Region:Asia

Author(s):Shubham

Product Code:KRAA1839

Pages:90

Published On:August 2025

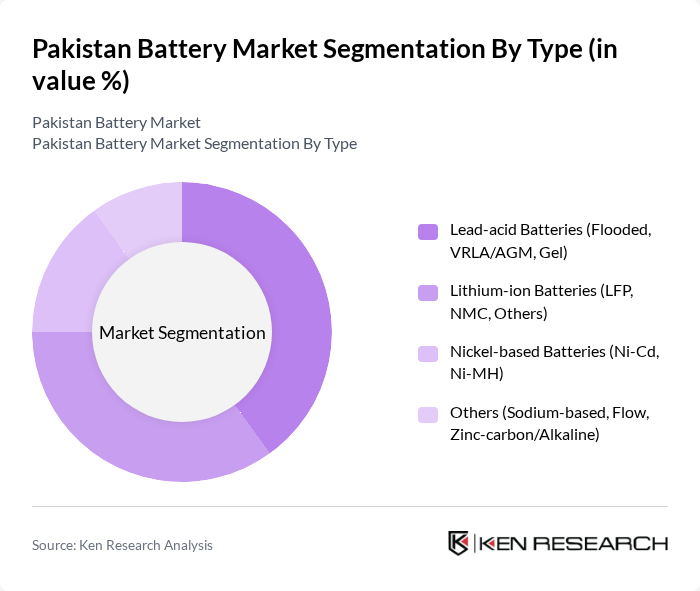

By Type:The battery market can be segmented into various types, including Lead-acid Batteries (Flooded, VRLA/AGM, Gel), Lithium-ion Batteries (LFP, NMC, Others), Nickel-based Batteries (Ni-Cd, Ni-MH), and Others (Sodium-based, Flow, Zinc-carbon/Alkaline). Each type serves different applications and industries, with specific characteristics that cater to consumer needs .

The Lead-acid Batteries segment is currently dominating the market due to their widespread use in automotive SLI and stationary backup (UPS/telecom) applications, supported by established local manufacturing and affordability . However, the Lithium-ion Batteries segment is gaining traction in solar hybrid systems, commercial and residential ESS, and small mobility and electronics, assisted by cost declines and broader availability; dedicated coverage sizes the lithium-ion segment at over one hundred million dollars within the broader market context . The demand for more efficient and longer-lasting batteries is pushing consumers and C&I buyers toward lithium-ion solutions, indicating gradual mix shift in selected applications .

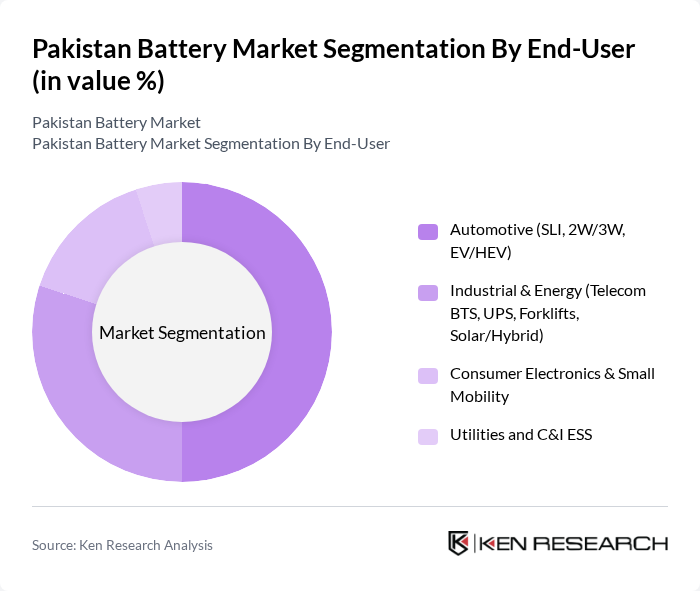

By End-User:The market can be segmented by end-user into Automotive (SLI, 2W/3W, EV/HEV), Industrial & Energy (Telecom BTS, UPS, Forklifts, Solar/Hybrid), Consumer Electronics & Small Mobility, and Utilities and C&I ESS. Each end-user category has distinct requirements and growth drivers, influencing the overall market landscape .

The Automotive segment is the largest end-user of batteries, led by SLI replacement demand and supported by 2W/3W segments; early EV/HEV uptake remains small but policy incentives and charging equipment duty relief support longer-term growth signals . The Industrial & Energy segment follows, driven by telecom BTS power needs, UPS deployments, material handling, and expanding solar-hybrid/ESS usage in homes and businesses facing load-shedding . Consumer electronics and small mobility also contribute meaningfully to lithium-ion cell demand within the country context, though their share is comparatively smaller than automotive and stationary backup .

The Pakistan Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Exide Pakistan Limited, Atlas Battery Limited (AGS), Phoenix Battery (Pakistan Accumulators Pvt. Ltd.), Volta Batteries (Pakistan Accumulators Pvt. Ltd.), Osaka Batteries (Galaxy Battery Company Pvt. Ltd.), Hi-Tech Lubricants & Batteries (Hi-Tech Group), AG Energies (AG Energies Pvt. Ltd.), Homage (Rays Technology Pvt. Ltd.), Inverex Power Solutions, PylonTech Pakistan (imported Li-ion ESS integrators), Tesla Industries Pakistan, United Battery Industries Pvt. Ltd., National Battery Industry Ltd., Dawlance (Arçelik) Power Solutions, Premier Energy (ESS integrator) contribute to innovation, geographic expansion, and service delivery in this space .

The Pakistan battery market is poised for significant transformation, driven by advancements in technology and increasing environmental awareness. The shift towards sustainable energy solutions and electric vehicles will likely create a robust demand for innovative battery technologies. Additionally, the government's commitment to enhancing local manufacturing capabilities and reducing import tariffs could further stimulate market growth. As the industry adapts to these changes, collaboration with technology firms and investment in recycling initiatives will be crucial for long-term sustainability and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Lead-acid Batteries (Flooded, VRLA/AGM, Gel) Lithium-ion Batteries (LFP, NMC, Others) Nickel-based Batteries (Ni-Cd, Ni-MH) Others (Sodium-based, Flow, Zinc-carbon/Alkaline) |

| By End-User | Automotive (SLI, 2W/3W, EV/HEV) Industrial & Energy (Telecom BTS, UPS, Forklifts, Solar/Hybrid) Consumer Electronics & Small Mobility Utilities and C&I ESS |

| By Application | SLI and Starter Batteries Uninterruptible Power Supplies (UPS) & Data Centers Solar and Off-grid/Hybrid Inverters Electric Mobility (EVs, e-rickshaws, e-bikes) Telecom Power Backup Portable/Consumer Devices |

| By Distribution Channel | OEM (Automotive/Industrial) Aftermarket/Dealers Direct Institutional & Project Sales Online & Retail |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Local Brands International Brands Emerging Brands |

| By Technology | Conventional Lead-acid (FLA/VRLA) Advanced Lithium-ion (BMS-integrated packs) Energy Storage Systems (Rack/Containerized) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Lead-Acid Battery Manufacturers | 100 | Production Managers, Quality Control Supervisors |

| Lithium-Ion Battery Suppliers | 80 | Sales Directors, Product Development Engineers |

| Battery Retailers and Distributors | 120 | Store Managers, Supply Chain Coordinators |

| Electric Vehicle Battery Providers | 70 | Business Development Managers, Technical Experts |

| Recycling and Disposal Firms | 60 | Environmental Compliance Officers, Operations Managers |

The Pakistan Battery Market is valued at approximately USD 1.2 billion, driven by demand from automotive, backup power, telecom, and energy storage applications. This valuation reflects a steady growth trend influenced by increasing renewable energy deployments and automotive replacement needs.