Region:Middle East

Author(s):Shubham

Product Code:KRAD0934

Pages:97

Published On:November 2025

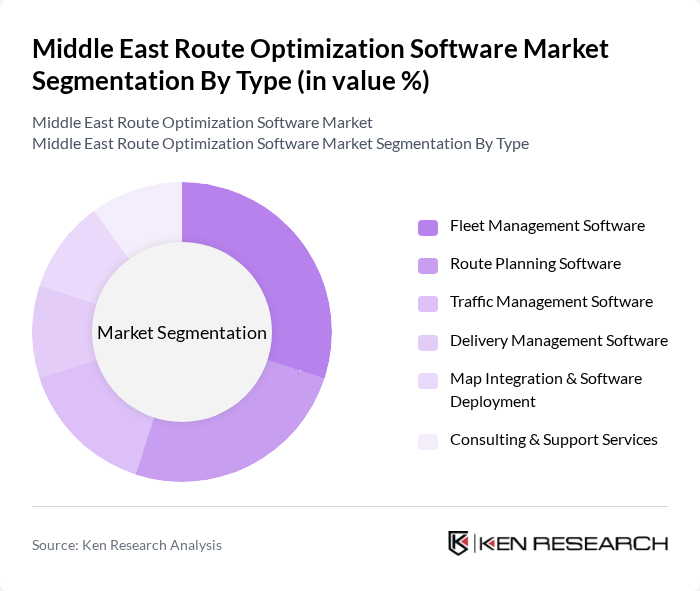

By Type:The market is segmented into various types, including Fleet Management Software, Route Planning Software, Traffic Management Software, Delivery Management Software, Map Integration & Software Deployment, and Consulting & Support Services. Each of these sub-segments plays a crucial role in enhancing operational efficiency and reducing costs for businesses. Fleet Management Software and Route Planning Software represent the largest and fastest-growing segments, driven by the need for real-time vehicle tracking, predictive maintenance, and dynamic route scheduling. Traffic Management and Delivery Management Software are increasingly adopted to address last-mile delivery challenges, while Map Integration and Consulting Services support seamless deployment and ongoing optimization .

The Fleet Management Software sub-segment is currently leading the market due to the increasing need for businesses to monitor and manage their vehicle fleets effectively. This software provides real-time tracking, maintenance scheduling, and fuel management, which are essential for reducing operational costs and improving service delivery. The growing trend of telematics and IoT integration further enhances the capabilities of fleet management solutions, making them indispensable for logistics and transportation providers .

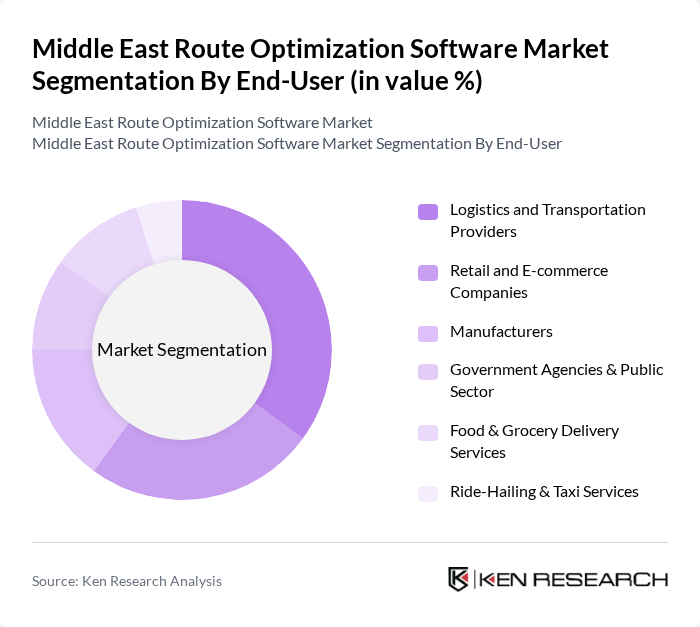

By End-User:The market is segmented by end-users, including Logistics and Transportation Providers, Retail and E-commerce Companies, Manufacturers, Government Agencies & Public Sector, Food & Grocery Delivery Services, Ride-Hailing & Taxi Services, and Others. Each end-user category has unique requirements and drives demand for specific software solutions. Logistics and Transportation Providers are the largest users, followed by Retail and E-commerce Companies, as both sectors require advanced route optimization to manage high delivery volumes and ensure timely, cost-effective operations. The adoption among Government Agencies is also rising, particularly for urban mobility and smart city initiatives .

Logistics and Transportation Providers dominate the market as they are the primary users of route optimization software. The need for efficient route planning, cost reduction, and improved delivery times drives the adoption of these solutions. Additionally, the rise of e-commerce has led to increased demand for logistics services, further propelling the growth of this segment .

The Middle East Route Optimization Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Corporation, SAP SE, Microsoft Corporation, IBM Corporation, Trimble Inc., Descartes Systems Group, HERE Technologies, Geotab Inc., Fleet Complete, Omnitracs, Teletrac Navman, Verizon Connect, Locus.sh, Routific, WorkWave, Paragon Software Systems, Route4Me, Microlise, Caliper Corporation, IFS International Holdings Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Middle East route optimization software market appears promising, driven by technological advancements and increasing demand for efficient logistics solutions. As companies seek to enhance operational efficiency, the integration of AI and machine learning will play a pivotal role in optimizing routes. Additionally, the expansion of e-commerce logistics will further fuel the need for innovative software solutions, creating a dynamic landscape for growth and development in the region's logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Management Software Route Planning Software Traffic Management Software Delivery Management Software Map Integration & Software Deployment Consulting & Support Services |

| By End-User | Logistics and Transportation Providers Retail and E-commerce Companies Manufacturers Government Agencies & Public Sector Food & Grocery Delivery Services Ride-Hailing & Taxi Services Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, etc.) Levant Region (Jordan, Lebanon, etc.) North Africa (Egypt, Morocco, etc.) Others |

| By Industry Vertical | Transportation and Logistics Retail & FMCG Healthcare & Pharmaceuticals Construction & Infrastructure Homecare & Field Services Others |

| By Functionality | Route Optimization Fleet Tracking & Telematics Performance Analytics & Reporting Real-Time Traffic & Congestion Management Others |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Optimization in Retail | 100 | Logistics Managers, Supply Chain Analysts |

| Route Planning for E-commerce | 60 | Operations Managers, IT Directors |

| Transportation Management in Manufacturing | 50 | Procurement Managers, Production Supervisors |

| Fleet Management Solutions | 40 | Fleet Managers, Logistics Coordinators |

| Software Adoption in Freight Forwarding | 70 | Business Development Managers, IT Specialists |

The Middle East Route Optimization Software Market is valued at approximately USD 1.0 billion, driven by the increasing demand for efficient logistics and transportation solutions, particularly in the context of e-commerce growth and advancements in real-time data analytics.