Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4489

Pages:93

Published On:October 2025

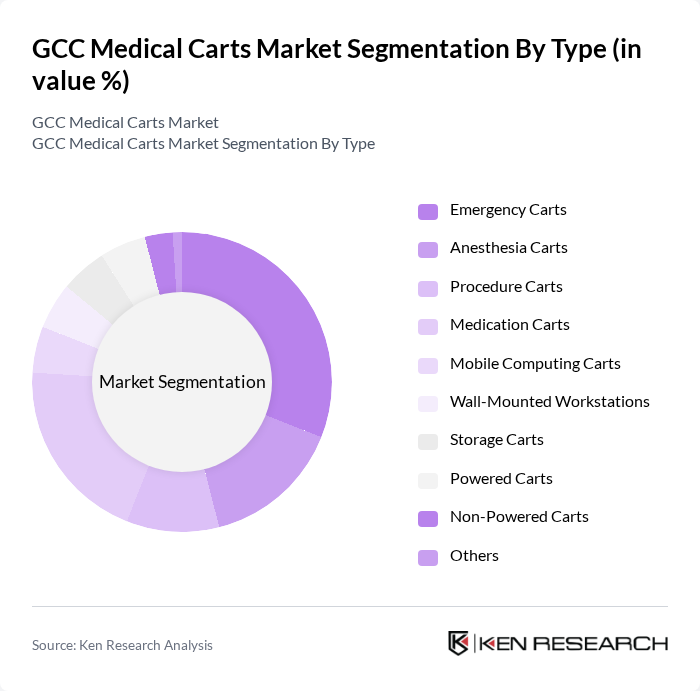

By Type:

The segmentation by type includes various categories such as Emergency Carts, Anesthesia Carts, Procedure Carts, Medication Carts, Mobile Computing Carts, Wall-Mounted Workstations, Storage Carts, Powered Carts, Non-Powered Carts, and Others. Among these,Emergency Cartsare leading the market due to their critical role in urgent medical situations, ensuring that healthcare professionals have immediate access to necessary supplies and equipment. The increasing focus on emergency preparedness and infection control in hospitals and clinics has further propelled the demand for these carts, making them essential in the healthcare ecosystem .

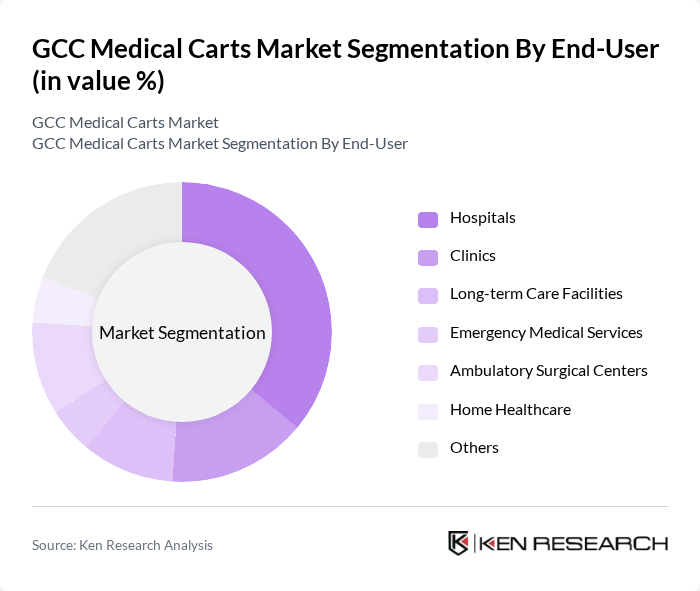

By End-User:

This segmentation includes Hospitals, Clinics, Long-term Care Facilities, Emergency Medical Services, Ambulatory Surgical Centers, Home Healthcare, and Others.Hospitalsare the dominant end-user segment, accounting for the largest portion of the market share. The increasing number of hospitals, the growing focus on improving patient care and operational efficiency, and the adoption of electronic health records are driving the demand for medical carts in this sector. Additionally, hospitals are investing in advanced medical technologies and mobile workstations, further enhancing the need for specialized carts to support various medical procedures .

The GCC Medical Carts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medline Industries, LP, Rubbermaid Commercial Products LLC, The Harloff Company, Capsa Healthcare, Omnicell, Inc., Advantech Co., Ltd., InterMetro Industries Corporation (Ali Group), TIDI Products, LLC, Stryker Corporation, Hillrom (Baxter International Inc.), JACO, Inc., GPC Medical Ltd., AFC Industries, Inc., ITD GmbH, Armstrong Medical Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC medical carts market appears promising, driven by ongoing technological advancements and increasing healthcare investments. As the region continues to prioritize healthcare quality and efficiency, the integration of smart technologies in medical carts will likely become standard. Additionally, the expansion of telemedicine and remote healthcare services will further necessitate the use of mobile medical carts, enhancing patient care and operational efficiency across healthcare facilities in the GCC.

| Segment | Sub-Segments |

|---|---|

| By Type | Emergency Carts Anesthesia Carts Procedure Carts Medication Carts Mobile Computing Carts Wall-Mounted Workstations Storage Carts Powered Carts Non-Powered Carts Others |

| By End-User | Hospitals Clinics Long-term Care Facilities Emergency Medical Services Ambulatory Surgical Centers Home Healthcare Others |

| By Material | Metal Plastic Composite Materials Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Price Range | Low Range Mid Range High Range |

| By Application | Surgical Procedures Patient Care Emergency Response Medication Management IT & Electronic Health Record Access Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Directors |

| Healthcare Facility Administrators | 80 | Facility Managers, Operations Directors |

| Medical Equipment Distributors | 60 | Sales Managers, Product Line Managers |

| Clinical Staff Using Medical Carts | 90 | Nurses, Doctors, Emergency Response Teams |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Affairs Managers |

The GCC Medical Carts Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the increasing demand for efficient healthcare delivery systems and technological advancements in medical equipment across the region.