Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3098

Pages:92

Published On:October 2025

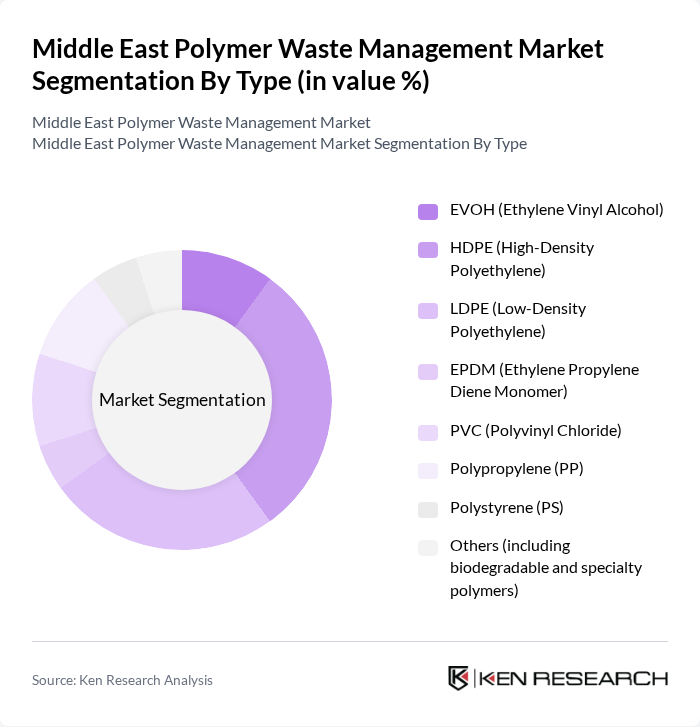

By Type:The market is segmented into various types of polymers, including EVOH (Ethylene Vinyl Alcohol), HDPE (High-Density Polyethylene), LDPE (Low-Density Polyethylene), EPDM (Ethylene Propylene Diene Monomer), PVC (Polyvinyl Chloride), Polypropylene (PP), Polystyrene (PS), and others, which include biodegradable and specialty polymers. Among these, HDPE and LDPE are the most widely used due to their versatility and recyclability, making them dominant in the polymer waste management landscape. HDPE, in particular, leads the segment, driven by its widespread application in packaging and infrastructure and its high recyclability .

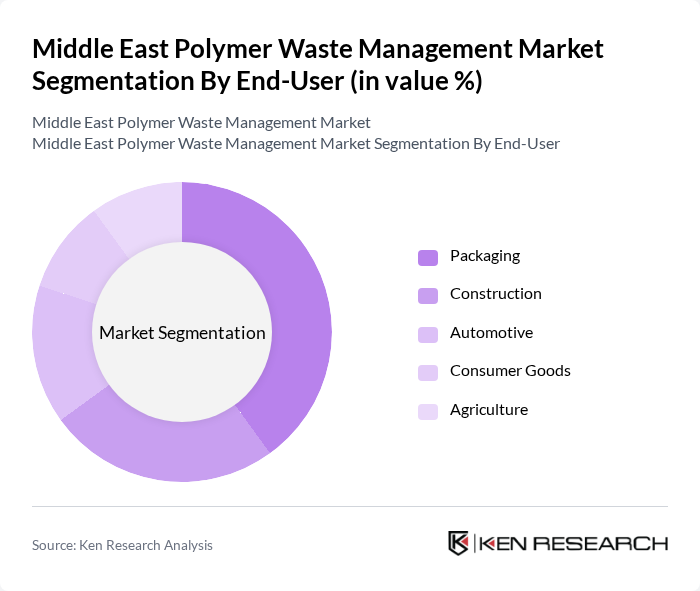

By End-User:The end-user segmentation includes packaging, construction, automotive, consumer goods, and agriculture. The packaging sector is the largest consumer of polymer materials, driven by the increasing demand for sustainable packaging solutions and the rise of e-commerce. The construction and automotive sectors also contribute significantly to the market, as they increasingly adopt recycled materials in their production processes. The adoption of recycled polymers in consumer goods and agriculture is also rising, reflecting broader sustainability trends .

The Middle East Polymer Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Environnement S.A., SUEZ Recycling and Recovery Middle East, Waste Management, Inc., Republic Services, Inc., Biffa plc, Dow Chemical Company, BASF SE, Covestro AG, SABIC (Saudi Basic Industries Corporation), Emirates Waste to Energy Company, Green Planet Recycling LLC, EcoWASTE (Abu Dhabi Waste Management Center), Averda, Tandeef (Bee’ah Group), Al Dhafra Recycling Industries LLC, Remondis SE & Co. KG, MBA Polymers, Plasgran Ltd, KW Plastics, TerraCycle contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polymer waste management market in the Middle East appears promising, driven by increasing regulatory pressures and a shift towards sustainable practices. As governments continue to enforce stricter waste management laws, the demand for innovative recycling technologies is expected to rise. Additionally, the growing emphasis on circular economy principles will likely lead to enhanced collaboration between public and private sectors, fostering investment in advanced waste management solutions and infrastructure development.

| Segment | Sub-Segments |

|---|---|

| By Type | EVOH (Ethylene Vinyl Alcohol) HDPE (High-Density Polyethylene) LDPE (Low-Density Polyethylene) EPDM (Ethylene Propylene Diene Monomer) PVC (Polyvinyl Chloride) Polypropylene (PP) Polystyrene (PS) Others (including biodegradable and specialty polymers) |

| By End-User | Packaging Construction Automotive Consumer Goods Agriculture |

| By Collection Method | Curbside Collection Drop-off Centers Deposit Return Schemes Industrial Collection Programs |

| By Processing Method | Mechanical Recycling Chemical Recycling Energy Recovery (Waste-to-Energy) Landfilling |

| By Geographic Distribution | Saudi Arabia United Arab Emirates Oman Kuwait Qatar Bahrain Israel Turkey |

| By Waste Type | Industrial Waste Household Waste Commercial Waste |

| By Policy Support | Subsidies for Recycling Programs Tax Incentives for Waste Management Companies Grants for Research and Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management Practices | 100 | City Waste Managers, Environmental Policy Makers |

| Recycling Facility Operations | 80 | Plant Managers, Operations Supervisors |

| Polymer Producers' Waste Strategies | 70 | Production Managers, Sustainability Officers |

| Consumer Attitudes Towards Recycling | 150 | General Public, Environmental Advocates |

| NGO Perspectives on Waste Management | 60 | Program Directors, Policy Analysts |

The Middle East Polymer Waste Management Market is valued at approximately USD 1.9 billion, reflecting a significant growth trend driven by increasing environmental awareness and stricter regulations on plastic waste management across the region.