Region:Africa

Author(s):Rebecca

Product Code:KRAB0245

Pages:83

Published On:August 2025

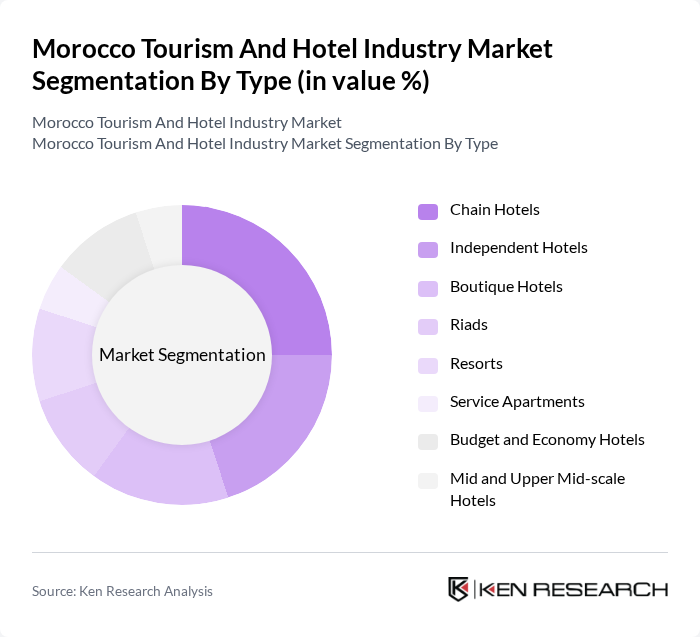

By Type:The market is segmented into various types of accommodations, including chain hotels, independent hotels, boutique hotels, riads, resorts, serviced apartments, budget and economy hotels, and mid and upper mid-scale hotels. Each accommodation type caters to distinct consumer preferences and price points, contributing to the overall diversity and competitiveness of the market.

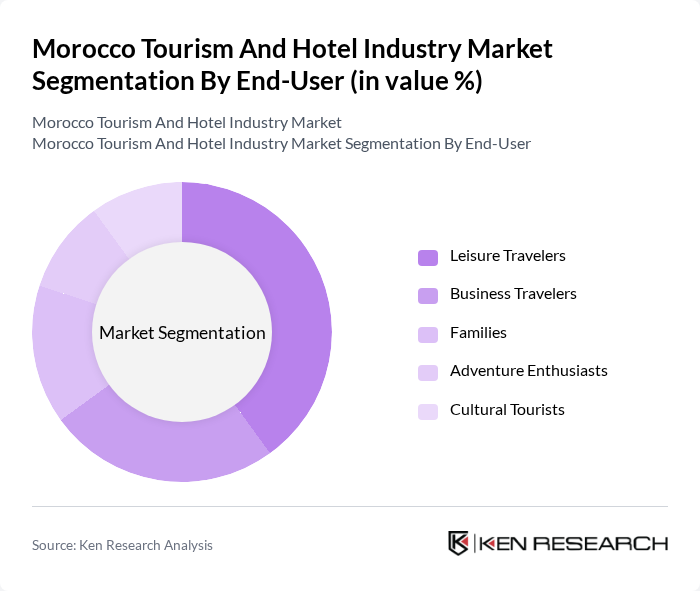

By End-User:The market serves a diverse range of end-users, including leisure travelers, business travelers, families, adventure enthusiasts, and cultural tourists. Each segment has unique requirements and preferences, influencing the types of services and accommodations offered by market participants.

The Morocco tourism and hotel industry market is characterized by a dynamic mix of regional and international players. Leading participants such as Accor S.A., Hilton Worldwide Holdings Inc., Marriott International, Inc., Iberostar Hotels & Resorts, Atlas Hospitality Morocco, Barceló Hotel Group, Mövenpick Hotels & Resorts, Royal Mansour Marrakech, Four Seasons Hotels and Resorts, RIU Hotels & Resorts, Kenzi Hotels Group, Sofitel Hotels & Resorts, Radisson Blu, Le Méridien, Hyatt Regency Casablanca contribute to innovation, geographic expansion, and service delivery in this space.

The future of Morocco's tourism and hotel industry appears promising, driven by ongoing government investments and a growing global interest in unique travel experiences. In future, the focus on sustainable tourism practices and eco-friendly accommodations is expected to attract environmentally conscious travelers. Additionally, the integration of technology in hospitality services will enhance customer experiences, making Morocco a more appealing destination. These trends indicate a robust recovery and growth trajectory for the industry in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chain Hotels Independent Hotels Boutique Hotels Riads Resorts Service Apartments Budget and Economy Hotels Mid and Upper Mid-scale Hotels |

| By End-User | Leisure Travelers Business Travelers Families Adventure Enthusiasts Cultural Tourists |

| By Region | Marrakech Casablanca Agadir Fes Tangier Essaouira Others |

| By Service Type | Accommodation Services Food and Beverage Services Spa and Wellness Services Event Management Services Transportation Services Tour Operator Services |

| By Booking Channel | Online Travel Agencies Direct Bookings Travel Agents Corporate Bookings |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Customer Demographics | Age Group Income Level Family Size Travel Purpose |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Segment | 60 | General Managers, Marketing Directors |

| Mid-range Accommodation | 50 | Operations Managers, Front Desk Supervisors |

| Budget Hotels and Hostels | 40 | Owners, Revenue Managers |

| Tourist Experience Feedback | 100 | International Tourists, Local Visitors |

| Travel Agency Insights | 40 | Travel Agents, Tour Operators |

The Morocco tourism and hotel industry market is valued at approximately USD 10.5 billion, reflecting significant growth driven by an influx of international tourists and government initiatives aimed at promoting tourism and enhancing hospitality services across the country.