Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8304

Pages:86

Published On:October 2025

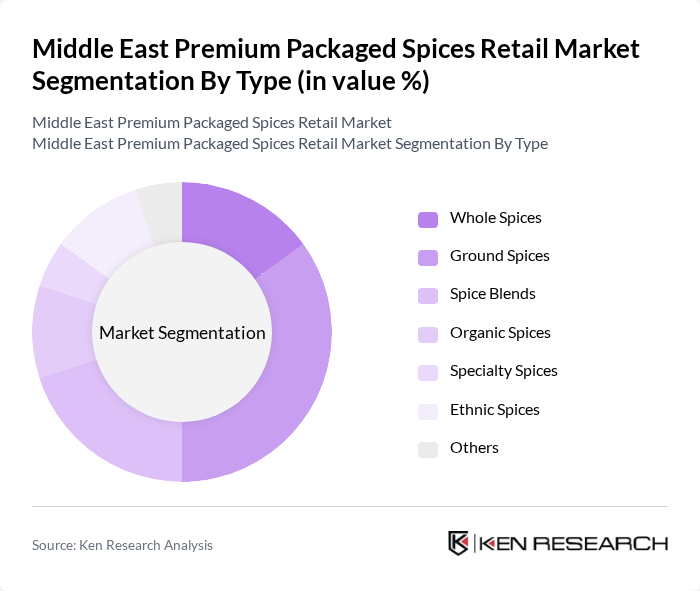

By Type:The market is segmented into various types of spices, including Whole Spices, Ground Spices, Spice Blends, Organic Spices, Specialty Spices, Ethnic Spices, and Others. Among these, Ground Spices are particularly popular due to their convenience and versatility in cooking. Consumers increasingly prefer ready-to-use ground spices, which are easy to incorporate into various dishes, driving their market share.

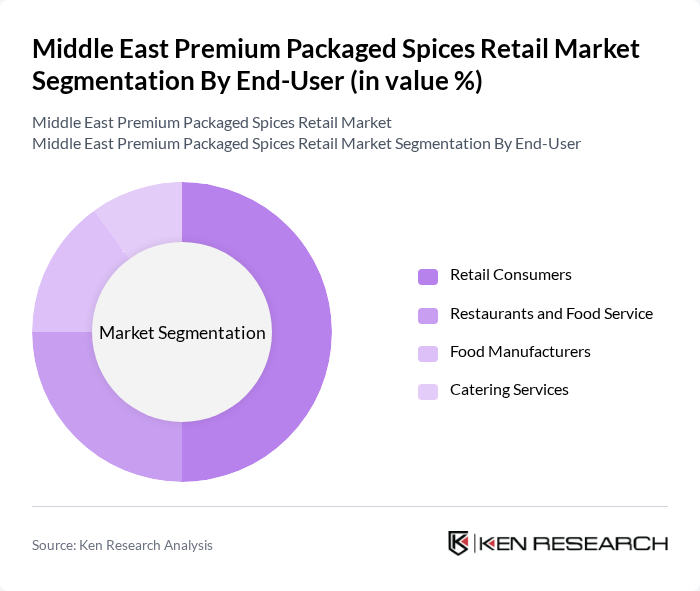

By End-User:The end-user segmentation includes Retail Consumers, Restaurants and Food Service, Food Manufacturers, and Catering Services. Retail Consumers dominate the market as the trend of home cooking continues to rise, with more individuals seeking premium spices for their culinary needs. This segment is characterized by a growing preference for high-quality, flavorful spices that enhance home-cooked meals.

The Middle East Premium Packaged Spices Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Watania, Al Adham Group, Al Kabeer Group, Spice Land, Al-Hamadi Spices, Al-Fakher, Tasty Spices, Al-Masah, Emirates Spice Company, Al-Sharq Spices, Al-Mahra Spices, Al-Mansour, Al-Muqaddimah, Al-Safwa, Al-Mahfouz contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East premium packaged spices market appears promising, driven by evolving consumer preferences and technological advancements. As health-conscious consumers increasingly seek organic and natural products, brands that innovate with unique spice blends and sustainable practices are likely to thrive. Additionally, the rise of digital marketing strategies will enhance brand visibility, allowing companies to engage with consumers more effectively and expand their market reach in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Spices Ground Spices Spice Blends Organic Spices Specialty Spices Ethnic Spices Others |

| By End-User | Retail Consumers Restaurants and Food Service Food Manufacturers Catering Services |

| By Sales Channel | Supermarkets and Hypermarkets Online Retail Specialty Stores Wholesale Distributors |

| By Packaging Type | Glass Jars Plastic Containers Pouches Bulk Packaging |

| By Price Range | Premium Mid-range Economy |

| By Brand Type | National Brands Private Labels Artisan Brands |

| By Region | GCC Countries Levant Region North Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Spice Outlets | 150 | Store Managers, Retail Buyers |

| Online Spice Retailers | 100 | E-commerce Managers, Digital Marketing Specialists |

| Wholesale Spice Distributors | 80 | Distribution Managers, Sales Executives |

| Consumer Focus Groups | 120 | Home Cooks, Culinary Enthusiasts |

| Food Service Industry | 90 | Restaurant Owners, Head Chefs |

The Middle East Premium Packaged Spices Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer demand for high-quality spices and the rising popularity of home cooking and gourmet food preparation.