Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5953

Pages:89

Published On:December 2025

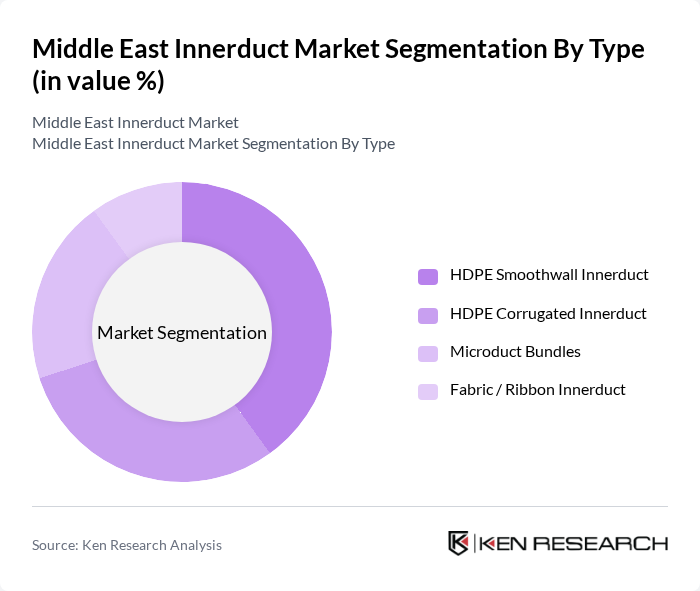

By Type:The innerduct market can be segmented into four main types: HDPE Smoothwall Innerduct, HDPE Corrugated Innerduct, Microduct Bundles, and Fabric / Ribbon Innerduct. HDPE Smoothwall and HDPE Corrugated innerducts are widely used for backbone and access fiber routes, while Microduct Bundles are increasingly adopted for high-density fiber-to-the-home (FTTH), 5G fronthaul, and data center connectivity, reflecting strong demand from telecom and broadband upgrades. Fabric / Ribbon innerduct solutions are gaining traction in congested ducts and urban environments where maximizing duct capacity and ease of installation are critical for operators and utilities.

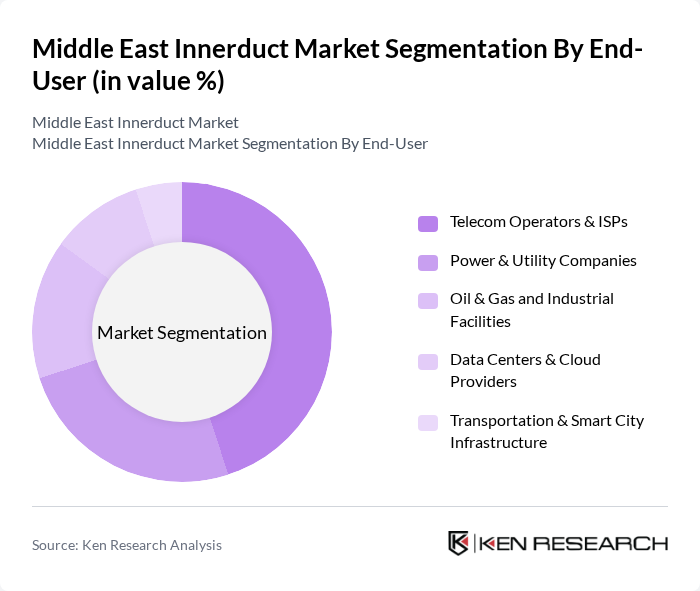

By End-User:The end-user segmentation includes Telecom Operators & ISPs, Power & Utility Companies, Oil & Gas and Industrial Facilities, Data Centers & Cloud Providers, and Transportation & Smart City Infrastructure. Telecom Operators & ISPs account for the largest share due to continuous fiber network expansion and 5G deployment, while data center and cloud providers, as well as smart city and transport projects, are rapidly increasing their use of innerduct to support high-bandwidth, low-latency connectivity across the region.

The Middle East Innerduct Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dura-Line (Orbia Advance Corporation), Prysmian Group, Nexans, Corning Incorporated, CommScope, Emtelle Group, NEX Telecom & Infrastructure (NEX Telecommunications Contracting Co., Saudi Arabia), Shamal Plastic Industries LLC (UAE), Union Pipes Industry LLC (UAE), DPS Oman (Dhofar Power & Systems LLC), Middle East Specialized Cables Co. (MESC, Saudi Arabia), Oman Fiber Optic Co. SAOG, Etihad Atheeb Telecom Co. – GO Fiber Infrastructure Partners, Fujikura Ltd., Belden Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East innerduct market is poised for significant growth, driven by technological advancements and increasing urbanization. As cities expand, the demand for efficient telecommunications infrastructure will rise, particularly with the integration of IoT and 5G technologies. Additionally, sustainability trends will push manufacturers to innovate eco-friendly innerduct materials. Collaborations with local governments will further enhance infrastructure development, ensuring that the market remains dynamic and responsive to emerging needs in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | HDPE Smoothwall Innerduct HDPE Corrugated Innerduct Microduct Bundles Fabric / Ribbon Innerduct |

| By End-User | Telecom Operators & ISPs Power & Utility Companies Oil & Gas and Industrial Facilities Data Centers & Cloud Providers Transportation & Smart City Infrastructure |

| By Application | Fiber-to-the-Home (FTTH) / FTTx Networks Long-Haul & Metro Fiber Backbones G/5G Mobile Backhaul & Fronthaul Enterprise & Campus Networks Substation & Utility Cable Management |

| By Material | HDPE PVC LSZH (Low Smoke Zero Halogen) Compounds Other Engineered Polymers |

| By Installation Method | Direct Burial Aerial & Facade Installation Duct-in-Duct / Conduit Systems Trenchless (HDD, Micro-trenching, Blown Fiber) |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant (Jordan, Lebanon, Iraq, others) Turkey North Africa (Egypt and Rest of North Africa) |

| By Project Size | Small Scale Projects (<10 km) Medium Scale Projects (10–100 km) Large Scale Projects (>100 km) Mega / National Backbone Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Infrastructure Projects | 120 | Project Managers, Network Engineers |

| Residential Innerduct Installations | 80 | Contractors, Home Builders |

| Commercial Building Installations | 60 | Facility Managers, Architects |

| Government Infrastructure Initiatives | 50 | Policy Makers, Urban Planners |

| Telecom Equipment Suppliers | 70 | Sales Managers, Product Development Leads |

The Middle East Innerduct Market is valued at approximately USD 0.1 billion, reflecting significant growth driven by the demand for high-speed internet and telecommunications infrastructure, particularly in smart city projects across the region.