutional Procurement Other Channels |

| By Region | Central Kuwait Northern Kuwait Southern Kuwait Other Regions |

| By Others | Custom Solutions Biodegradable Additives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturers of Biodegradable Plastics | 60 | Production Managers, R&D Heads |

| Distributors and Wholesalers | 50 | Sales Managers, Supply Chain Coordinators |

| Retailers Using Biodegradable Products | 40 | Store Managers, Procurement Officers |

| Environmental Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Consumers of Biodegradable Products | 100 | General Public, Eco-conscious Consumers |

The Kuwait Biodegradable Plastics Market is valued at approximately USD 12 million, reflecting a growing segment within the broader Middle East biodegradable plastics market, which totals USD 117.8 million.