Region:Middle East

Author(s):Rebecca

Product Code:KRAD4315

Pages:87

Published On:December 2025

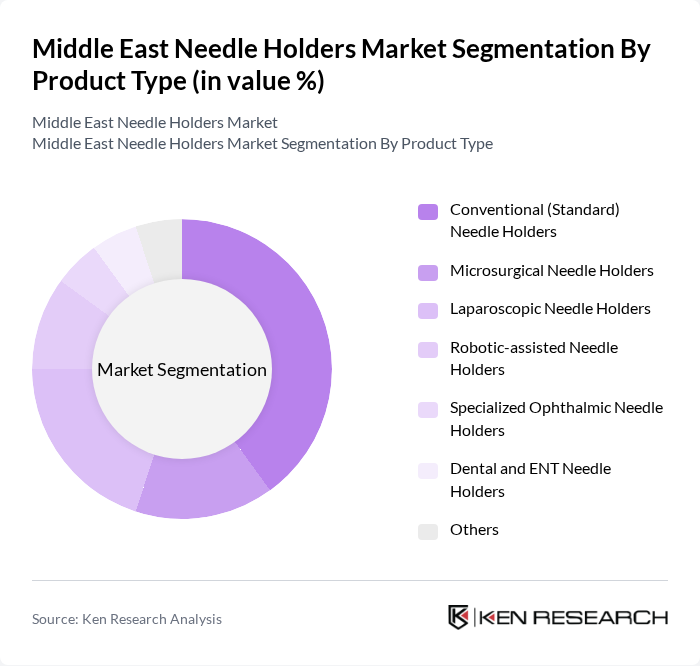

By Product Type:The product type segmentation includes various categories of needle holders, each designed for specific surgical applications. The subsegments are Conventional (Standard) Needle Holders, Microsurgical Needle Holders, Laparoscopic Needle Holders, Robotic-assisted Needle Holders, Specialized Ophthalmic Needle Holders, Dental and ENT Needle Holders, and Others. Among these, Conventional Needle Holders are the most widely used due to their versatility and cost-effectiveness, making them a preferred choice in various surgical settings.

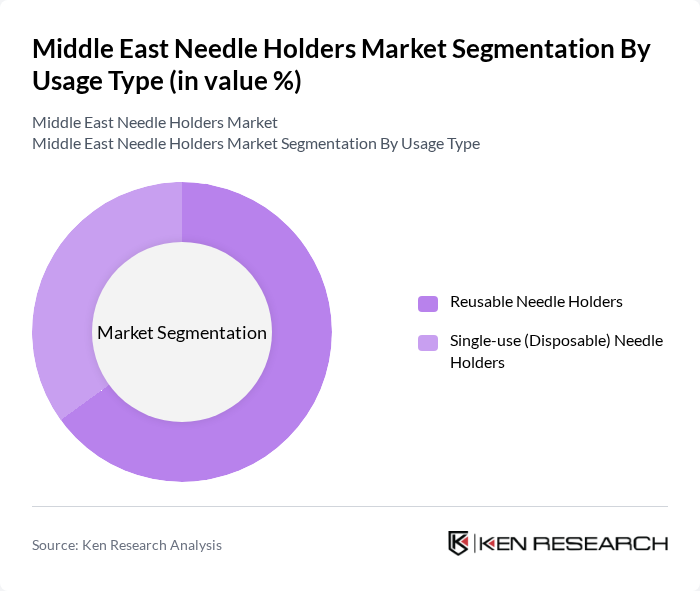

By Usage Type:The usage type segmentation includes Reusable Needle Holders and Single-use (Disposable) Needle Holders. Reusable Needle Holders dominate the market due to their cost-effectiveness and environmental considerations, as they can be sterilized and used multiple times. However, Single-use Needle Holders are gaining traction in surgical settings where sterility and convenience are paramount, particularly in outpatient procedures.

The Middle East Needle Holders Market is characterized by a dynamic mix of regional and international players. Leading participants such as B. Braun Melsungen AG, Medtronic plc, Johnson & Johnson (Ethicon), Smith & Nephew plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., Aesculap, Inc. (a B. Braun company), Integra LifeSciences Holdings Corporation, KLS Martin Group, Stille AB, Karl Storz SE & Co. KG, Teleflex Incorporated, Sklar Surgical Instruments, Martin Medical (Middle East regional distributor/brand), Gulf Medical Co. Ltd. (regional distributor of surgical instruments) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East needle holders market appears promising, driven by ongoing advancements in surgical technology and increasing healthcare investments. As hospitals and surgical centers continue to adopt minimally invasive techniques, the demand for specialized needle holders is expected to rise. Additionally, the growing focus on infection control and safety will likely lead to innovations in product design, enhancing functionality and usability in surgical settings, thereby shaping the market landscape positively.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Conventional (Standard) Needle Holders Microsurgical Needle Holders Laparoscopic Needle Holders Robotic-assisted Needle Holders Specialized Ophthalmic Needle Holders Dental and ENT Needle Holders Others |

| By Usage Type | Reusable Needle Holders Single-use (Disposable) Needle Holders |

| By Application | General and abdominal surgery Orthopedic and trauma surgery Cardiovascular and thoracic surgery Plastic and reconstructive surgery Gynecology and obstetrics surgery Others |

| By Material | Stainless steel needle holders Titanium needle holders Tungsten carbide-insert needle holders Polymer/composite needle holders Others |

| By End-User | Public hospitals Private hospitals Ambulatory surgical centers Specialty and super-specialty clinics Academic and research institutes Others |

| By Distribution Channel | Direct tenders and institutional sales Local distributors and dealers E-commerce and online medical platforms Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Turkey Egypt Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Surgical Instrument Manufacturers | 80 | Product Managers, Sales Directors |

| Healthcare Policy Makers | 50 | Health Economists, Regulatory Affairs Specialists |

| Clinical Users of Needle Holders | 70 | Surgeons, Surgical Nurses |

| Medical Device Distributors | 60 | Distribution Managers, Sales Representatives |

The Middle East Needle Holders Market is valued at approximately USD 8 million, driven by an increase in surgical procedures and advancements in healthcare infrastructure, particularly in GCC countries like Saudi Arabia and the United Arab Emirates.