Region:Asia

Author(s):Rebecca

Product Code:KRAC9687

Pages:90

Published On:November 2025

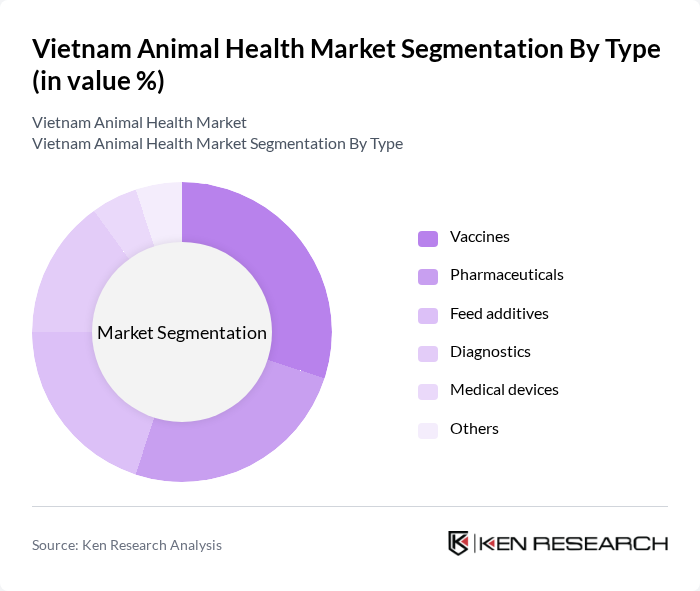

By Type:The market can be segmented into various types, including vaccines, pharmaceuticals, feed additives, diagnostics, medical devices, and others. Each of these subsegments plays a crucial role in maintaining animal health and productivity. Vaccines are essential for disease prevention, while pharmaceuticals are used for treatment. Feed additives enhance nutrition, diagnostics aid in disease detection, and medical devices support veterinary practices. The demand for feed additives and diagnostics is rising as producers focus on disease prevention and early detection to maximize productivity and minimize losses .

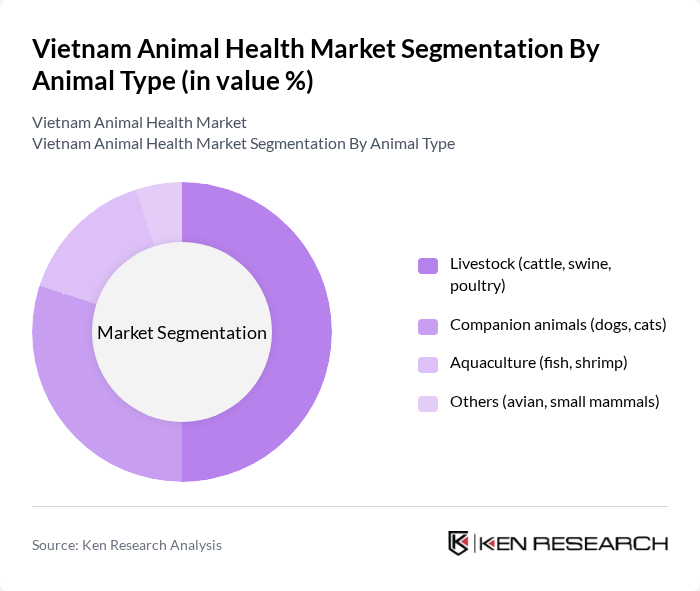

By Animal Type:The market is also segmented by animal type, which includes livestock (cattle, swine, poultry), companion animals (dogs, cats), aquaculture (fish, shrimp), and others (avian, small mammals). Livestock remains the dominant segment due to the high demand for meat and dairy products, while companion animals are gaining traction as pet ownership increases. The aquaculture sector is also expanding, reflecting Vietnam's leading position in global seafood exports and the growing need for aquatic animal health products .

The Vietnam Animal Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Vietnam, Merck Animal Health (MSD Animal Health Vietnam), Boehringer Ingelheim Vietnam, Elanco Animal Health Vietnam, Vemedim Corporation, Viphavet Co., Ltd., Vetoquinol Vietnam, Huvepharma Vietnam, Dechra Veterinary Products, Phibro Animal Health Vietnam, Bio-Pharmachemie, Intervet Vietnam, Alltech Vietnam, Neogen Corporation, GreenVet Joint Stock Company contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam animal health market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The shift towards preventive healthcare and the adoption of digital veterinary services are expected to enhance service delivery and product accessibility. Additionally, the increasing focus on sustainability in animal farming practices will likely shape product development and regulatory frameworks, fostering a more resilient and innovative market landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Vaccines Pharmaceuticals Feed additives Diagnostics Medical devices Others |

| By Animal Type | Livestock (cattle, swine, poultry) Companion animals (dogs, cats) Aquaculture (fish, shrimp) Others (avian, small mammals) |

| By Distribution Channel | Veterinary clinics & hospitals Online platforms/e-commerce Pharmacies & drug stores Direct sales (to farms, institutions) Pet shops & specialty stores Others |

| By Product Formulation | Injectable Oral (tablets, liquids, powders) Topical (ointments, sprays) Others |

| By End-User | Commercial farmers Pet owners Aquaculture operators Veterinary professionals Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Mekong Delta Others |

| By Regulatory Compliance | Local regulations International standards Certification requirements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 60 | Veterinarians, Clinic Managers |

| Livestock Farmers | 90 | Farm Owners, Animal Health Managers |

| Animal Health Product Distributors | 40 | Sales Representatives, Distribution Managers |

| Regulatory Bodies | 45 | Policy Makers, Regulatory Officers |

| Research Institutions | 50 | Animal Health Researchers, Academics |

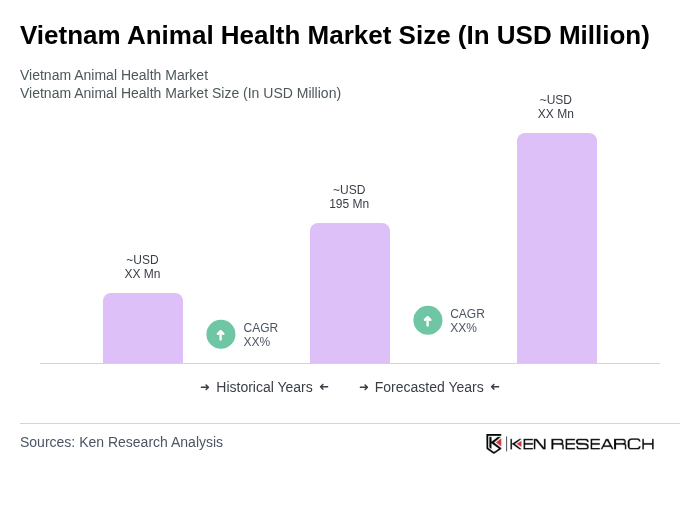

The Vietnam Animal Health Market is valued at approximately USD 195 million, driven by increasing livestock production, rising pet ownership, and greater awareness of animal health and welfare among farmers and pet owners.