Region:Asia

Author(s):Geetanshi

Product Code:KRAC9360

Pages:82

Published On:November 2025

By Type:The market is segmented into various types of preservatives, including natural preservatives, synthetic preservatives, antioxidants, antimicrobials, chelating agents, enzyme inhibitors, and others. Among these, synthetic preservatives are currently dominating the market due to their effectiveness in extending shelf life and maintaining food quality. The increasing demand for processed foods has led to a higher adoption of synthetic preservatives, as they are often more cost-effective and have a longer shelf life compared to natural alternatives. However, demand for natural preservatives is rising, driven by consumer preference for clean-label and sustainable ingredients .

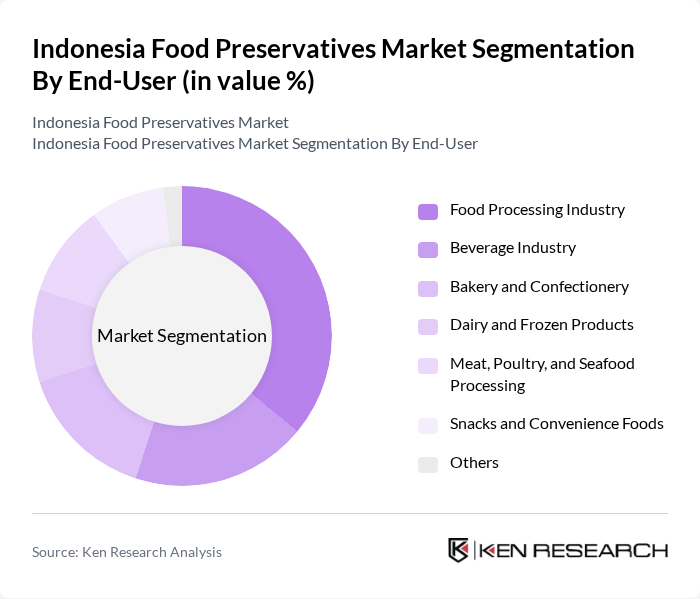

By End-User:The end-user segmentation includes the food processing industry, beverage industry, bakery and confectionery, dairy and frozen products, meat, poultry, and seafood processing, snacks and convenience foods, and others. The food processing industry is the leading segment, driven by the increasing demand for ready-to-eat meals and processed foods. This trend is further supported by the growing urban population and changing consumer lifestyles, which favor convenience and longer shelf life in food products. The beverage and bakery segments also show robust growth due to innovation and product diversification .

The Indonesia Food Preservatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Sorini Agro Asia Corporindo Tbk, PT. Budi Starch & Sweetener Tbk, PT. Indesso Aroma, PT. Kimia Farma Tbk, PT. Sari Incofood Corporation, PT. Sumber Bumi Sukses, PT. Cargill Indonesia, PT. Ajinomoto Indonesia, PT. Nestlé Indonesia, PT. Unilever Indonesia Tbk, PT. Danone Indonesia, PT. Indofood Sukses Makmur Tbk, PT. Mayora Indah Tbk, PT. Wilmar Nabati Indonesia, PT. Sumber Food Ingredient Indonesia, PT. Foodex Ingredients Indonesia, PT. Daesang Ingredients Indonesia, PT. Huabao Food Technology Indonesia, and PT. Tetra Pak Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian food preservatives market appears promising, driven by ongoing innovations in food preservation technologies and a growing emphasis on food safety. As consumers increasingly demand transparency and quality, manufacturers are likely to invest in cleaner label products and sustainable practices. Additionally, the rise of e-commerce platforms is expected to facilitate broader access to food products, enhancing market reach and consumer engagement, ultimately shaping a more dynamic industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Preservatives (e.g., salt, sugar, vinegar, essential oils, plant extracts) Synthetic Preservatives (e.g., sorbates, benzoates, nitrites, nitrates, propionates) Antioxidants (e.g., ascorbic acid, tocopherols, BHA, BHT) Antimicrobials (e.g., nisin, natamycin, lysozyme) Chelating Agents (e.g., EDTA, citric acid) Enzyme Inhibitors Others |

| By End-User | Food Processing Industry Beverage Industry Bakery and Confectionery Dairy and Frozen Products Meat, Poultry, and Seafood Processing Snacks and Convenience Foods Others |

| By Application | Meat and Poultry Seafood Fruits and Vegetables Sauces, Dressings, and Condiments Bakery and Confectionery Dairy Products Ready-to-Eat Meals Oils and Fats Snacks Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales Others |

| By Region | Java Sumatra Bali and Nusa Tenggara Kalimantan Sulawesi |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging Others |

| By Product Form | Liquid Powder Granular Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 100 | Production Managers, Quality Assurance Officers |

| Retail Food Outlets | 80 | Store Managers, Purchasing Agents |

| Food Safety Regulatory Bodies | 40 | Regulatory Officers, Compliance Managers |

| Consumer Insights | 120 | General Consumers, Health-Conscious Shoppers |

| Food Technology Experts | 60 | Food Scientists, Research & Development Managers |

The Indonesia Food Preservatives Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the increasing demand for processed and packaged foods, urbanization, and heightened consumer awareness regarding food safety and shelf life.