Region:Asia

Author(s):Dev

Product Code:KRAB0604

Pages:89

Published On:August 2025

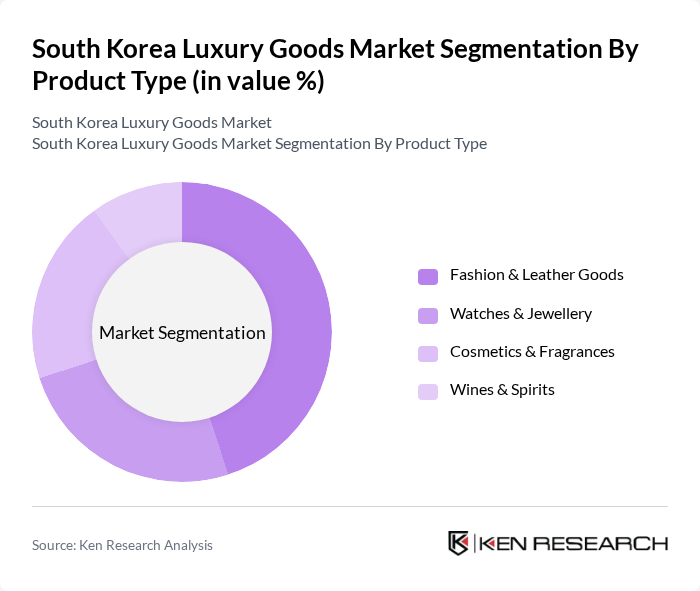

By Product Type:The luxury goods market can be segmented into various product types, including Fashion & Leather Goods, Watches & Jewellery, Cosmetics & Fragrances, and Wines & Spirits. Among these, Fashion & Leather Goods dominate the market due to their high demand and the influence of fashion trends. Consumers are increasingly investing in high-quality apparel and accessories, driven by brand loyalty, the desire for exclusivity, and the impact of celebrity endorsements and social media.

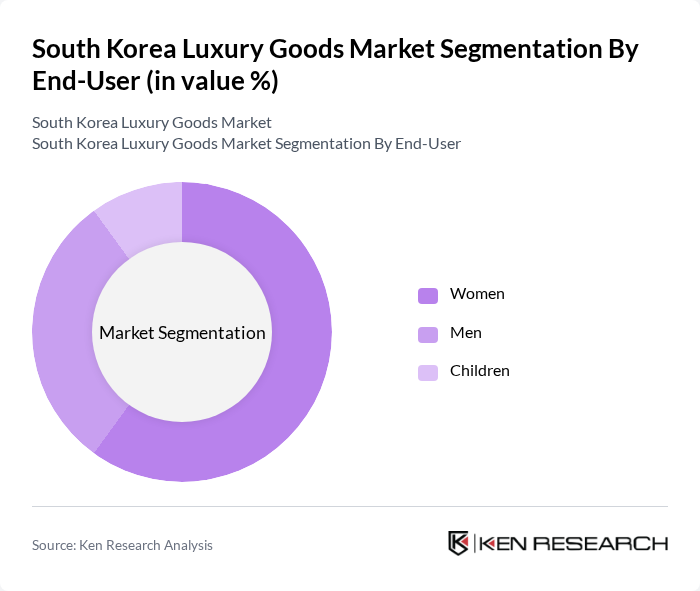

By End-User:The luxury goods market is segmented by end-user demographics, including Women, Men, and Children. Women represent the largest segment, driven by higher spending power, a greater inclination towards luxury fashion and beauty products, and the increasing trend of self-gifting. The influence of social media, K-pop culture, and digital marketing further bolster this segment's dominance.

The South Korea Luxury Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Gucci, Chanel, Prada, Hermès, Cartier, Burberry, Tiffany & Co., Dior, Fendi, Versace, Valentino, Bvlgari, Montblanc, Salvatore Ferragamo, Amorepacific, Sulwhasoo, Gentle Monster, MCM, Samsung C&T Fashion Group contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean luxury goods market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt eco-friendly practices are likely to attract a more conscientious consumer base. Additionally, the integration of augmented reality and artificial intelligence in retail experiences is expected to enhance customer engagement, making luxury shopping more interactive and personalized. These trends will shape the market landscape, fostering innovation and new opportunities for growth.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fashion & Leather Goods Watches & Jewellery Cosmetics & Fragrances Wines & Spirits |

| By End-User | Women Men Children |

| By Distribution Channel | Offline Retail Online Retail Department Stores Duty-Free Shops |

| By Price Range | Premium Super Premium Ultra Luxury |

| By Brand Origin | Domestic Brands International Brands |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| By Product Lifecycle Stage | New Launches Established Products Declining Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Fashion Retail | 120 | Store Managers, Sales Associates |

| High-End Cosmetics | 90 | Beauty Advisors, Brand Representatives |

| Luxury Jewelry Market | 70 | Jewelry Store Owners, Sales Executives |

| Luxury Travel Services | 50 | Travel Agents, Luxury Concierge Specialists |

| Luxury Home Goods | 40 | Interior Designers, Retail Buyers |

The South Korea luxury goods market is valued at approximately USD 7 billion, driven by increasing disposable income, a rising middle class, and a growing demand for premium products among consumers.