Region:Asia

Author(s):Shubham

Product Code:KRAC0596

Pages:82

Published On:August 2025

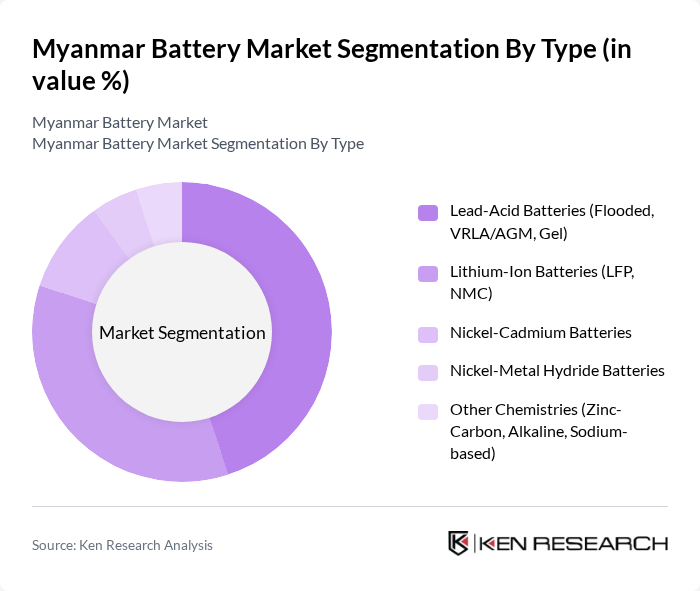

By Type:The battery market can be segmented into various types, including Lead-Acid Batteries (Flooded, VRLA/AGM, Gel), Lithium-Ion Batteries (LFP, NMC), Nickel-Cadmium Batteries, Nickel-Metal Hydride Batteries, and Other Chemistries (Zinc-Carbon, Alkaline, Sodium-based). Among these, Lead-Acid Batteries dominate the market due to their widespread use in automotive applications and affordability. However, Lithium-Ion Batteries are gaining traction, particularly in renewable energy storage and electric vehicles, driven by technological advancements and decreasing costs.

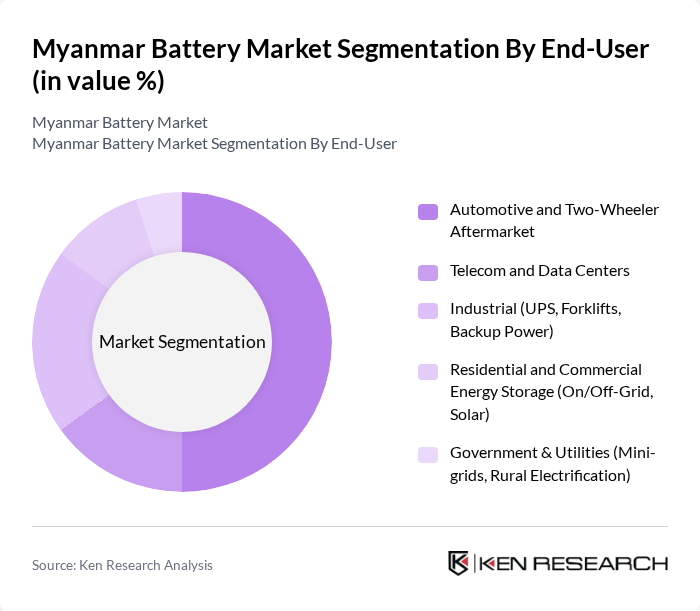

By End-User:The end-user segmentation includes Automotive and Two-Wheeler Aftermarket, Telecom and Data Centers, Industrial (UPS, Forklifts, Backup Power), Residential and Commercial Energy Storage (On/Off-Grid, Solar), and Government & Utilities (Mini-grids, Rural Electrification). The Automotive and Two-Wheeler Aftermarket is the leading segment, driven by the high demand for vehicles and the need for reliable battery replacements. The growth of renewable energy solutions is also boosting the Residential and Commercial Energy Storage segment.

The Myanmar Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siam GS Battery Myanmar Limited, Toyo Battery Myanmar Co., Ltd., Panasonic Corporation, Schneider Electric SE, Exide Industries Ltd. (Myanmar distribution), Amara Raja Energy & Mobility Ltd. (Myanmar distribution), Yuasa Battery (GS Yuasa Group), Narada Power Source Co., Ltd., CATL (Contemporary Amperex Technology Co., Limited) – import supply, BYD Company Limited – energy storage and EV batteries, LONGi Energy Storage (via partners) – ESS supply, Huawei Digital Power (UPS and ESS solutions), Deye Energy Storage (inverter-battery systems via distributors), Pylontech (residential ESS batteries via importers), Eastman Auto & Power Ltd. (lead-acid and solar batteries) contribute to innovation, geographic expansion, and service delivery in this space.

The Myanmar battery market is poised for significant growth, driven by increasing investments in renewable energy and electric vehicle infrastructure. As the government continues to implement supportive policies, the demand for advanced battery technologies will rise. Additionally, the integration of smart grid technologies and energy storage systems will enhance the efficiency of energy distribution. The focus on sustainability and eco-friendly products will further shape market dynamics, encouraging innovation and attracting foreign investments in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Lead-Acid Batteries (Flooded, VRLA/AGM, Gel) Lithium-Ion Batteries (LFP, NMC) Nickel-Cadmium Batteries Nickel-Metal Hydride Batteries Other Chemistries (Zinc-Carbon, Alkaline, Sodium-based) |

| By End-User | Automotive and Two-Wheeler Aftermarket Telecom and Data Centers Industrial (UPS, Forklifts, Backup Power) Residential and Commercial Energy Storage (On/Off-Grid, Solar) Government & Utilities (Mini-grids, Rural Electrification) |

| By Application | Automotive Starter and Traction Consumer Electronics and Small Devices Renewable and Storage (Solar PV, BESS, Mini-grids) Telecommunications Backup Industrial UPS and Motive Power |

| By Distribution Channel | OEM Supply Independent Dealers and Retail Outlets Distributor/Wholesaler Networks Online Channels and Marketplaces |

| By Price Range | Budget Mid-Range Premium |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Import Duty and Tax Incentives EV and Charging Infrastructure Incentives Renewable Energy Procurement and Net-Metering |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturing Sector | 120 | Production Managers, Quality Control Supervisors |

| Retail Battery Distribution | 100 | Sales Managers, Retail Store Owners |

| Electric Vehicle Battery Usage | 80 | Fleet Managers, Automotive Engineers |

| Renewable Energy Storage Solutions | 70 | Project Managers, Energy Consultants |

| Battery Recycling Operations | 60 | Recycling Facility Managers, Environmental Compliance Officers |

The Myanmar Battery Market is valued at approximately USD 1.1 billion, driven by increasing demand for energy storage solutions, particularly in renewable energy and electric vehicles, along with supportive government initiatives aimed at enhancing energy access and sustainability.