Region:Middle East

Author(s):Dev

Product Code:KRAC4852

Pages:86

Published On:October 2025

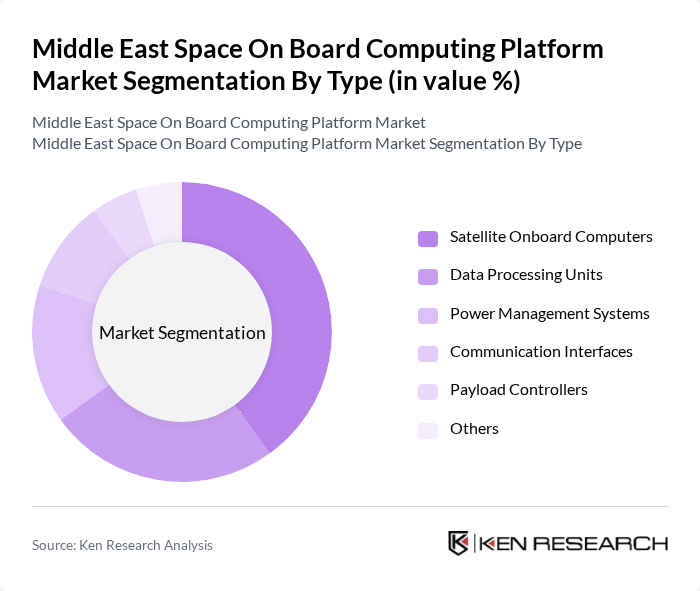

By Type:The market is segmented into Satellite Onboard Computers, Data Processing Units, Power Management Systems, Communication Interfaces, Payload Controllers, and Others. Among these, Satellite Onboard Computers represent the dominant segment, reflecting their essential role in satellite operations by enabling mission-critical data processing, communications, and system management. The growing complexity of satellite missions, increased deployment of CubeSats and small satellites, and the integration of AI-driven autonomous operations are key factors driving demand for advanced onboard computing platforms .

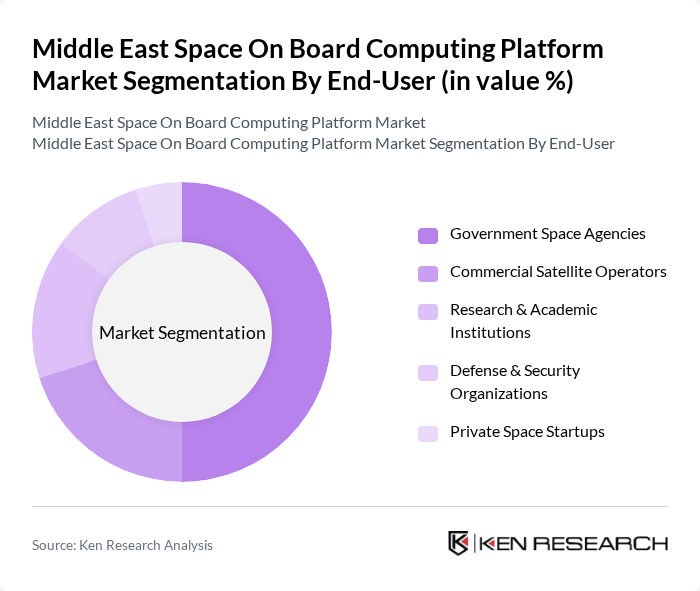

By End-User:The market is categorized by end-users, including Government Space Agencies, Commercial Satellite Operators, Research & Academic Institutions, Defense & Security Organizations, and Private Space Startups. Government Space Agencies are the leading end-user segment, supported by significant public funding and a strategic focus on expanding national space capabilities. These agencies are increasingly investing in next-generation onboard computing platforms to enhance satellite performance, support scientific research, and enable advanced Earth observation and communications missions .

The Middle East Space On Board Computing Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thales Alenia Space, Airbus Defence and Space, Northrop Grumman Corporation, Lockheed Martin Corporation, BAE Systems, Honeywell International Inc., RUAG Space, Mohammed Bin Rashid Space Centre (MBRSC), Israel Aerospace Industries (IAI), Turkish Aerospace Industries (TAI), Saudi Space Commission, Raytheon Technologies, SpaceX, Arianespace, Planet Labs contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East space onboard computing platform market appears promising, driven by technological advancements and increased collaboration among regional players. As countries invest in space capabilities, the integration of artificial intelligence and IoT technologies is expected to enhance satellite functionalities. Furthermore, the growing trend towards sustainability will likely influence the development of energy-efficient computing solutions, positioning the region as a competitive player in the global space industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Satellite Onboard Computers Data Processing Units Power Management Systems Communication Interfaces Payload Controllers Others |

| By End-User | Government Space Agencies Commercial Satellite Operators Research & Academic Institutions Defense & Security Organizations Private Space Startups |

| By Application | Earth Observation Communication Scientific Research Navigation & Positioning Space Exploration |

| By Component | Hardware Software Services |

| By Platform | Small Satellites (CubeSats, NanoSats, MicroSats) Medium & Large Satellites Space Probes Space Stations Launch Vehicles |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Price Range | Low-End Mid-Range High-End |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Satellite Communication Systems | 120 | Aerospace Engineers, Satellite Program Managers |

| Earth Observation Technologies | 100 | Data Analysts, Remote Sensing Specialists |

| Scientific Research Missions | 80 | Research Scientists, Project Coordinators |

| Space Exploration Initiatives | 70 | Mission Planners, Space Policy Experts |

| Commercial Space Ventures | 110 | Business Development Managers, Investment Analysts |

The Middle East Space On Board Computing Platform Market is valued at approximately USD 145 million, reflecting significant growth driven by investments in space exploration and advancements in satellite technology.