Region:Middle East

Author(s):Shubham

Product Code:KRAB8241

Pages:94

Published On:October 2025

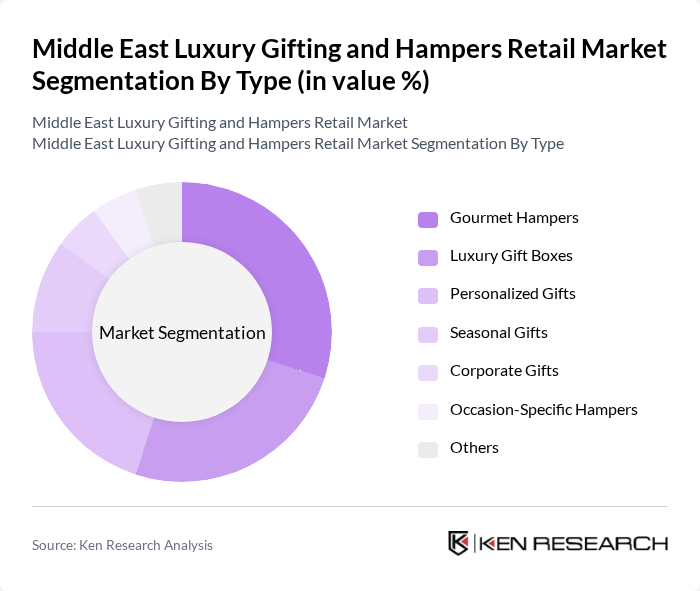

By Type:The market is segmented into various types of luxury gifting options, including gourmet hampers, luxury gift boxes, personalized gifts, seasonal gifts, corporate gifts, occasion-specific hampers, and others. Among these, gourmet hampers and luxury gift boxes are particularly popular due to their appeal as premium gifting options that cater to diverse consumer preferences. The trend towards personalization is also gaining traction, as consumers seek unique and tailored gifts for their loved ones.

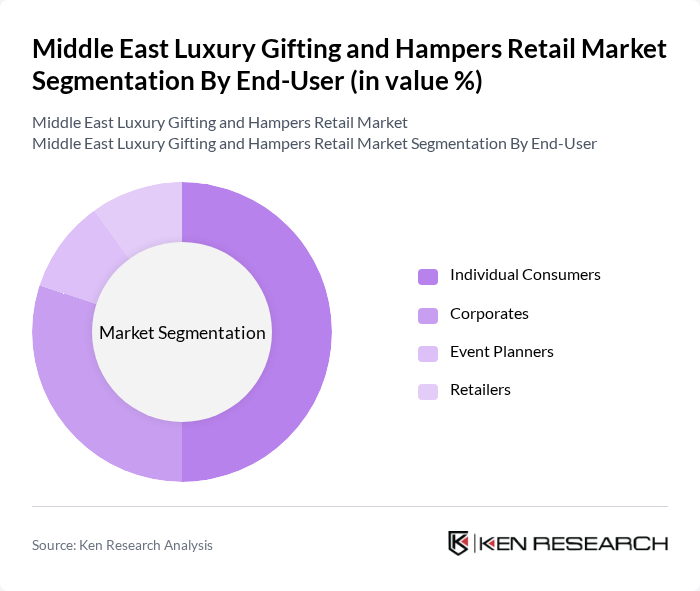

By End-User:The end-user segmentation includes individual consumers, corporates, event planners, and retailers. Individual consumers dominate the market as they are the primary purchasers of luxury gifts for personal use and special occasions. Corporates also play a significant role, particularly in the context of employee gifting and client appreciation, while event planners and retailers contribute to the market through organized events and retail sales.

The Middle East Luxury Gifting and Hampers Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Al Fardan Group, Bateel International, Gourmet Gulf, The Hamper Company, Maison des Fleurs, Fauchon Paris, Godiva Chocolatier, Patchi, Mamas & Papas, The Gift Oasis, Bloom & Wild, The Luxury Gift Company, Gifts for Good, The White Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury gifting and hampers market in the Middle East appears promising, driven by evolving consumer preferences and technological advancements. As personalization becomes increasingly important, retailers are expected to invest in innovative solutions that enhance customer experiences. Additionally, the rise of social media and influencer marketing will likely play a crucial role in shaping consumer behavior, encouraging more individuals to explore luxury gifting options. Overall, the market is poised for growth, adapting to changing dynamics and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Gourmet Hampers Luxury Gift Boxes Personalized Gifts Seasonal Gifts Corporate Gifts Occasion-Specific Hampers Others |

| By End-User | Individual Consumers Corporates Event Planners Retailers |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Corporate Sales Wholesale Distributors |

| By Price Range | Premium Range Mid-Range Budget Range |

| By Occasion | Weddings Birthdays Corporate Events Festivals |

| By Packaging Type | Eco-Friendly Packaging Luxury Packaging Standard Packaging |

| By Distribution Mode | Direct Sales Indirect Sales E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Retailers | 100 | Store Managers, Marketing Directors |

| Consumers of Luxury Hampers | 150 | Affluent Individuals, Gift Buyers |

| Corporate Gifting Managers | 80 | HR Managers, Procurement Officers |

| Online Gifting Platforms | 70 | eCommerce Managers, Product Development Leads |

| Luxury Event Planners | 60 | Event Coordinators, Client Relationship Managers |

The Middle East Luxury Gifting and Hampers Retail Market is valued at approximately USD 1.2 billion, driven by increasing disposable incomes and a growing gifting culture, particularly during festive seasons and special occasions.