Region:Middle East

Author(s):Rebecca

Product Code:KRAD2877

Pages:85

Published On:November 2025

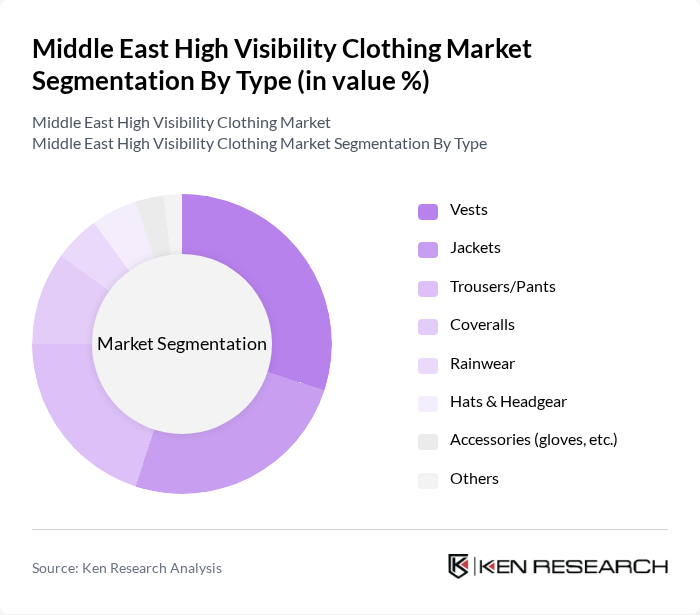

By Type:The market is segmented into various types of high visibility clothing, including vests, jackets, trousers/pants, coveralls, rainwear, hats & headgear, accessories, and others. Among these, vests and jackets are the most popular due to their versatility and comfort, making them suitable for a wide range of industries. The demand for trousers and coveralls is also significant, particularly in construction and industrial sectors, where full-body protection is essential. The popularity of hats and headgear is further supported by the region’s climate and cultural preferences .

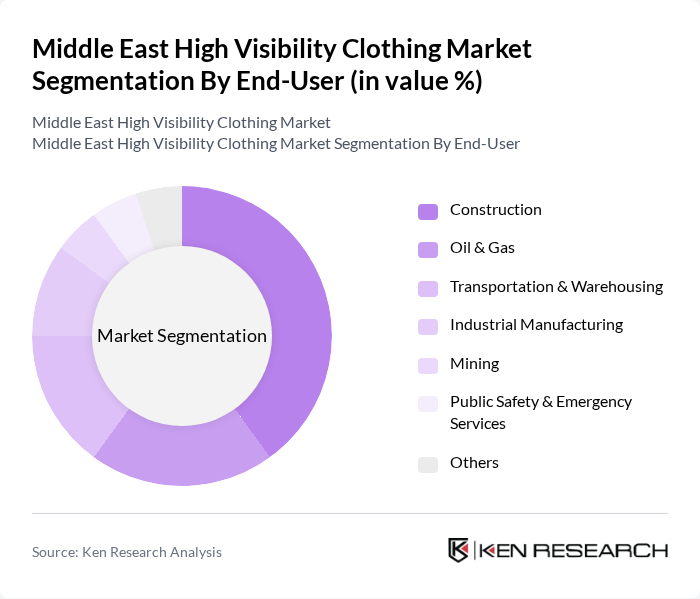

By End-User:The high visibility clothing market is segmented by end-user industries, including construction, oil & gas, transportation & warehousing, industrial manufacturing, mining, public safety & emergency services, and others. The construction sector is the largest consumer of high visibility clothing, driven by stringent safety regulations and the need for visibility in hazardous environments. The oil & gas industry also represents a significant segment due to the high-risk nature of operations in this sector. Transportation and warehousing are also major end-users, reflecting the region’s logistics and infrastructure development .

The Middle East High Visibility Clothing Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Honeywell International Inc., DuPont de Nemours, Inc., Carhartt, Inc., MCR Safety, Pyramex Safety Products, LLC, Portwest Ltd., Ansell Limited, Lakeland Industries, Inc., Blåkläder Workwear, Snickers Workwear, UVEX Safety Group GmbH & Co. KG, Radians, Inc., Safety Jogger (Cortina Group), Ergodyne, ASATEX AG, Delta Plus Group, Al Asayel Health & Safety (UAE), Durasafe (Saudi Arabia), KARAM Safety (Middle East operations) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East high visibility clothing market appears promising, driven by ongoing infrastructure projects and heightened safety awareness. As companies increasingly adopt smart textiles and wearable technology, the demand for innovative safety gear is expected to rise. Furthermore, the push for sustainability in production methods will likely shape the market landscape, encouraging manufacturers to explore eco-friendly materials and practices, thus aligning with global trends toward environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Vests Jackets Trousers/Pants Coveralls Rainwear Hats & Headgear Accessories (gloves, etc.) Others |

| By End-User | Construction Oil & Gas Transportation & Warehousing Industrial Manufacturing Mining Public Safety & Emergency Services Others |

| By Material | Polyester Cotton Blends Reflective Materials Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales B2B Sales Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Iraq, Palestine) North Africa (Egypt, Libya, Algeria, Morocco, Tunisia) Turkey Others |

| By Certification Standards | ANSI/ISEA 107 EN ISO 20471 AS/NZS 4602.1 Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Safety Managers | 100 | Safety Managers, Site Managers |

| Manufacturing Sector Procurement Heads | 80 | Procurement Managers, Operations Directors |

| Transportation and Logistics Safety Coordinators | 70 | Logistics Managers, Fleet Safety Supervisors |

| Retail Sector Buyers of Safety Apparel | 60 | Merchandise Managers, Retail Buyers |

| Government Regulatory Bodies | 40 | Regulatory Officers, Compliance Managers |

The Middle East High Visibility Clothing Market is valued at approximately USD 155 million, driven by increasing safety regulations, workplace safety awareness, and the expansion of construction and infrastructure projects in the region.