Region:Global

Author(s):Dev

Product Code:KRAA0464

Pages:81

Published On:August 2025

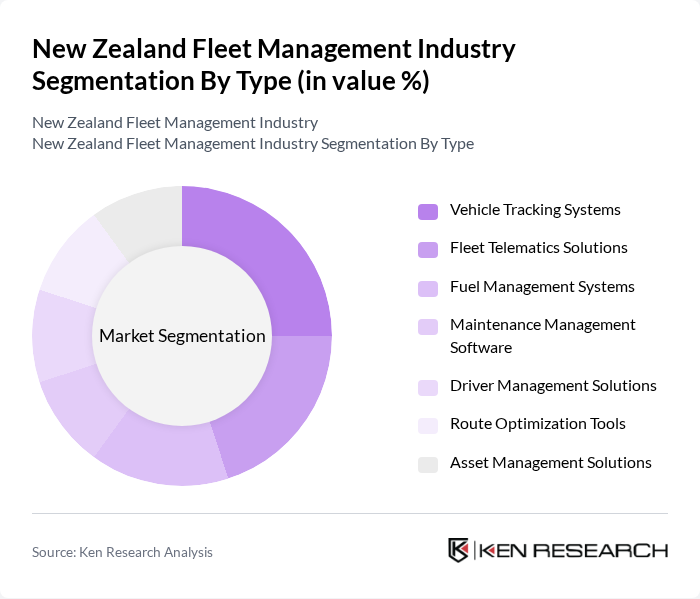

By Type:The fleet management industry is segmented into Vehicle Tracking Systems, Fleet Telematics Solutions, Fuel Management Systems, Maintenance Management Software, Driver Management Solutions, Route Optimization Tools, and Asset Management Solutions. These segments are integral to improving operational efficiency, regulatory compliance, cost reduction, and safety for fleet operators. Vehicle tracking and telematics solutions are especially prominent due to their role in real-time monitoring, regulatory compliance, and data-driven decision-making .

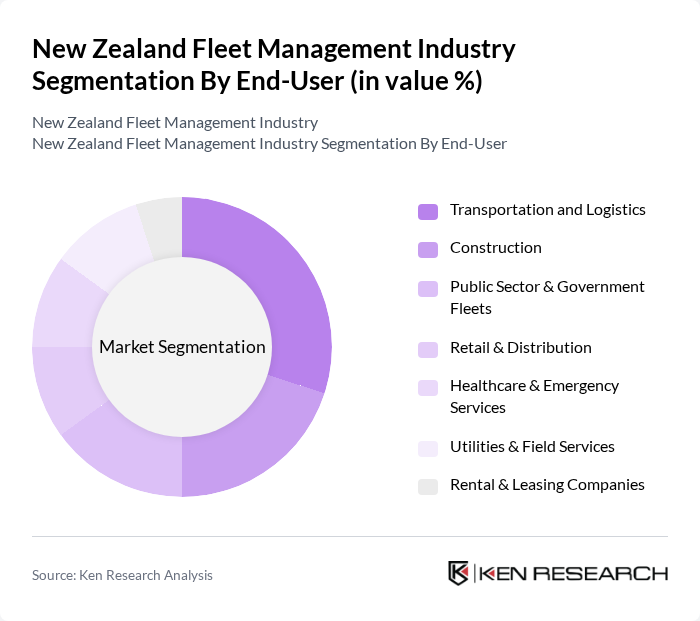

By End-User:The fleet management industry serves diverse end-users, including Transportation and Logistics, Construction, Public Sector & Government Fleets, Retail & Distribution, Healthcare & Emergency Services, Utilities & Field Services, and Rental & Leasing Companies. Each sector has specific operational and compliance needs that drive the adoption of fleet management solutions. Transportation and logistics remain the largest segment, driven by the need for real-time tracking and efficiency, while public sector and construction fleets are also significant due to regulatory and safety requirements .

The New Zealand Fleet Management Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as Teletrac Navman, EROAD, MTData (Telstra), FleetPartners, Fleetco, SmartFleet, Ctrack (Inseego), Geotab, Coretex (now part of EROAD), Fleet Complete, TomTom Telematics, Verizon Connect, Quartix, Smartrak, Navman Wireless contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand fleet management industry appears promising, driven by technological innovations and a strong push towards sustainability. As companies increasingly adopt telematics and eco-friendly vehicles, operational efficiencies are expected to improve significantly. Additionally, the regulatory landscape will continue to evolve, encouraging further investments in green technologies. Overall, the industry is poised for transformation, with a focus on enhancing productivity while addressing environmental concerns, ultimately leading to a more sustainable fleet management ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Vehicle Tracking Systems Fleet Telematics Solutions Fuel Management Systems Maintenance Management Software Driver Management Solutions Route Optimization Tools Asset Management Solutions |

| By End-User | Transportation and Logistics Construction Public Sector & Government Fleets Retail & Distribution Healthcare & Emergency Services Utilities & Field Services Rental & Leasing Companies |

| By Fleet Size | Small Fleets (1-10 Vehicles) Medium Fleets (11-50 Vehicles) Large Fleets (51+ Vehicles) |

| By Vehicle Type | Light Commercial Vehicles (LCVs) Heavy-Duty Trucks Vans Buses & Coaches Passenger Cars |

| By Service Type | Software-as-a-Service (SaaS) Solutions Consulting & Integration Services Maintenance & Support Services Training & Onboarding Services |

| By Geographic Distribution | North Island South Island Urban Areas Rural Areas |

| By Technology Integration | GPS Tracking RFID & Sensor Technology Mobile Applications Cloud Computing & Data Analytics AI & Machine Learning Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 100 | Fleet Managers, Operations Directors |

| Public Transport Fleet Operations | 80 | Transport Planners, Fleet Supervisors |

| Construction Vehicle Fleet | 60 | Project Managers, Equipment Managers |

| Telematics and Fleet Technology | 50 | IT Managers, Technology Officers |

| Corporate Fleet Leasing | 70 | Leasing Managers, Financial Analysts |

The New Zealand Fleet Management Industry is valued at approximately USD 1.1 billion, driven by advancements in telematics, regulatory compliance, rising fuel costs, and the need for operational efficiency among fleet operators.