Region:Europe

Author(s):Rebecca

Product Code:KRAB4124

Pages:99

Published On:October 2025

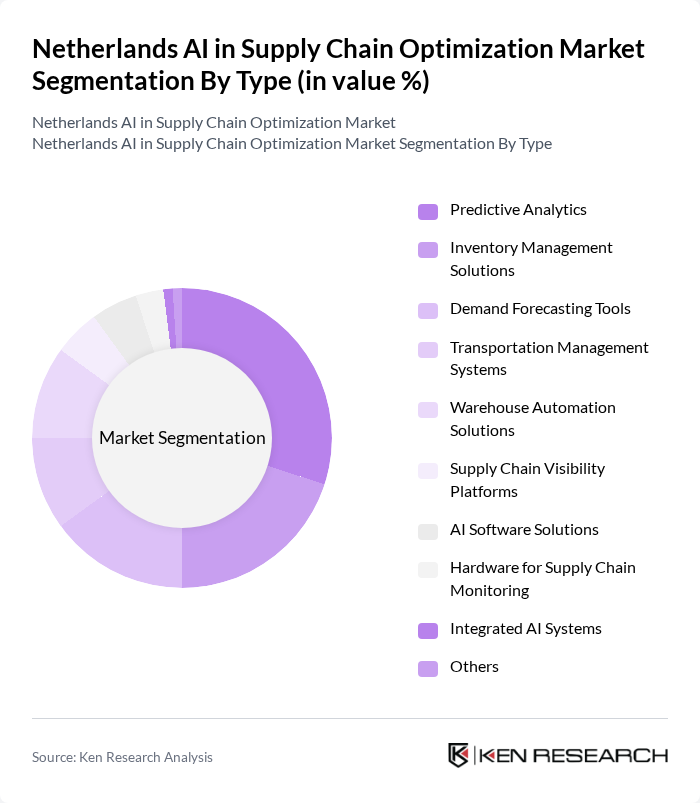

By Type:The market is segmented into Predictive Analytics, Inventory Management Solutions, Demand Forecasting Tools, Transportation Management Systems, Warehouse Automation Solutions, Supply Chain Visibility Platforms, AI Software Solutions, Hardware for Supply Chain Monitoring, Integrated AI Systems, and Others. Predictive Analytics leads the market due to its capacity to deliver actionable insights, enhance demand forecasting, and optimize inventory levels. The adoption of predictive analytics is further accelerated by the need for resilient supply chains and real-time decision-making in response to disruptions .

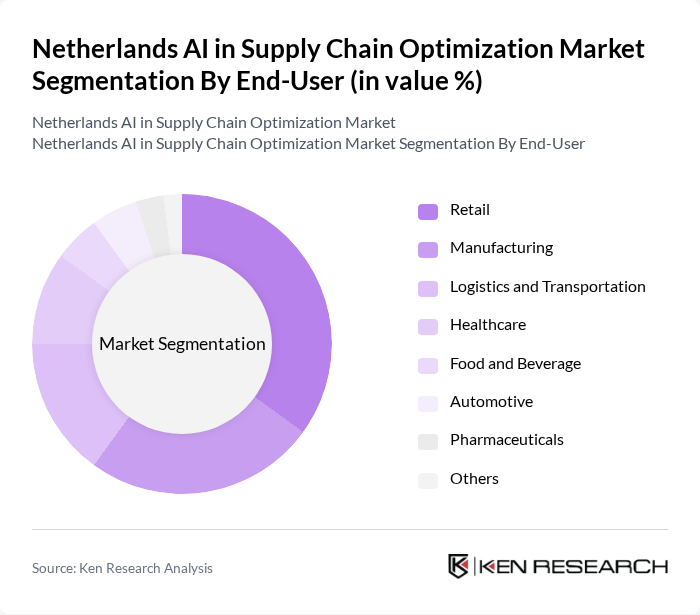

By End-User:The end-user segmentation includes Retail, Manufacturing, Logistics and Transportation, Healthcare, Food and Beverage, Automotive, Pharmaceuticals, and Others. The Retail sector is the dominant end-user, driven by the need for efficient inventory management and enhanced customer experience through AI-driven solutions. E-commerce growth and omnichannel retailing have accelerated the adoption of AI for demand forecasting, personalized logistics, and real-time inventory optimization .

The Netherlands AI in Supply Chain Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, SAP SE, Oracle Corporation, Microsoft Corporation, Blue Yonder (formerly JDA Software), Kinaxis Inc., Llamasoft, Inc. (now part of Coupa Software), Siemens AG, Infor, Coupa Software, C3.ai, Honeywell International Inc., Schneider Electric SE, ClearMetal (project44), Roambee Corporation, Zest Labs, Sensitech Inc., Controlant, Tive Inc., Traxens contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in supply chain optimization in the Netherlands appears promising, driven by technological advancements and increasing demand for efficiency. As companies continue to embrace automation and AI-driven analytics, the logistics sector is expected to evolve significantly. The emphasis on sustainability will also shape future developments, with firms seeking eco-friendly solutions. Collaborations between established companies and tech startups will likely foster innovation, enhancing the overall effectiveness of supply chain operations in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Inventory Management Solutions Demand Forecasting Tools Transportation Management Systems Warehouse Automation Solutions Supply Chain Visibility Platforms AI Software Solutions Hardware for Supply Chain Monitoring Integrated AI Systems Others |

| By End-User | Retail Manufacturing Logistics and Transportation Healthcare Food and Beverage Automotive Pharmaceuticals Others |

| By Application | Supply Chain Planning Order Fulfillment Risk Management Supplier Relationship Management Logistics Optimization Temperature Monitoring Route Optimization Inventory Management Others |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers Others |

| By Distribution Mode | B2B B2C C2C Direct Distribution Third-Party Logistics Others |

| By Industry Vertical | Consumer Goods Electronics Pharmaceuticals Chemicals Food and Beverage Others |

| By Policy Support | Government Grants Tax Incentives Research Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Optimization | 100 | Supply Chain Managers, Operations Directors |

| Retail Inventory Management | 60 | Logistics Coordinators, Inventory Analysts |

| Transportation and Logistics Services | 55 | Fleet Managers, Logistics Service Providers |

| Food and Beverage Supply Chain | 45 | Procurement Managers, Quality Assurance Officers |

| Pharmaceutical Distribution Networks | 50 | Regulatory Affairs Managers, Supply Chain Analysts |

The Netherlands AI in Supply Chain Optimization Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of AI technologies in logistics and supply chain management to enhance operational efficiency and reduce costs.