Region:Europe

Author(s):Dev

Product Code:KRAB4278

Pages:100

Published On:October 2025

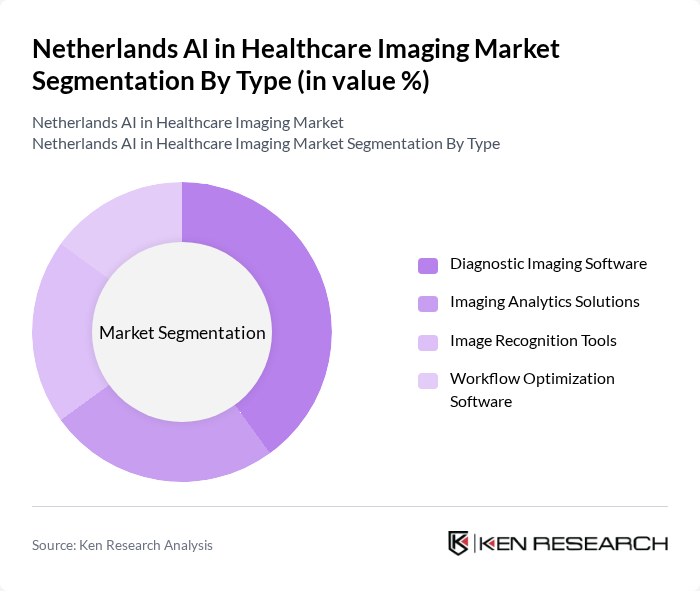

By Type:The market is segmented into various types, including Diagnostic Imaging Software, Imaging Analytics Solutions, Image Recognition Tools, and Workflow Optimization Software. Among these, Diagnostic Imaging Software is the leading sub-segment, driven by the increasing need for accurate and efficient diagnostic solutions. The rise in chronic diseases and the demand for early detection have led to a surge in the adoption of these software solutions across healthcare facilities.

By End-User:The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Research Institutions, and Others. Hospitals are the dominant end-user segment, as they require advanced imaging solutions to improve patient care and operational efficiency. The increasing number of hospitals adopting AI technologies for imaging diagnostics is a significant factor contributing to this segment's growth.

The Netherlands AI in Healthcare Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, GE Healthcare, IBM Watson Health, Aidoc, Zebra Medical Vision, Qure.ai, Arterys, Enlitic, RadNet, Lunit, PathAI, DeepMind Technologies, Aidence, Vuno contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands AI in healthcare imaging market appears promising, driven by ongoing technological advancements and increasing healthcare investments. As AI continues to evolve, its integration into imaging systems will enhance diagnostic accuracy and efficiency. Furthermore, the growing emphasis on personalized medicine will likely spur demand for AI-driven solutions, enabling tailored treatment plans. Collaborations between healthcare providers and technology firms will also play a crucial role in fostering innovation and addressing existing challenges in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Software Imaging Analytics Solutions Image Recognition Tools Workflow Optimization Software |

| By End-User | Hospitals Diagnostic Imaging Centers Research Institutions Others |

| By Application | Radiology Cardiology Oncology Neurology |

| By Component | Software Services Hardware |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Budget Mid-range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Radiology Departments | 100 | Radiologists, Imaging Technologists |

| Healthcare Administrators | 80 | Hospital Managers, IT Directors |

| AI Technology Providers | 60 | Product Managers, Business Development Executives |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Healthcare Consultants | 70 | Consultants, Market Analysts |

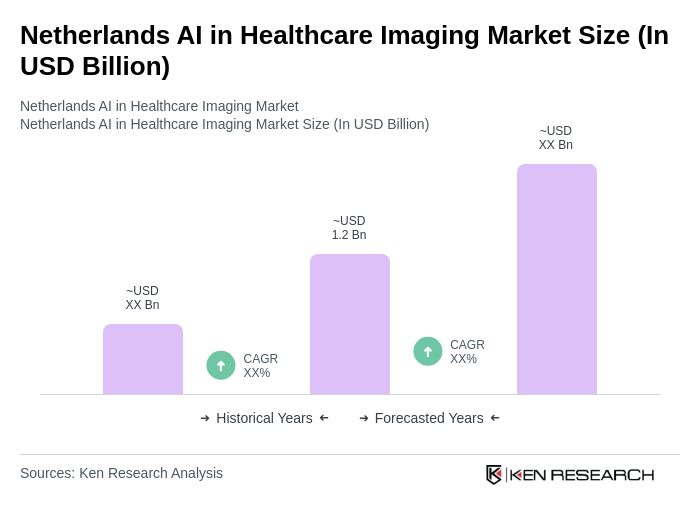

The Netherlands AI in Healthcare Imaging Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by technological advancements, increased demand for diagnostic tools, and the rising prevalence of chronic diseases.