Region:Asia

Author(s):Geetanshi

Product Code:KRAD1145

Pages:96

Published On:November 2025

By Type:The lubricant additives market is segmented into Dispersants, Viscosity Index Improvers, Detergents, Anti-Wear Agents, Antioxidants, Corrosion Inhibitors, Friction Modifiers, Emulsifiers, and Others. Detergents and Dispersants lead the market due to their essential roles in maintaining engine cleanliness and performance. The demand for high-quality engine oils in the automotive sector, driven by increased vehicle ownership and stricter emission standards, continues to propel these subsegments .

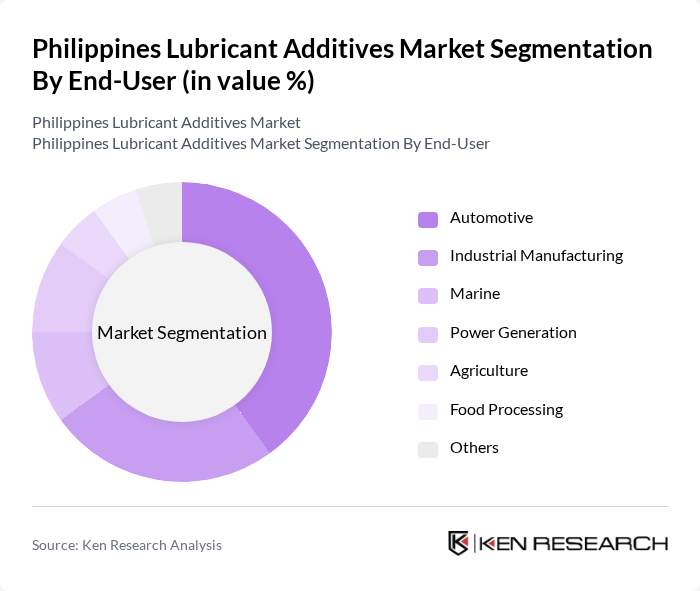

By End-User:The market is also segmented by end-user industries, including Automotive, Industrial Manufacturing, Marine, Power Generation, Agriculture, Food Processing, and Others. The Automotive sector remains the largest end-user, supported by the growing vehicle fleet and demand for high-performance lubricants. Industrial manufacturing is another significant segment, as machinery and equipment require specialized additives to enhance operational efficiency and reduce wear .

The Philippines Lubricant Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petron Corporation, Pilipinas Shell Petroleum Corporation, Chevron Philippines Inc., Total Philippines Corporation, ExxonMobil Asia Pacific Pte Ltd., Fuchs Lubricants Philippines, Inc., Castrol Limited, Repsol Lubricants, Gulf Oil Marine Ltd., Klüber Lubrication, Lubrizol Corporation, Afton Chemical Corporation, Innospec Inc., BASF SE, Croda International Plc contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines lubricant additives market is poised for significant transformation in future, driven by technological advancements and evolving consumer preferences. As the automotive sector shifts towards electric vehicles, the demand for specialized lubricant formulations will increase. Additionally, the focus on sustainability will encourage the development of bio-based additives. Companies that invest in research and development to create innovative, eco-friendly products will likely gain a competitive advantage, positioning themselves favorably in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Dispersants Viscosity Index Improvers Detergents Anti-Wear Agents Antioxidants Corrosion Inhibitors Friction Modifiers Emulsifiers Others |

| By End-User | Automotive Industrial Manufacturing Marine Power Generation Agriculture Food Processing Others |

| By Application | Engine Oils Transmission & Gear Oils Hydraulic Fluids Greases Metalworking Fluids Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | Luzon Visayas Mindanao Others |

| By Product Formulation | Synthetic Additives Mineral Additives Bio-based Additives Semi-Synthetic Additives Others |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Lubricant Manufacturers | 45 | Production Managers, Quality Control Supervisors |

| Industrial Lubricant Suppliers | 40 | Sales Directors, Technical Support Engineers |

| Distributors of Lubricant Additives | 40 | Logistics Coordinators, Procurement Managers |

| Regulatory Bodies and Associations | 40 | Policy Analysts, Compliance Officers |

| End-users in Automotive and Industrial Sectors | 50 | Maintenance Managers, Operations Directors |

The Philippines Lubricant Additives Market is valued at approximately USD 42 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for high-performance lubricants in both automotive and industrial sectors.