Region:Middle East

Author(s):Shubham

Product Code:KRAD6604

Pages:99

Published On:December 2025

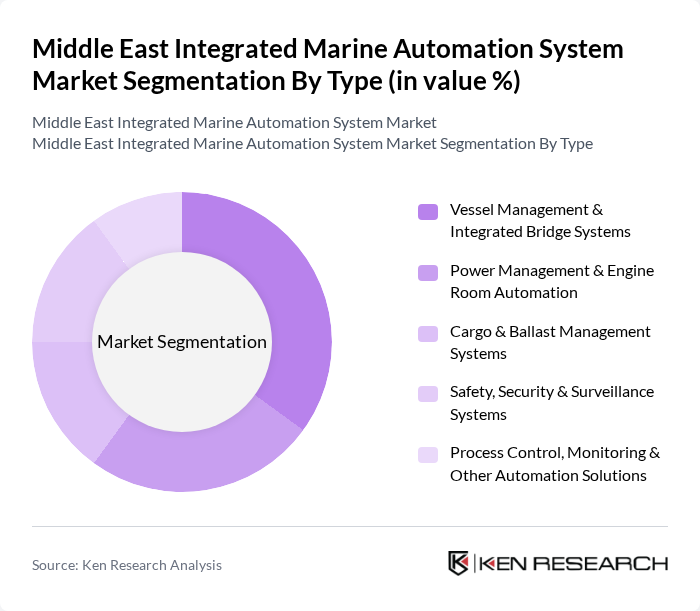

By Type:The market is segmented into various types of integrated marine automation systems, each catering to specific operational needs within the maritime industry. The key subsegments include Vessel Management & Integrated Bridge Systems, Power Management & Engine Room Automation, Cargo & Ballast Management Systems, Safety, Security & Surveillance Systems, and Process Control, Monitoring & Other Automation Solutions. Among these, Vessel Management & Integrated Bridge Systems is the leading subsegment, driven by the increasing need for efficient navigation and operational control in commercial shipping.

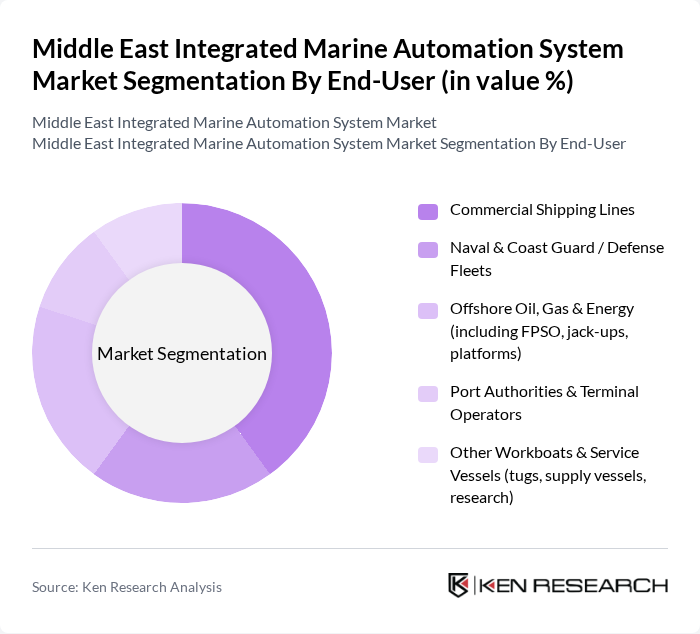

By End-User:The market is categorized based on end-users, including Commercial Shipping Lines, Naval & Coast Guard / Defense Fleets, Offshore Oil, Gas & Energy (including FPSO, jack-ups, platforms), Port Authorities & Terminal Operators, and Other Workboats & Service Vessels (tugs, supply vessels, research). The Commercial Shipping Lines segment is the most significant, as the demand for efficient and automated solutions in shipping operations continues to rise, driven by the need for cost reduction and improved safety.

The Middle East Integrated Marine Automation System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kongsberg Maritime AS (Kongsberg Gruppen), Wärtsilä Marine Systems (Wärtsilä Corporation), ABB Marine & Ports (ABB Ltd.), Siemens Energy & Siemens Digital Industries (Marine), Rolls-Royce Power Systems – mtu Marine, Thales Group (Naval & Maritime Systems), Honeywell Marine Solutions (Honeywell International Inc.), Raytheon Anschütz GmbH (Raytheon Technologies Corporation), Mitsubishi Heavy Industries Marine Machinery & Equipment Co., Ltd., GE Power Conversion (General Electric Company), Northrop Grumman Sperry Marine, BAE Systems Maritime, DNV (Det Norske Veritas) – Digital & Maritime, Inmarsat Maritime (Inmarsat Global Ltd.), Furuno Electric Co., Ltd. (Marine Electronics) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East integrated marine automation system market appears promising, driven by ongoing technological advancements and increasing investments in maritime infrastructure. As countries in the region prioritize modernization and efficiency, the adoption of cloud-based solutions and autonomous vessels is expected to gain momentum. Furthermore, collaboration between maritime and technology sectors will likely foster innovation, enhancing operational capabilities and addressing security concerns, ultimately positioning the region as a leader in maritime automation.

| Segment | Sub-Segments |

|---|---|

| By Type | Vessel Management & Integrated Bridge Systems Power Management & Engine Room Automation Cargo & Ballast Management Systems Safety, Security & Surveillance Systems Process Control, Monitoring & Other Automation Solutions |

| By End-User | Commercial Shipping Lines Naval & Coast Guard / Defense Fleets Offshore Oil, Gas & Energy (including FPSO, jack-ups, platforms) Port Authorities & Terminal Operators Other Workboats & Service Vessels (tugs, supply vessels, research) |

| By Vessel Type | Container & General Cargo Vessels Tankers (oil, chemical, LNG/LPG) Passenger & Cruise Ships / Ferries Offshore Support Vessels (OSVs, AHTS, PSVs) Naval, Coast Guard & Special Purpose Vessels |

| By Region | Gulf Cooperation Council (GCC) Levant Region North Africa Other Middle East Countries |

| By Application | Navigation, Situational Awareness & Bridge Automation Communication, Connectivity & Fleet Management Machinery, Power, and Process Monitoring & Control Safety, Security, Cybersecurity & Regulatory Compliance |

| By Investment Source | Private Shipowners & Operators Government & State-Owned Entities Multilateral & Development Finance Institutions Other Strategic and Institutional Investors |

| By Policy Support | Subsidies & Incentives for Digitalization and Automation Tax Incentives for Maritime & Port Technology Investments Grants for R&D, Innovation and Pilot Autonomous Projects Other Regulatory and Policy Support Measures |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Shipping Automation | 100 | Fleet Managers, Operations Directors |

| Port Management Systems | 80 | Port Authorities, Logistics Coordinators |

| Fishing Industry Automation | 60 | Fishing Fleet Operators, Regulatory Compliance Officers |

| Tourism and Leisure Marine Automation | 50 | Tour Operators, Marine Safety Inspectors |

| Research and Development in Marine Tech | 70 | Marine Engineers, Technology Innovators |

The Middle East Integrated Marine Automation System Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the increasing demand for automation in maritime operations and the need for enhanced safety and efficiency.