Region:Middle East

Author(s):Dev

Product Code:KRAD7641

Pages:90

Published On:December 2025

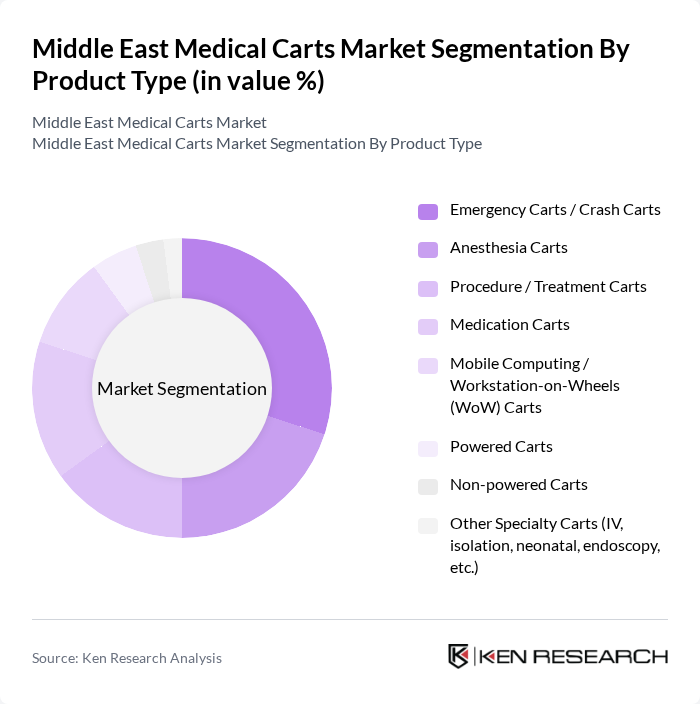

By Product Type:The product type segmentation includes various categories of medical carts that cater to specific needs within healthcare settings. Emergency Carts / Crash Carts represent a core application area because of their role in rapid response for resuscitation and critical events, and they remain a substantial share of cart demand across acute-care hospitals. However, in the Middle East and Africa, mobile computing carts and computer medical carts have emerged as one of the largest and fastest-growing product categories, reflecting strong investment in electronic medical records, bedside documentation, and point-of-care connectivity. Anesthesia carts and medication carts are crucial for operating rooms, perioperative environments, and pharmacy workflows, supporting controlled access, barcode medication administration, and standardized storage. The trend towards mobile computing solutions has also driven wider adoption of workstation-on-wheels (WoW) carts and powered carts, particularly in larger hospitals and integrated delivery networks, as facilities seek to improve clinician productivity and real-time data capture at the bedside.

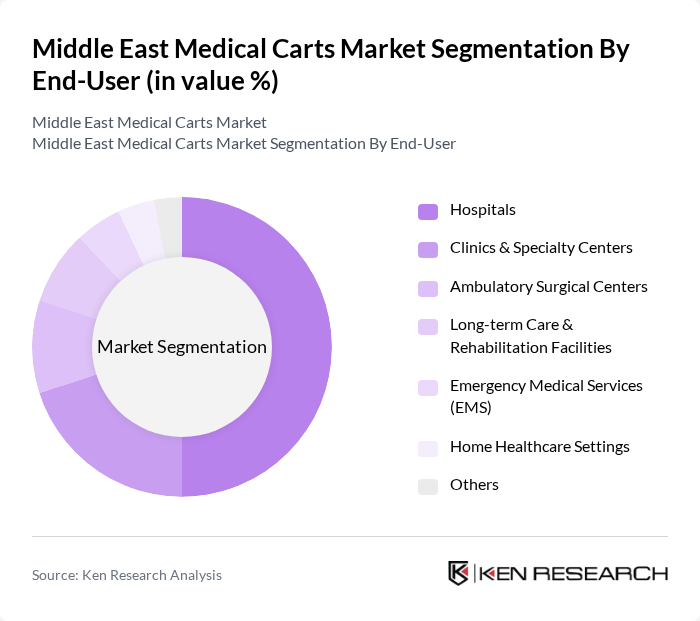

By End-User:The end-user segmentation highlights the various healthcare settings that utilize medical carts. Hospitals are the leading end-user, driven by the need for efficient patient care, integration with electronic health records, and support for intensive care, emergency, and operating room workflows. Clinics and specialty centers also represent a significant portion of the market, as they require procedure, treatment, and medication carts tailored to specialties such as oncology, dialysis, endoscopy, and day surgery. The rise of ambulatory surgical centers and day hospitals, together with expanding long-term care and rehabilitation facilities in GCC countries, has further diversified demand, reflecting changing patient preferences and the increasing trend towards outpatient and step-down care. Home healthcare and emergency medical services increasingly make use of lightweight, compact, and modular carts or trolley systems to support mobile care teams and community-based chronic disease management.

The Middle East Medical Carts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Capsa Healthcare, Ergotron, Inc., Harloff Manufacturing Co., Midmark Corporation, Cornel MedTech (Cornel Saudi Arabia), Armstrong Medical Industries, Inc., Waterloo Healthcare, Bergmann Group (Bergmann Medizin & Medibox Carts), Pegasus Medical Concepts, Metro (InterMetro Industries Corporation), JACO, Inc., ITD GmbH, Belimed Life Science / Belimed Infection Control (medication & procedure carts), Stryker Corporation, Hillrom (Baxter International Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East medical carts market appears promising, driven by ongoing technological advancements and increasing healthcare investments. As healthcare providers prioritize patient safety and operational efficiency, the demand for innovative medical carts is expected to rise. Additionally, the integration of IoT and telemedicine solutions will further enhance the functionality of medical carts, making them indispensable in modern healthcare settings. The focus on sustainability will also shape product development, leading to eco-friendly medical cart solutions.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Emergency Carts / Crash Carts Anesthesia Carts Procedure / Treatment Carts Medication Carts Mobile Computing / Workstation-on-Wheels (WoW) Carts Powered Carts Non-powered Carts Other Specialty Carts (IV, isolation, neonatal, endoscopy, etc.) |

| By End-User | Hospitals Clinics & Specialty Centers Ambulatory Surgical Centers Long-term Care & Rehabilitation Facilities Emergency Medical Services (EMS) Home Healthcare Settings Others |

| By Application / Clinical Area | Emergency & Critical Care Operating Rooms & Anesthesia Medication Management & Pharmacy Point-of-Care Computing & Documentation Diagnostic & Procedure Support Others |

| By Material | Metal Carts (Steel / Aluminum) Plastic / Polymer Carts Composite / Hybrid Carts Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Israel Rest of Middle East |

| By Distribution Channel | Direct Sales (Manufacturers to End-Users) Regional Distributors / Dealers Group Purchasing Organizations (GPOs) & Tender-based Procurement Online / E-procurement Platforms Others |

| By Price Range | Budget Carts Mid-range Carts Premium / High-end Carts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 120 | Procurement Managers, Supply Chain Coordinators |

| Healthcare Facility Administrators | 100 | Facility Managers, Operations Directors |

| Medical Equipment Distributors | 80 | Sales Managers, Product Specialists |

| Clinical Staff Using Medical Carts | 100 | Nurses, Doctors, Technicians |

| Healthcare Consultants | 70 | Healthcare Analysts, Market Researchers |

The Middle East Medical Carts Market is valued at approximately USD 1.1 billion, reflecting a significant demand for efficient healthcare delivery systems and technological advancements in medical equipment across the region.