Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7125

Pages:99

Published On:December 2025

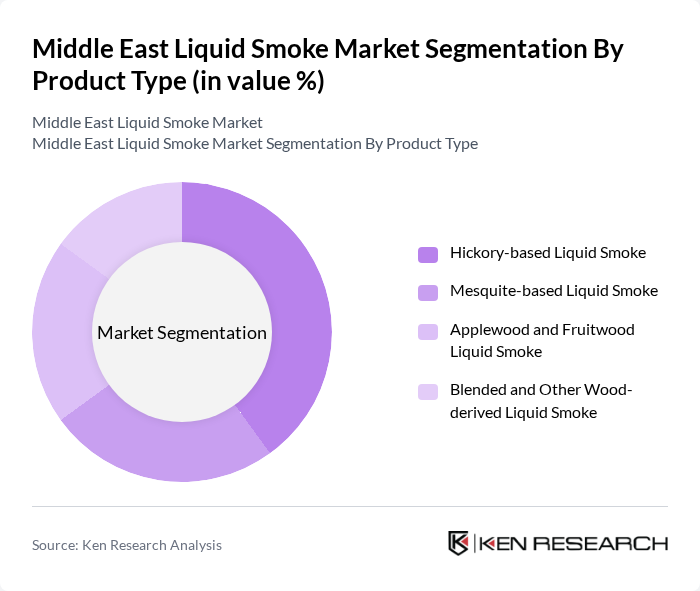

By Product Type:The product type segmentation includes various forms of liquid smoke derived from different wood sources. The subsegments are Hickory-based Liquid Smoke, Mesquite-based Liquid Smoke, Applewood and Fruitwood Liquid Smoke, and Blended and Other Wood-derived Liquid Smoke. Each type offers unique flavor profiles, catering to diverse consumer preferences and culinary applications.

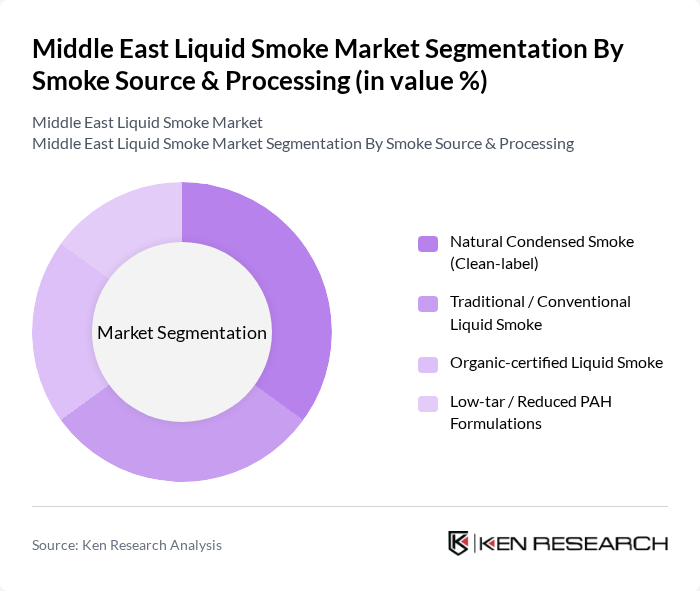

By Smoke Source & Processing:This segmentation focuses on the methods of producing liquid smoke and the sources of the smoke used. The subsegments include Natural Condensed Smoke (Clean-label), Traditional / Conventional Liquid Smoke, Organic-certified Liquid Smoke, and Low-tar / Reduced PAH Formulations. Each method caters to specific consumer demands for health and safety.

The Middle East Liquid Smoke Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kerry Group plc (Red Arrow brand), Besmoke Ltd, Azelis Group NV, Frutarom / IFF (International Flavors & Fragrances Inc.), Symrise AG, Firmenich SA (dsm-firmenich), Bamberger Mälzerei GmbH (Smoke & Spice), Ruitenberg Ingredients B.V., Middle East Specialized Cables Co. (as regional industrial flavor distributor), Givaudan SA, Essentia Protein Solutions, Food Specialities Limited (UAE), IFFCO Group (UAE), Savola Foods Company, Kerry Middle East DMCC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East liquid smoke market appears promising, driven by evolving consumer preferences towards natural and organic products. As health consciousness continues to rise, manufacturers are likely to innovate and diversify their offerings, incorporating liquid smoke into a broader range of food products. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility, allowing consumers to explore and purchase liquid smoke products conveniently, thus enhancing market penetration and growth potential.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Hickory-based Liquid Smoke Mesquite-based Liquid Smoke Applewood and Fruitwood Liquid Smoke Blended and Other Wood-derived Liquid Smoke |

| By Smoke Source & Processing | Natural Condensed Smoke (Clean-label) Traditional / Conventional Liquid Smoke Organic-certified Liquid Smoke Low-tar / Reduced PAH Formulations |

| By Application | Meat and Poultry Processing Seafood and Fish Products Sauces, Marinades, and Seasonings Snack Foods, Ready Meals, and Convenience Foods Plant-based and Halal Meat Analogues Dairy and Specialty Food Applications |

| By End-User | Industrial Food and Beverage Manufacturers Meat, Poultry & Seafood Processors Quick Service Restaurants (QSRs) & Foodservice Chains Artisanal Smokehouses and Small Processors Retail & Household Consumers |

| By Distribution Channel | Direct Sales to Food Manufacturers Distributors and Importers Supermarkets/Hypermarkets and Cash & Carry HoReCa Supply and Foodservice Distributors Online B2B and B2C Channels |

| By Packaging Type | Foodservice and Industrial Drums/IBCs Bulk Containers and Intermediate Packaging Retail Bottles and Jars Sachets, Pouches, and Bag-in-Box |

| By Physical Form | Liquid Concentrates Smoke Powders Water-soluble Emulsions and Pastes |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait, Oman and Bahrain Turkey Israel Egypt Rest of Middle East & North Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Companies | 120 | Production Managers, Quality Assurance Officers |

| Retail Outlets and Supermarkets | 100 | Category Managers, Purchasing Agents |

| Food Service Industry | 80 | Restaurant Owners, Executive Chefs |

| Flavoring and Additive Suppliers | 70 | Sales Representatives, Product Development Managers |

| Regulatory Bodies and Food Safety Authorities | 50 | Policy Makers, Compliance Officers |

The Middle East Liquid Smoke Market is valued at approximately USD 5 million, driven by the increasing demand for natural flavoring agents and the popularity of smoked flavors in various cuisines.