Region:Middle East

Author(s):Shubham

Product Code:KRAD1933

Pages:90

Published On:December 2025

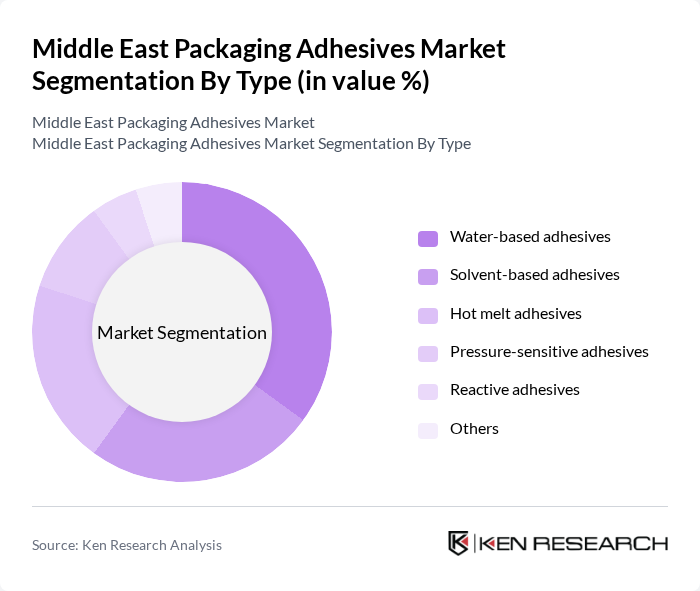

By Type:The Middle East Packaging Adhesives Market is segmented into various types, including water-based adhesives, solvent-based adhesives, hot melt adhesives, pressure-sensitive adhesives, reactive adhesives, and others. Among these, water-based adhesives are gaining significant traction due to their eco-friendly properties and compliance with stringent regulations. The demand for solvent-based adhesives remains strong in specific applications, while hot melt adhesives are favored for their quick bonding capabilities in high-speed production environments.

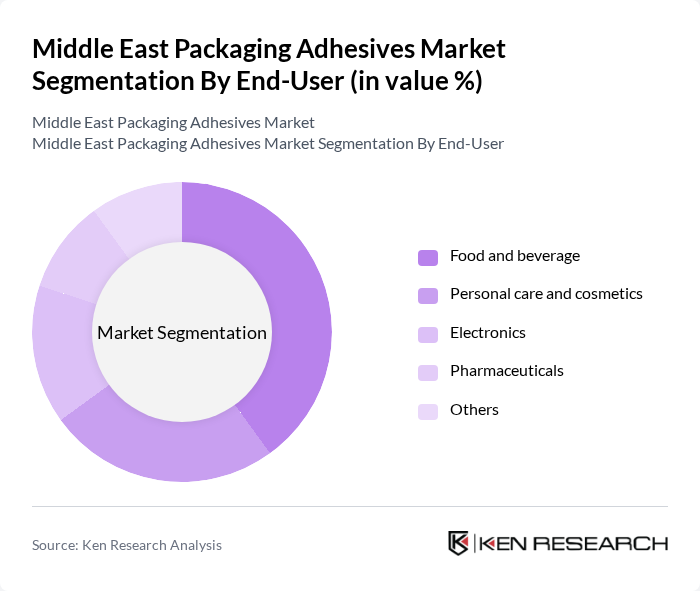

By End-User:The end-user segmentation of the Middle East Packaging Adhesives Market includes food and beverage, personal care and cosmetics, electronics, pharmaceuticals, and others. The food and beverage sector is the largest consumer of packaging adhesives, driven by the need for safe and efficient packaging solutions. The personal care and cosmetics industry also contributes significantly, as manufacturers seek high-performance adhesives for diverse packaging formats.

The Middle East Packaging Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, Sika AG, H.B. Fuller Company, Bostik SA, Avery Dennison Corporation, Dow Inc., Ashland Global Holdings Inc., RPM International Inc., Jowat SE, Tesa SE, ITW (Illinois Tool Works Inc.), Momentive Performance Materials Inc., Wacker Chemie AG, Arkema S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East packaging adhesives market is poised for significant transformation, driven by the integration of sustainable practices and technological innovations. As the demand for eco-friendly adhesives rises, manufacturers are expected to invest heavily in R&D to develop bio-based and smart adhesive solutions. Additionally, the ongoing expansion of the e-commerce sector will further fuel the need for efficient packaging solutions, creating a dynamic landscape for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-based adhesives Solvent-based adhesives Hot melt adhesives Pressure-sensitive adhesives Reactive adhesives Others |

| By End-User | Food and beverage Personal care and cosmetics Electronics Pharmaceuticals Others |

| By Packaging Type | Flexible packaging Rigid packaging Labels and tapes Others |

| By Application | Carton sealing Labeling Surface bonding Others |

| By Distribution Channel | Direct sales Distributors Online sales Others |

| By Geography | GCC Countries Levant Region North Africa Others |

| By Regulatory Compliance | ISO certifications FDA approvals CE marking Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Adhesives | 100 | Packaging Engineers, Quality Assurance Managers |

| Cosmetics and Personal Care Adhesives | 80 | Product Development Managers, Regulatory Affairs Specialists |

| Pharmaceutical Packaging Adhesives | 70 | Manufacturing Managers, Compliance Officers |

| Industrial Adhesives for Packaging | 60 | Operations Managers, Supply Chain Coordinators |

| Eco-friendly Adhesives in Packaging | 90 | Sustainability Managers, R&D Directors |

The Middle East Packaging Adhesives Market is valued at approximately USD 1.5 billion, driven by factors such as infrastructure expansion, rising e-commerce demand, and a focus on sustainable packaging solutions.