Region:Middle East

Author(s):Dev

Product Code:KRAD5110

Pages:85

Published On:December 2025

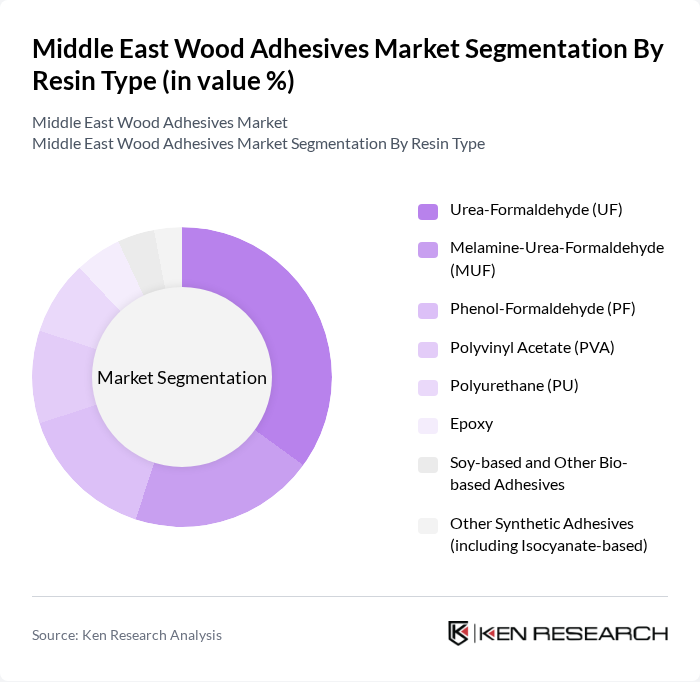

By Resin Type:The resin type segmentation includes various categories such as Urea-Formaldehyde (UF), Melamine-Urea-Formaldehyde (MUF), Phenol-Formaldehyde (PF), Polyvinyl Acetate (PVA), Polyurethane (PU), Epoxy, Soy-based and Other Bio-based Adhesives, and Other Synthetic Adhesives (including Isocyanate-based). Among these, Urea-Formaldehyde (UF) is the leading subsegment due to its widespread use in the production of particleboard, MDF, and other interior-grade panels, driven by its cost-effectiveness, fast curing, and strong bonding properties in dry-service conditions. The increasing demand for engineered wood products and panel?based furniture in residential, commercial, and hospitality projects across the Middle East further solidifies its market position, while MUF and PF resins are preferred for higher moisture and exterior applications.

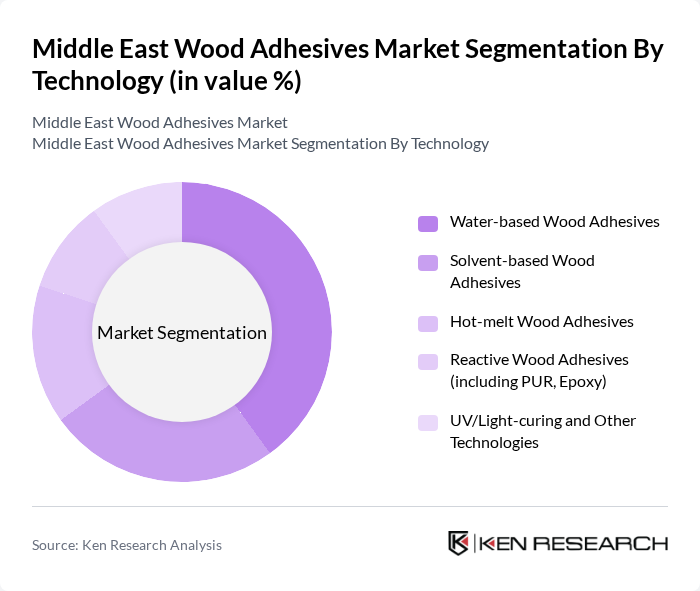

By Technology:The technology segmentation encompasses Water-based Wood Adhesives, Solvent-based Wood Adhesives, Hot-melt Wood Adhesives, Reactive Wood Adhesives (including PUR, Epoxy), and UV/Light-curing and Other Technologies. Water-based Wood Adhesives dominate this segment due to their eco-friendliness, low VOC emissions, and worker safety benefits, making them increasingly popular in both industrial production lines and DIY/retail applications. The shift towards sustainable practices in woodworking, panel manufacturing, and green building certifications across the Middle East has further propelled the demand for water-based and reactive PUR dispersion solutions, positioning them as the preferred choice among manufacturers seeking to meet performance and environmental criteria simultaneously.

The Middle East Wood Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, H.B. Fuller Company, Sika AG, Bostik SA (Arkema Group), Dow Chemical Company, BASF SE, Jowat SE, Akzo Nobel N.V. (Wood Coatings & Adhesives), Pidilite Industries Ltd., Huntsman Corporation, Mapei S.p.A., Al Muqarram Group (UAE), National Adhesives Ltd. (Saudi Arabia), The Industrial Group Ltd. (Saudi Arabia), and other regional and local wood adhesive manufacturers contribute to innovation, geographic expansion, and service delivery in this space, with portfolios spanning PVAc, UF/MUF, polyurethane, epoxy, hot-melt, and specialty low?VOC and formaldehyde?reduced systems for furniture, panels, flooring, and interior joinery applications.

The future of the Middle East wood adhesives market appears promising, driven by a growing emphasis on sustainability and innovation. As the construction and furniture sectors continue to expand, the demand for advanced adhesive solutions is expected to rise. Additionally, the increasing adoption of eco-friendly products will likely lead to the development of new formulations that meet both performance and environmental standards, positioning manufacturers to capitalize on emerging trends and consumer preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Resin Type | Urea-Formaldehyde (UF) Melamine-Urea-Formaldehyde (MUF) Phenol-Formaldehyde (PF) Polyvinyl Acetate (PVA) Polyurethane (PU) Epoxy Soy-based and Other Bio-based Adhesives Other Synthetic Adhesives (including Isocyanate-based) |

| By Technology | Water-based Wood Adhesives Solvent-based Wood Adhesives Hot-melt Wood Adhesives Reactive Wood Adhesives (including PUR, Epoxy) UV/Light-curing and Other Technologies |

| By Application | Plywood Particleboard and MDF Laminated Veneer Lumber (LVL) and Glulam Flooring and Panels Furniture and Cabinetry Doors, Windows, and Joinery Others |

| By End-Use Sector | Residential Construction Non-Residential / Commercial Construction Industrial & Infrastructure Furniture & Woodworking Shops DIY and Small Workshops |

| By Distribution Channel | Direct Sales to OEMs and Panel Manufacturers Industrial Distributors Retail / Dealers and Trade Counters Online and E-commerce Channels Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Turkey Rest of Middle East |

| By Performance Characteristics | High-Strength Structural Adhesives Fast-Curing / High-Throughput Adhesives Water-Resistant and Waterproof Adhesives Heat- and Chemical-Resistant Adhesives Low-VOC and Formaldehyde-free Adhesives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Furniture Manufacturing Sector | 120 | Production Managers, Quality Control Supervisors |

| Construction Industry Adhesive Usage | 110 | Project Managers, Site Supervisors |

| Automotive Interior Applications | <90 | Product Development Engineers, Procurement Specialists |

| DIY and Retail Adhesive Sales | 80 | Store Managers, Sales Representatives |

| Research and Development in Adhesives | 60 | R&D Managers, Technical Directors |

The Middle East Wood Adhesives Market is valued at approximately USD 120 million, driven by growth in the construction sector, demand for furniture, and eco-friendly adhesive systems. This valuation is based on a five-year historical analysis of market trends.