Region:Middle East

Author(s):Dev

Product Code:KRAD0375

Pages:95

Published On:August 2025

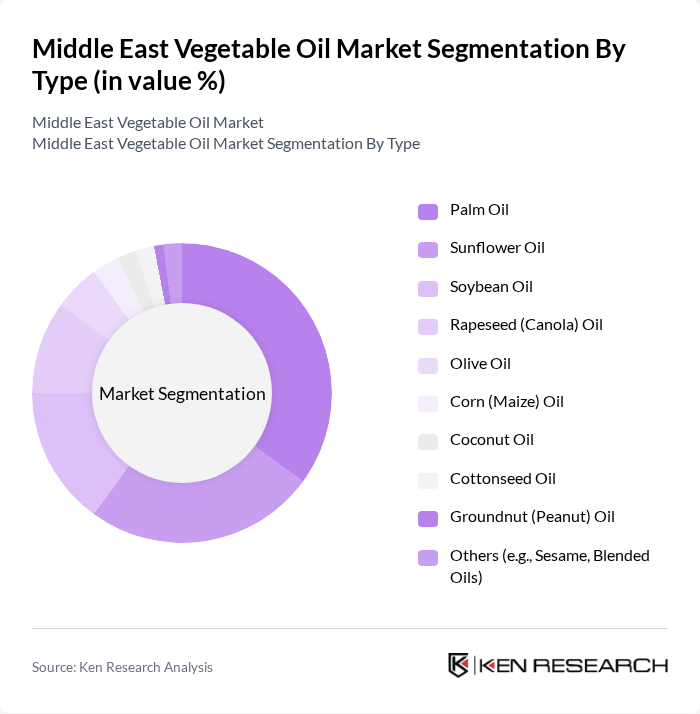

By Type:The vegetable oil market is segmented into various types, including palm oil, sunflower oil, soybean oil, rapeseed (canola) oil, olive oil, corn (maize) oil, coconut oil, cottonseed oil, groundnut (peanut) oil, and others such as sesame and blended oils. Among these, palm oil and sunflower oil are the most widely consumed due to their versatility and cost-effectiveness. The demand for these oils is driven by their extensive use in cooking, food processing, and industrial applications .

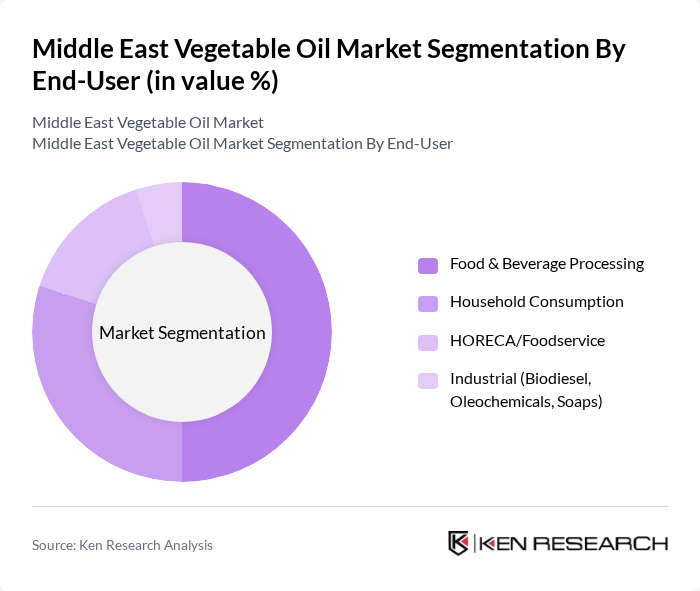

By End-User:The end-user segmentation includes food and beverage processing, household consumption, HORECA (Hotels, Restaurants, and Catering), and industrial applications such as biodiesel and oleochemicals. The food and beverage processing sector is the largest consumer of vegetable oils, driven by the increasing demand for processed foods and convenience products. Household consumption is also significant, as consumers seek healthier cooking options .

The Middle East Vegetable Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Savola Group, IFFCO Group, United Foods Company, Abu Dhabi Vegetable Oil Company (ADVOC), Al Ghurair Foods (AGROP), Emirates Refining Company (ERC), Cargill, Archer Daniels Midland (ADM), Bunge, Omani Vegetable Oils & Derivatives Co. (OVODC), Near East Olive Products, Rafael Salgado S.A., Sime Darby Plantation Berhad, Hayel Saeed Anam Group (Aden Refined/Nahel brands), Afia International Company contribute to innovation, geographic expansion, and service delivery in this space .

The Middle East vegetable oil market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The shift towards sustainable sourcing is expected to gain momentum, with more companies adopting eco-friendly practices. Additionally, the integration of digital marketing strategies will enhance brand visibility and consumer engagement. As health-conscious consumers continue to seek organic and natural products, the market will likely see an increase in innovative product offerings that cater to these demands, fostering growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Palm Oil Sunflower Oil Soybean Oil Rapeseed (Canola) Oil Olive Oil Corn (Maize) Oil Coconut Oil Cottonseed Oil Groundnut (Peanut) Oil Others (e.g., Sesame, Blended Oils) |

| By End-User | Food & Beverage Processing Household Consumption HORECA/Foodservice Industrial (Biodiesel, Oleochemicals, Soaps) |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience & Grocery Stores Wholesale/B2B Distributors & Cash-and-Carry |

| By Packaging Type | PET Bottles Metal Cans/Tins Flexible Pouches/Sachets Bulk (Jerrycans, Drums, IBCs) |

| By Price Range | Premium Mid-Range Economy |

| By Origin | Domestic Production Imported |

| By Certification | Organic Non-GMO Halal RSPO/ISPO/MSPO or Equivalent Sustainable Sourcing Others |

| By Country | Saudi Arabia United Arab Emirates Iran Kuwait Qatar Oman Bahrain Egypt Jordan Israel Lebanon Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Vegetable Oil Sales | 150 | Store Managers, Category Buyers |

| Food Service Industry Usage | 100 | Restaurant Owners, Chefs |

| Household Consumption Patterns | 140 | Home Cooks, Nutritionists |

| Export Market Insights | 80 | Export Managers, Trade Analysts |

| Health and Wellness Trends | 70 | Dietitians, Health Coaches |

The Middle East Vegetable Oil Market is valued at approximately USD 8.5 billion, driven by increasing consumer demand for healthy cooking oils, urbanization, and growth in the food processing industry.