Region:Middle East

Author(s):Shubham

Product Code:KRAD6706

Pages:92

Published On:December 2025

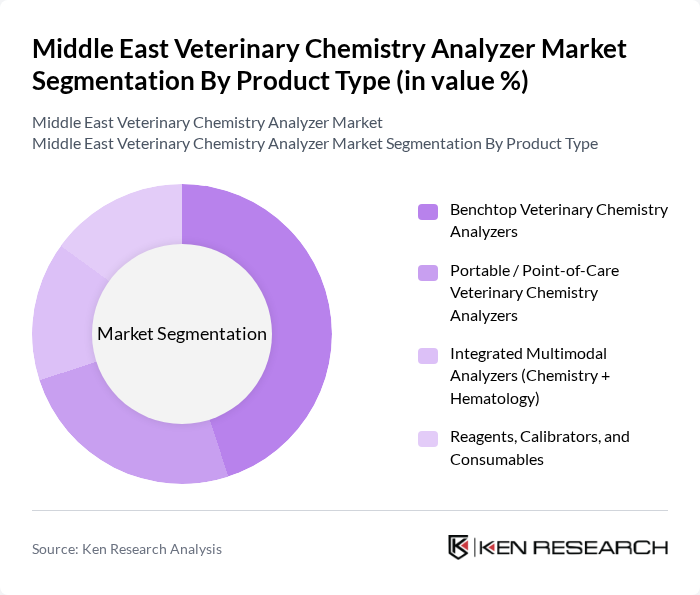

By Product Type:The product type segmentation includes various categories such as Benchtop Veterinary Chemistry Analyzers, Portable / Point-of-Care Veterinary Chemistry Analyzers, Integrated Multimodal Analyzers (Chemistry + Hematology), and Reagents, Calibrators, and Consumables. Among these, Benchtop Veterinary Chemistry Analyzers are leading the market due to their high accuracy, reliability, and extensive usage in veterinary clinics and hospitals. The demand for portable analyzers is also increasing, driven by the need for on-site testing in remote areas.

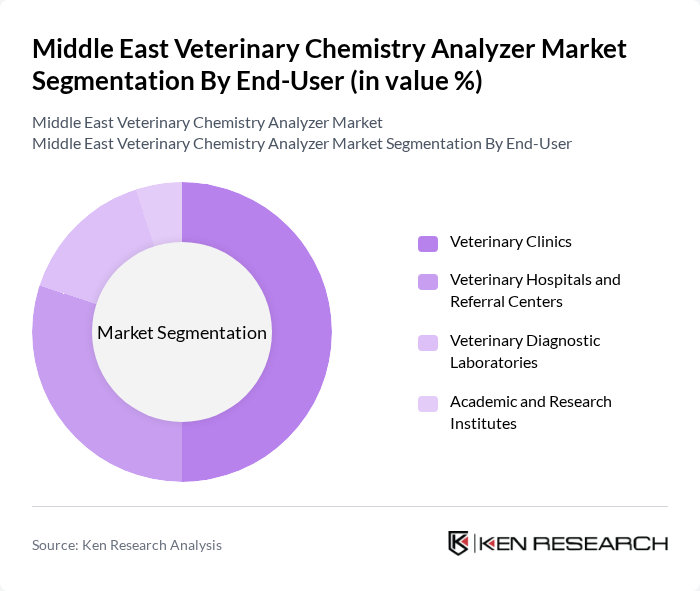

By End-User:The end-user segmentation encompasses Veterinary Clinics, Veterinary Hospitals and Referral Centers, Veterinary Diagnostic Laboratories, and Academic and Research Institutes. Veterinary Clinics are the dominant segment, primarily due to the increasing number of pet owners seeking regular health check-ups and diagnostics for their animals. The growth of veterinary hospitals and referral centers is also notable, as they provide specialized services and advanced diagnostic capabilities.

The Middle East Veterinary Chemistry Analyzer Market is characterized by a dynamic mix of regional and international players. Leading participants such as IDEXX Laboratories, Inc., Zoetis Inc. (including Abaxis, Inc.), Heska Corporation (a Mars, Incorporated company), Virbac Group, Mindray Animal Medical (Shenzhen Mindray Bio?Medical Electronics Co., Ltd.), HORIBA Medical (HORIBA, Ltd.), FUJIFILM Vet Systems Co., Ltd., Woodley Veterinary Diagnostics, Eurolyser Diagnostica GmbH, URIT Medical Electronic Co., Ltd. (Veterinary Division), Samsung Medison Co., Ltd. (Veterinary Diagnostics Portfolio), Randox Laboratories Ltd. (Veterinary Diagnostics), Skyla Corporation, Bionote Co., Ltd., Local and Regional Middle East Distributors and Integrators (e.g., Gulf Veterinary Laboratory Suppliers, Dubai; Saudi Veterinary Medical Supply Companies) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East veterinary chemistry analyzer market appears promising, driven by ongoing advancements in technology and a growing emphasis on animal health. As the region's pet population continues to rise, the demand for efficient diagnostic solutions will likely increase. Additionally, the integration of telemedicine and AI in veterinary practices is expected to enhance service delivery, making diagnostics more accessible. This evolving landscape presents opportunities for innovation and collaboration among stakeholders in the veterinary sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Benchtop Veterinary Chemistry Analyzers Portable / Point-of-Care Veterinary Chemistry Analyzers Integrated Multimodal Analyzers (Chemistry + Hematology) Reagents, Calibrators, and Consumables |

| By End-User | Veterinary Clinics Veterinary Hospitals and Referral Centers Veterinary Diagnostic Laboratories Academic and Research Institutes |

| By Animal Type | Companion Animals (Canine, Feline) Equine Livestock (Bovine, Ovine, Caprine, Porcine) Others (Avian, Zoological, Exotic Species) |

| By Application | Clinical Chemistry and Routine Biochemistry Panels Critical Care and Emergency Testing Pre?surgical Screening and Wellness Testing Disease Monitoring and Therapeutic Drug Monitoring |

| By Distribution Channel | Direct Sales by Manufacturers Regional Distributors and Dealers E?commerce and Online Procurement Platforms Group Purchasing Organizations and Tender-Based Procurement |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Rest of Middle East |

| By Technology | Dry Chemistry Analyzers Wet Chemistry Analyzers Fully Automated Analyzers Semi?Automated Analyzers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 120 | Veterinarians, Clinic Managers |

| Diagnostic Laboratories | 80 | Laboratory Technicians, Pathologists |

| Veterinary Equipment Distributors | 60 | Sales Managers, Product Specialists |

| Pet Owners | 100 | Pet Owners, Animal Caretakers |

| Veterinary Associations | 40 | Association Leaders, Policy Makers |

The Middle East Veterinary Chemistry Analyzer Market is valued at approximately USD 55 million, driven by increasing demand for veterinary diagnostics, advancements in technology, and heightened awareness of animal health among pet owners and livestock farmers.