Region:Middle East

Author(s):Rebecca

Product Code:KRAE0966

Pages:93

Published On:December 2025

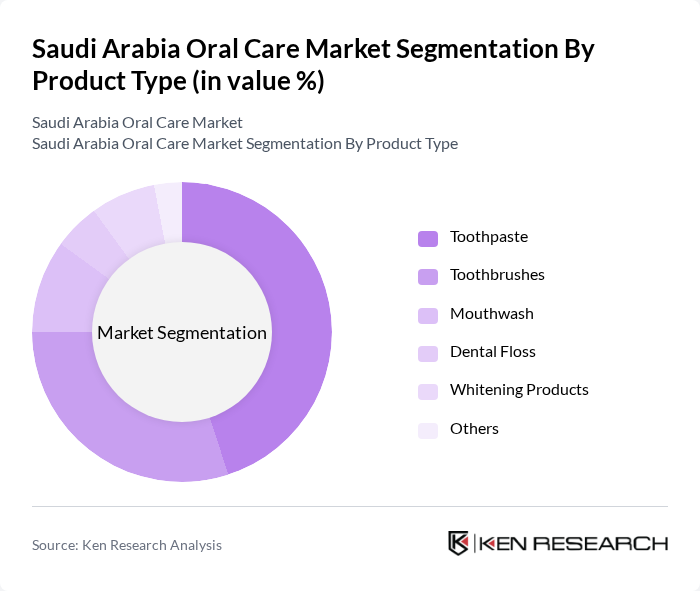

By Product Type:The oral care market in Saudi Arabia is segmented into various product types, including toothpaste, toothbrushes, mouthwash, dental floss, whitening products, and others. Among these, toothpaste remains the dominant segment due to its essential role in daily oral hygiene routines. However, toothbrushes are emerging as the fastest-growing category, driven by innovations in technology and design that cater to evolving consumer preferences. The demand for specialized products, such as whitening and herbal formulations, is also on the rise, reflecting a shift towards more personalized oral care solutions.

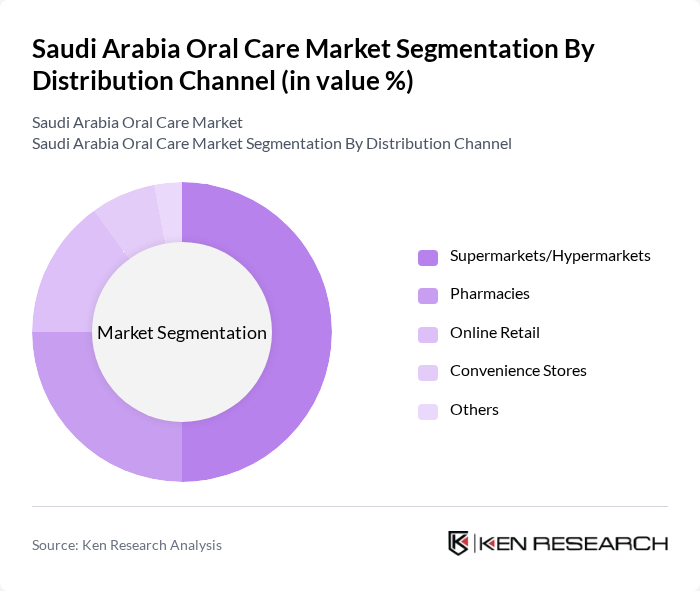

By Distribution Channel:The distribution channels for oral care products in Saudi Arabia include supermarkets/hypermarkets, pharmacies, online retail, convenience stores, and others. Supermarkets and hypermarkets dominate the market due to their extensive reach and ability to offer a wide range of products under one roof. The rise of e-commerce has also significantly impacted the market, with online retail gaining traction as consumers increasingly prefer the convenience of shopping from home. Pharmacies remain a crucial channel, particularly for therapeutic and specialized products.

The Saudi Arabia Oral Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble, Colgate-Palmolive, Unilever, Johnson & Johnson, GlaxoSmithKline, Henkel, Church & Dwight, Oral-B, Philips Sonicare, Listerine, Sensodyne, Crest, Biotene, Tom's of Maine, Arm & Hammer contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia oral care market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As the population increasingly prioritizes preventive dental care, the demand for innovative products, such as smart toothbrushes and personalized oral care solutions, is expected to rise. Additionally, the growth of e-commerce platforms will enhance product accessibility, allowing consumers to purchase a wider range of oral care items conveniently. This shift will likely reshape the competitive landscape, encouraging brands to adapt to evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Toothpaste Toothbrushes Mouthwash Dental Floss Whitening Products Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies Online Retail Convenience Stores Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Income Level (Low, Middle, High) Others |

| By Oral Care Needs | Preventive Care Therapeutic Care Cosmetic Care Others |

| By Brand Loyalty | Brand Loyal Consumers Brand Switchers Others |

| By Packaging Type | Tube Pump Sachet Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Oral Care Preferences | 150 | General Consumers, Health-Conscious Individuals |

| Dental Professional Insights | 100 | Dentists, Dental Hygienists |

| Retail Market Trends | 80 | Retail Managers, Pharmacy Owners |

| Product Development Feedback | 70 | Product Managers, R&D Specialists |

| Health Awareness Campaign Impact | 60 | Public Health Officials, NGO Representatives |

The Saudi Arabia Oral Care Market is valued at approximately USD 360 million. This valuation reflects the growing consumer awareness of oral hygiene and the increasing demand for specialized products, driven by rising disposable incomes and the expansion of retail channels.