Region:Middle East

Author(s):Rebecca

Product Code:KRAA2160

Pages:92

Published On:August 2025

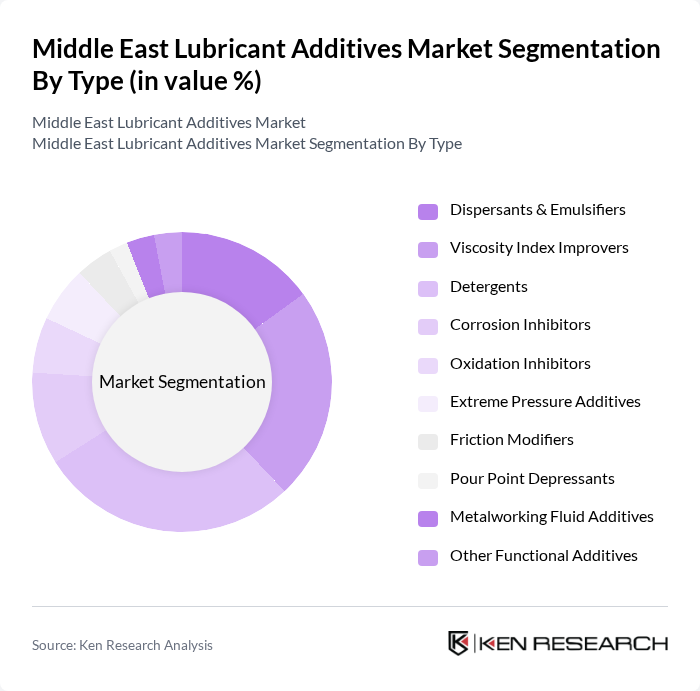

By Type:The market is segmented into various types of lubricant additives, including Dispersants & Emulsifiers, Viscosity Index Improvers, Detergents, Corrosion Inhibitors, Oxidation Inhibitors, Extreme Pressure Additives, Friction Modifiers, Pour Point Depressants, Metalworking Fluid Additives, and Other Functional Additives. Among these, Detergents and Viscosity Index Improvers are leading due to their critical roles in enhancing lubricant performance and engine cleanliness. The increasing demand for high-quality engine oils in the automotive sector drives the growth of these subsegments. Viscosity Index Improvers, in particular, account for a significant share due to their importance in maintaining lubricant stability under varying temperature conditions .

By Application:The market is segmented by application into Engine Oil, Transmission & Hydraulic Fluids, Gear Oil, Industrial Oil, Metalworking Fluid, Grease, Process Oil, and Others. Engine Oil is the dominant application segment, driven by the increasing number of vehicles and the demand for high-performance lubricants that enhance engine efficiency and longevity. The automotive industry's shift towards synthetic oils further supports the growth of this segment. Industrial Oil and Transmission & Hydraulic Fluids also represent substantial shares, reflecting the region’s industrial expansion and infrastructure investments .

The Middle East Lubricant Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Chevron Oronite Company LLC, Afton Chemical Corporation, Evonik Industries AG, The Lubrizol Corporation, Innospec Inc., TotalEnergies SE, Clariant AG, Croda International Plc, Huntsman Corporation, Shell Global Solutions International B.V., ExxonMobil Chemical Company, Fuchs Petrolub SE, Gulf Oil International Ltd., ADNOC (Abu Dhabi National Oil Company), Infineum International Limited, Nouryon contribute to innovation, geographic expansion, and service delivery in this space .

The Middle East lubricant additives market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt eco-friendly practices, the demand for bio-based additives is expected to rise. Additionally, the shift towards electric vehicles will create new opportunities for specialized lubricants. Strategic partnerships among manufacturers and research institutions will further enhance innovation, ensuring that the market remains competitive and responsive to evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Dispersants & Emulsifiers Viscosity Index Improvers Detergents Corrosion Inhibitors Oxidation Inhibitors Extreme Pressure Additives Friction Modifiers Pour Point Depressants Metalworking Fluid Additives Other Functional Additives |

| By Application | Engine Oil Transmission & Hydraulic Fluids Gear Oil Industrial Oil Metalworking Fluid Grease Process Oil Others |

| By End-User Industry | Automotive & Transportation Construction Power Generation Heavy Equipment Metallurgy & Metal Working Food & Beverage Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Geography | Saudi Arabia United Arab Emirates Iran Qatar Rest of Middle East |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Lubricant Additives | 100 | Product Managers, R&D Engineers |

| Industrial Lubricant Additives | 80 | Operations Managers, Technical Sales Representatives |

| Marine Lubricant Additives | 50 | Marine Engineers, Procurement Specialists |

| Consumer Lubricant Products | 60 | Marketing Managers, Brand Strategists |

| Regulatory Compliance in Lubricants | 40 | Compliance Officers, Quality Assurance Managers |

The Middle East Lubricant Additives Market is valued at approximately USD 2.15 billion, driven by the increasing demand for high-performance lubricants in automotive and industrial applications, as well as the region's expanding manufacturing and automotive sectors.