Region:Asia

Author(s):Shubham

Product Code:KRAD0827

Pages:95

Published On:November 2025

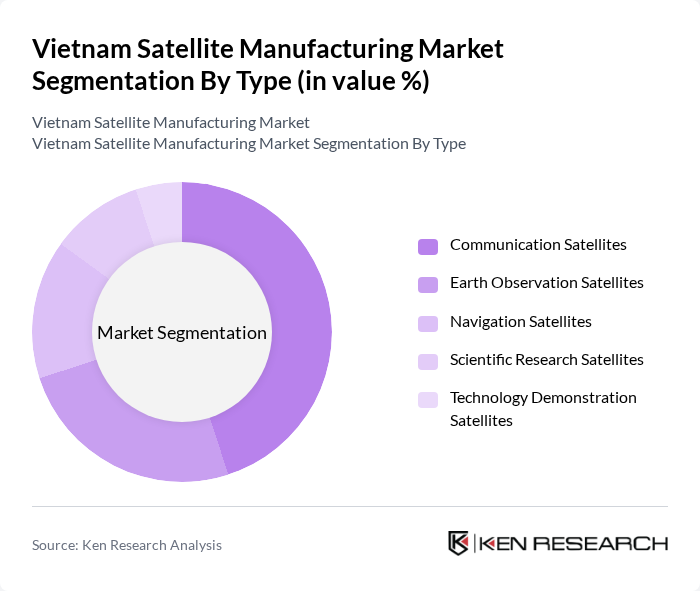

By Type:The segmentation by type includes various categories such as Communication Satellites, Earth Observation Satellites, Navigation Satellites, Scientific Research Satellites, and Technology Demonstration Satellites. Among these, Communication Satellites are currently leading the market due to the increasing demand for broadband services and connectivity solutions. The rise in internet penetration and mobile communication needs has significantly boosted the production and deployment of these satellites. Earth Observation Satellites also hold a substantial share, driven by applications in agriculture, urban planning, and disaster management. The trend toward miniaturization and the adoption of Low Earth Orbit (LEO) satellites are further shaping the market landscape .

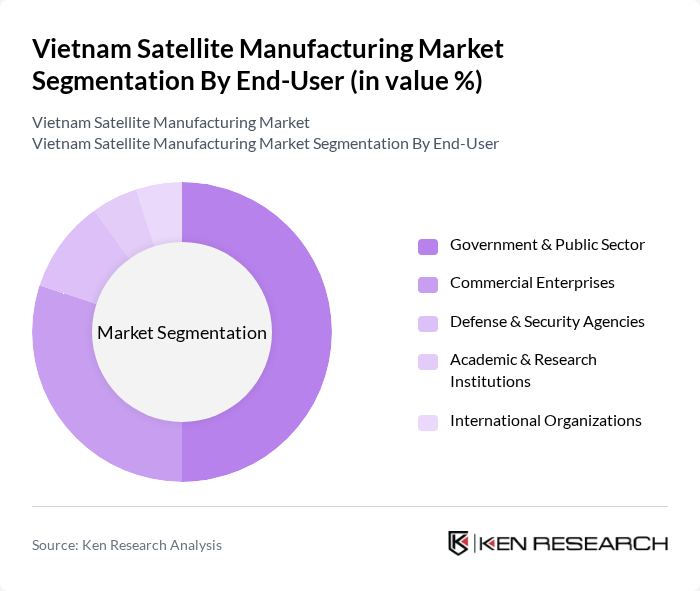

By End-User:The end-user segmentation includes Government & Public Sector, Commercial Enterprises, Defense & Security Agencies, Academic & Research Institutions, and International Organizations. The Government & Public Sector is the dominant segment, primarily due to significant investments in satellite technology for national security, disaster management, and environmental monitoring. Commercial Enterprises are also growing rapidly, driven by the increasing need for satellite services in telecommunications and broadcasting. The expansion of smart agriculture and environmental monitoring applications is further driving demand from both public and private sectors .

The Vietnam Satellite Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as VNREDSat (Vietnam Natural Resources, Environment and Disaster Monitoring Satellite), Vietnam National Space Center (VNSC), VNPT (Vietnam Posts and Telecommunications Group), Viettel Group, FPT Corporation, VNG Corporation, CMC Corporation, SpaceX (Vietnam Operations & Partnerships), Wistron NeWeb Corporation (Neweb Vietnam), Thales Group (Vietnam Partnerships), Amazon Kuiper Systems (Vietnam), Vietnam Aerospace Association, Vietnam Space Technology Institute, Vietnam National University, Hanoi University of Science and Technology, Institute of Space Technology, Vietnam Academy of Science and Technology contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's satellite manufacturing market appears promising, driven by increasing government support and a growing demand for satellite-based services. As the country invests in advanced technologies and infrastructure, the sector is likely to witness significant advancements in satellite capabilities. Furthermore, the emergence of private players and collaborations with international space agencies will enhance innovation and competitiveness, positioning Vietnam as a key player in the regional satellite manufacturing landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Communication Satellites Earth Observation Satellites Navigation Satellites Scientific Research Satellites Technology Demonstration Satellites |

| By End-User | Government & Public Sector Commercial Enterprises Defense & Security Agencies Academic & Research Institutions International Organizations |

| By Application | Telecommunications & Broadband Remote Sensing & Earth Observation Scientific Research & Experimentation Disaster Management & Environmental Monitoring Navigation & Positioning |

| By Payload Capacity | Small Satellites (up to 500 kg) Medium Satellites (500–2,500 kg) Large Satellites (above 2,500 kg) Micro/Nano Satellites |

| By Launch Method | Dedicated Launch Vehicles Ride-Share Launches Hosted Payloads |

| By Manufacturing Process | In-House Manufacturing Outsourced Manufacturing Joint Ventures & Partnerships Contract Manufacturing |

| By Funding Source | Government Funding Private Investments International Grants & Development Aid Corporate R&D Budgets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Space Policy | 50 | Policy Makers, Space Agency Officials |

| Satellite Manufacturing Firms | 40 | CEOs, Production Managers, R&D Heads |

| Aerospace Research Institutions | 40 | Research Scientists, Project Managers |

| International Collaborations | 40 | Partnership Managers, International Relations Officers |

| End-User Industries (Telecom, Defense) | 40 | Procurement Officers, Technical Directors |

The Vietnam Satellite Manufacturing Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by government investments, advancements in satellite technology, and increasing demand for satellite-based services across various sectors.