Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4181

Pages:83

Published On:December 2025

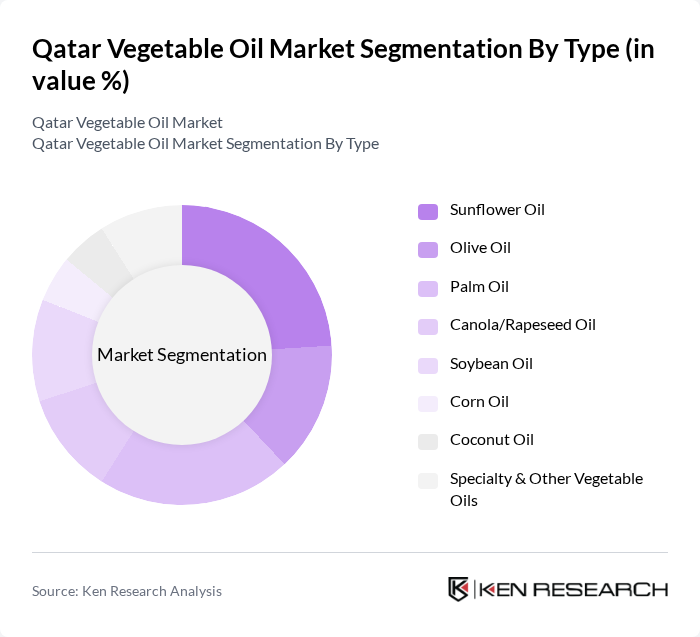

By Type:The vegetable oil market can be segmented into various types, including sunflower oil, olive oil, palm oil, canola/rapeseed oil, soybean oil, corn oil, coconut oil, and specialty & other vegetable oils. Each type caters to different consumer preferences and culinary applications, influencing market dynamics, with sunflower, canola, soybean, and palm oils widely used in everyday cooking and food service, while olive oil holds a strong position in premium and health-oriented segments.

The leading sub-segment in the vegetable oil market is sunflower oil, which is favored for its light flavor and relatively high smoke point, making it suitable for frying and daily cooking in both households and food service outlets. The increasing health consciousness among consumers and the shift towards perceived healthier, low-trans-fat and low-cholesterol oils have supported the demand for sunflower, canola, and blended vegetable oils. Additionally, the versatility of sunflower oil in various culinary applications, along with strong availability in modern retail and horeca channels, has solidified its position as a dominant choice among consumers.

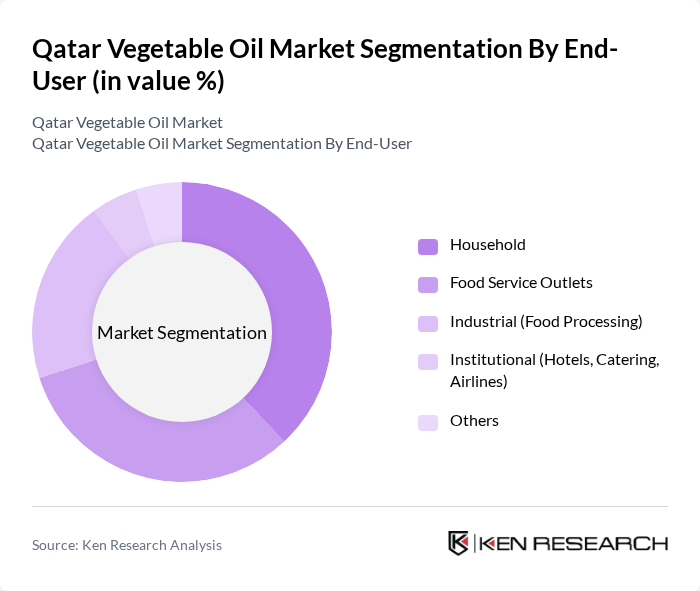

By End-User:The market can be segmented based on end-users, including households, food service outlets (restaurants, cafés, QSRs), industrial (food processing), institutional (hotels, catering, airlines), and others. Each segment has unique requirements and consumption patterns that influence the overall market, with retail packs dominating household use and bulk packaging more relevant for food service and industrial users.

Households represent the largest end-user segment in the vegetable oil market, supported by population growth, higher disposable incomes, and a strong trend toward home cooking and healthier eating, especially in packaged and branded oils. The demand for cooking oils in households is influenced by factors such as dietary preferences, health trends (including interest in cholesterol-friendly and fortified oils), and the availability of various oil types through supermarkets, hypermarkets, and e-commerce. Food service outlets also play a significant role, as they require large quantities of vegetable oils for frying and food preparation in quick-service restaurants, cafés, and catering, further driving market growth in bulk and value segments.

The Qatar Vegetable Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Flour Mills Company (Qatar Flour Mills / QFM), Hassad Food Company Q.S.C., Widam Food Company Q.P.S.C., Baladna Q.P.S.C., Qatar Distribution Company (QDC), Qatar National Import & Export Co. (QNIE), Ali Bin Ali Holding – Consumer & Retail Division, Al Meera Consumer Goods Company Q.P.S.C., Safari Group – Hypermarkets Division, Family Food Centre, LuLu Group International – Qatar Operations, Tadmur Trading – Food Division, Qatar Quality Products Co. (Vegetable Oil & Food Trading), Al Jazeera Food Company, Gulf Food Production & Import Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar vegetable oil market appears promising, driven by increasing health awareness and a shift towards sustainable practices. As consumers demand healthier options, local producers are likely to innovate and diversify their product offerings. Additionally, the rise of e-commerce platforms is expected to enhance distribution channels, making it easier for consumers to access a variety of oils. The government's support for local production will further bolster the market's growth potential, fostering a more resilient industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Sunflower Oil Olive Oil Palm Oil Canola/Rapeseed Oil Soybean Oil Corn Oil Coconut Oil Specialty & Other Vegetable Oils (e.g., avocado, sesame, blended oils) |

| By End-User | Household Food Service Outlets (Restaurants, Cafés, QSRs) Industrial (Food Processing) Institutional (Hotels, Catering, Airlines) Others |

| By Packaging Type | Bottles Pouches Cans Bulk Packaging (Drums, IBCs) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Wholesale Distributors & Cash-and-Carry Others |

| By Origin | Imported – Branded Imported – Private Label Locally Packed/Refined Others |

| By Price Range | Economy Mid-range Premium Super-premium & Organic |

| By Health & Functional Positioning | Heart Health (Low Cholesterol / High Monounsaturated) Weight Management & Fitness-Oriented Oils Fortified Oils (Vitamins, Omega-3, etc.) Clean Label / Organic / Non-GMO Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Vegetable Oil Sales | 120 | Store Managers, Category Buyers |

| Food Service Industry Usage | 100 | Restaurant Owners, Head Chefs |

| Local Oilseed Farmers | 80 | Agricultural Producers, Cooperative Leaders |

| Import and Distribution Channels | 100 | Logistics Managers, Import Agents |

| Consumer Preferences and Trends | 150 | Household Consumers, Health-Conscious Shoppers |

The Qatar Vegetable Oil Market is valued at approximately USD 1.5 billion, reflecting a significant growth driven by increasing consumer demand for healthier cooking oils and the expansion of the food service and hospitality industries in the region.