Region:Middle East

Author(s):Rebecca

Product Code:KRAD6204

Pages:94

Published On:December 2025

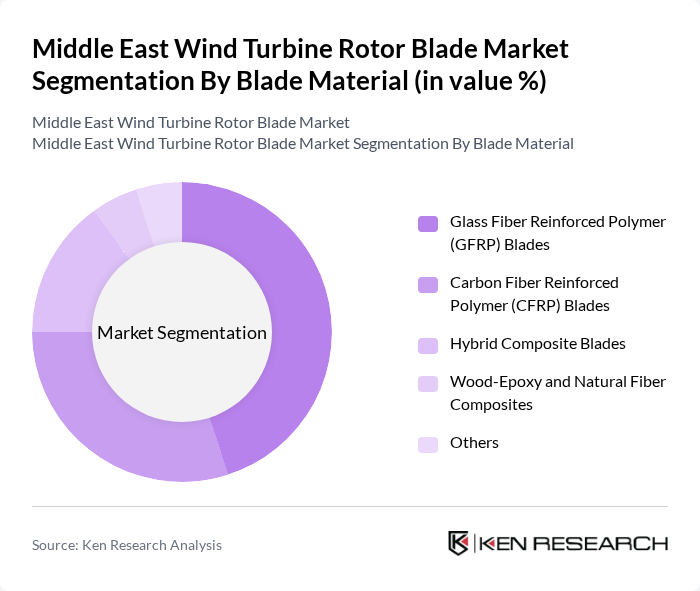

By Blade Material:The segmentation by blade material includes various types such as Glass Fiber Reinforced Polymer (GFRP) Blades, Carbon Fiber Reinforced Polymer (CFRP) Blades, Hybrid Composite Blades, Wood-Epoxy and Natural Fiber Composites, and Others. GFRP blades are the most widely used in commercial wind turbines globally due to their cost-effectiveness, mature manufacturing base, and good fatigue resistance, making them a preferred choice for many wind turbine manufacturers. At the same time, the increasing focus on lightweight materials, larger rotor diameters, and higher specific power ratings is driving the demand for CFRP and hybrid composite blades, which are gaining traction in high-performance onshore and offshore applications despite their higher cost.

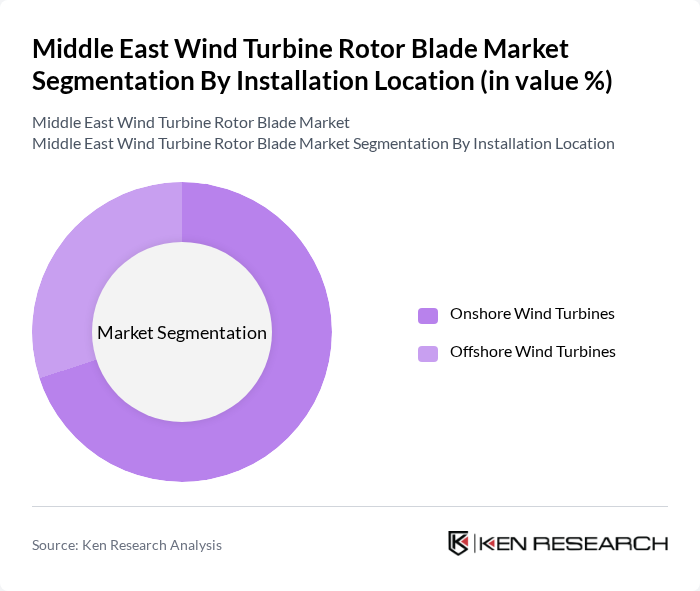

By Installation Location:The market is segmented based on installation location into Onshore Wind Turbines and Offshore Wind Turbines. Onshore wind turbines currently dominate installed capacity in the Middle East and wider MEA region, supported by lower installation and grid-connection costs, shorter project lead times, and easier access for construction and maintenance. However, offshore wind turbines are gaining strategic interest as governments and developers assess high?capacity factor sites in the Red Sea, Arabian Gulf, and eastern Mediterranean; their higher energy generation potential per project and lower visual and land?use impact are encouraging early?stage feasibility studies and tenders, which will gradually increase the relevance of offshore rotor blades in the region.

The Middle East Wind Turbine Rotor Blade Market is characterized by a dynamic mix of regional and international players. Leading participants such as LM Wind Power (a GE Vernova business), TPI Composites, Inc., Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, GE Vernova (GE Renewable Energy), Nordex SE, Suzlon Energy Limited, Envision Energy, Xinjiang Goldwind Science & Technology Co., Ltd. (Goldwind), Mingyang Smart Energy Group Co., Ltd., Sinoma Wind Power Blade Co., Ltd., Zhongfu Lianzhong Composites Group Co., Ltd., SANY Renewable Energy Co., Ltd., ACCIONA Energía, S.A., Enercon GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East wind turbine rotor blade market appears promising, driven by increasing investments in renewable energy and supportive government policies. As countries in the region strive to meet ambitious clean energy targets, the demand for advanced rotor blade technologies is expected to rise. Additionally, the integration of smart technologies and AI in wind energy management will enhance operational efficiency, paving the way for a more sustainable energy landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Blade Material | Glass Fiber Reinforced Polymer (GFRP) Blades Carbon Fiber Reinforced Polymer (CFRP) Blades Hybrid Composite Blades Wood-Epoxy and Natural Fiber Composites Others |

| By Installation Location | Onshore Wind Turbines Offshore Wind Turbines |

| By Blade Length / Rated Power Class | Up to 2 MW (? 45 m) –4 MW (46–70 m) Above 4 MW (> 70 m) |

| By Application | New Turbine Installations (Greenfield) Repowering & Blade Replacement |

| By Customer Type | Turbine OEMs IPPs & Utility Developers EPC Contractors Operations & Maintenance (O&M) Service Providers |

| By Country | Saudi Arabia United Arab Emirates Egypt Morocco Jordan Others (Rest of Middle East) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wind Farm Developers | 100 | Project Managers, Development Directors |

| Manufacturers of Rotor Blades | 60 | Production Managers, R&D Engineers |

| Energy Policy Makers | 40 | Government Officials, Regulatory Analysts |

| Maintenance and Operations Teams | 50 | Operations Managers, Field Technicians |

| Consultants in Renewable Energy | 40 | Energy Analysts, Market Researchers |

The Middle East Wind Turbine Rotor Blade Market is valued at approximately USD 0.17 billion, reflecting a historical analysis of the region's wind capacity and investments in renewable energy projects.