Region:Middle East

Author(s):Dev

Product Code:KRAC3609

Pages:90

Published On:January 2026

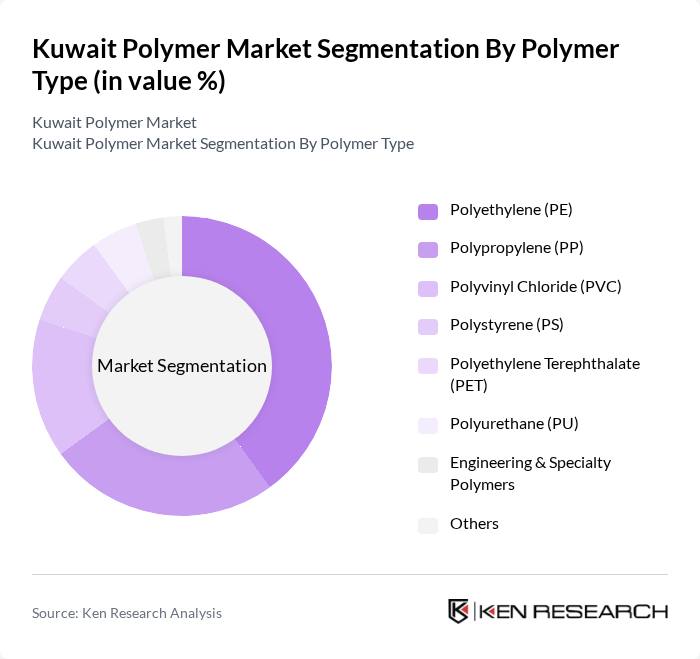

By Polymer Type:The polymer type segmentation includes various categories such as Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Polyethylene Terephthalate (PET), Polyurethane (PU), Engineering & Specialty Polymers, and Others. This structure is consistent with the way regional and global polymer markets are typically segmented. Among these, Polyethylene (PE) is the leading subsegment due to its extensive use in packaging films, containers, pipes, geomembranes, and consumer goods, driven by its versatility, ease of processing, and cost-effectiveness. The demand for PE is bolstered by the growing packaging industry in the Gulf region, which is increasingly focused on lightweight, durable, and moisture?resistant materials for food, consumer goods, and industrial applications.

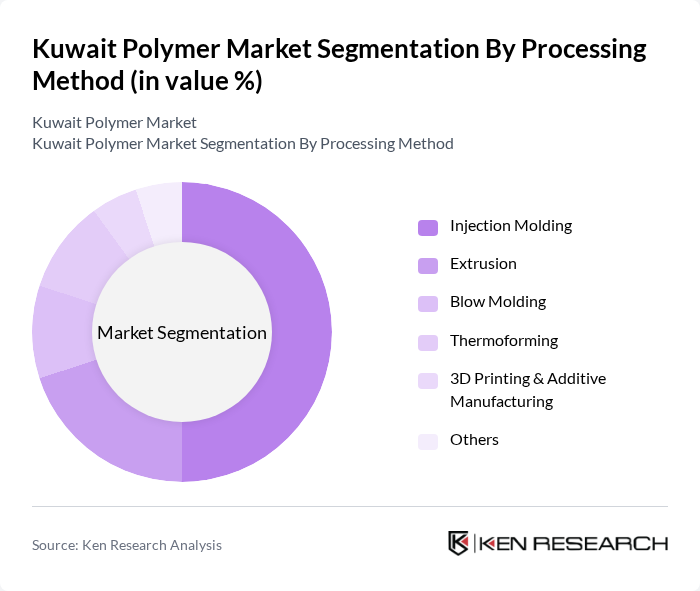

By Processing Method:The processing method segmentation encompasses Injection Molding, Extrusion, Blow Molding, Thermoforming, 3D Printing & Additive Manufacturing, and Others, which aligns with common industrial conversion routes for commodity and specialty polymers. Injection Molding is the dominant processing method, favored for its high productivity, suitability for mass production of complex parts, and ability to produce components with tight tolerances for sectors such as automotive components, caps and closures, consumer goods, electrical housings, and household products. The increasing demand for customized and design?intensive plastic products in automotive, appliances, electronics, and consumer packaging drives the growth of this segment, while extrusion and blow molding remain critical for films, pipes, and containers.

The Kuwait Polymer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Petroleum Corporation (KPC), Petrochemical Industries Company (PIC), EQUATE Petrochemical Company, Boubyan Petrochemical Company, Qurain Petrochemical Industries Company, Kuwait Styrene Company, National Industries Group (NIG), Gulf Plastic Industries, Al-Dhow Plastic Recycling Company, Al-Kout Industrial Projects Company, Kuwait Rubber Manufacturing Company, Al-Khaldiya Plastic Factory, Al-Mutlaa Plastic Factory, Al-Salam Plastic Factory, Other Local Converters and Compounders contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait polymer market appears promising, driven by a combination of technological advancements and a growing emphasis on sustainability. As the government continues to invest in infrastructure and eco-friendly initiatives, the demand for innovative polymer applications is expected to rise. Additionally, the shift towards a circular economy will encourage manufacturers to adopt sustainable practices, enhancing their market position. Overall, the industry is poised for growth, with a focus on environmentally responsible production and product development.

| Segment | Sub-Segments |

|---|---|

| By Polymer Type | Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Polystyrene (PS) Polyethylene Terephthalate (PET) Polyurethane (PU) Engineering & Specialty Polymers Others |

| By Processing Method | Injection Molding Extrusion Blow Molding Thermoforming D Printing & Additive Manufacturing Others |

| By End-Use Industry | Packaging Building & Construction Automotive & Transportation Electrical & Electronics Consumer Goods & Household Products Industrial & Energy (Oil & Gas, Pipes, Fittings) Healthcare & Medical Others |

| By Function | Structural & Load-Bearing Components Barrier & Protective Applications Insulation (Thermal & Electrical) Adhesives, Sealants & Coatings Elastomeric & Flexible Applications Others |

| By Sustainability Profile | Conventional Petrochemical Polymers Recycled Content Polymers Bio-based & Biodegradable Polymers High-Performance Durable Polymers |

| By Customer Type | Integrated Petrochemical Producers Converters & Compounders OEMs (Automotive, Electrical, Industrial) Distributors & Traders Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Polymer Manufacturing Sector | 90 | Production Managers, Operations Directors |

| Packaging Industry Insights | 75 | Procurement Managers, Product Development Leads |

| Automotive Polymer Applications | 65 | Design Engineers, Supply Chain Managers |

| Construction Material Usage | 70 | Project Managers, Material Engineers |

| Recycling and Sustainability Initiatives | 55 | Sustainability Officers, Compliance Managers |

The Kuwait Polymer Market is valued at approximately USD 1.3 billion, reflecting its significant role within the broader Middle East polymer and specialty polymer sectors, driven by increasing demand across various industries.