Region:Middle East

Author(s):Shubham

Product Code:KRAA0746

Pages:97

Published On:August 2025

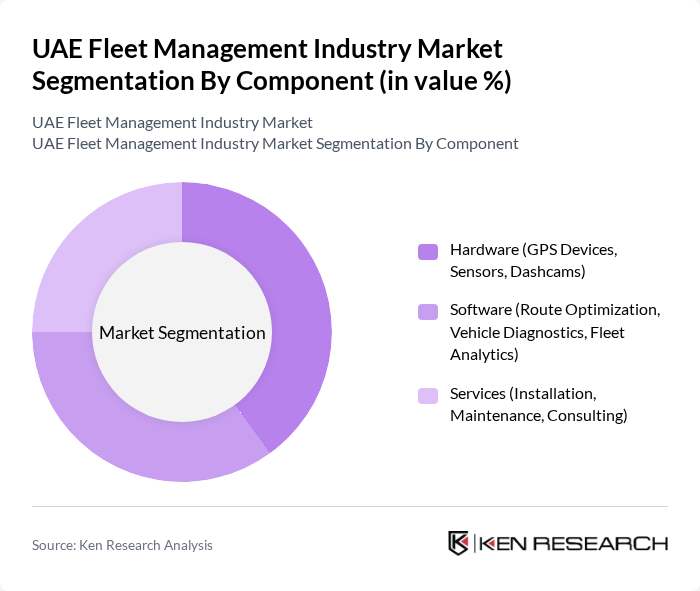

By Component:The components of the fleet management market include hardware, software, and services. Hardware encompasses GPS devices, sensors, and dashcams, which are essential for tracking and monitoring vehicles. Software solutions focus on route optimization, vehicle diagnostics, and fleet analytics, providing insights for better decision-making. Services include installation, maintenance, and consulting, which are crucial for ensuring the effective operation of fleet management systems.

The hardware segment, particularly GPS devices and sensors, is dominating the market due to the increasing need for real-time tracking and monitoring of vehicles. Fleet operators are increasingly investing in advanced hardware solutions to enhance operational efficiency and ensure compliance with government regulations. The growing trend of data-driven decision-making in fleet management is also propelling the demand for sophisticated hardware solutions that provide accurate and timely information.

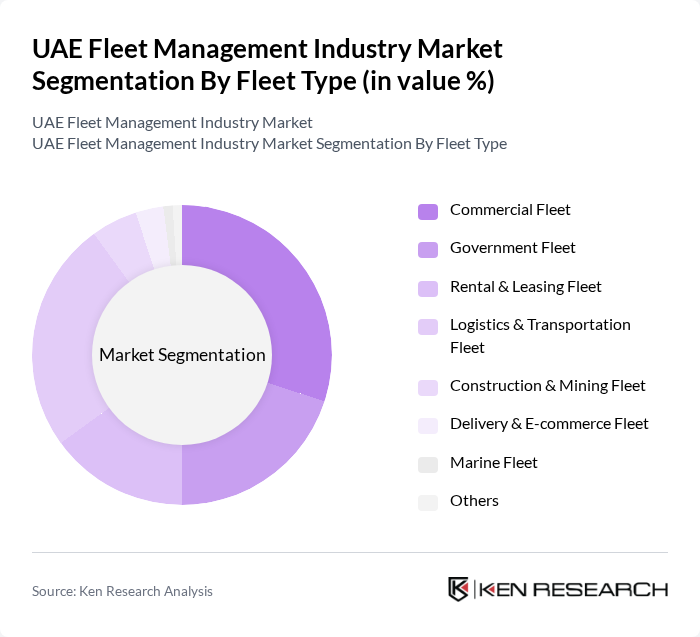

By Fleet Type:The fleet management market is segmented by fleet type, which includes commercial fleet, government fleet, rental & leasing fleet, logistics & transportation fleet, construction & mining fleet, delivery & e-commerce fleet, marine fleet, and others. Each fleet type has unique requirements and challenges, influencing the adoption of specific fleet management solutions tailored to their operational needs.

The logistics & transportation fleet segment is leading the market due to the increasing demand for efficient supply chain management and the growth of e-commerce. Companies are investing in fleet management solutions to optimize routes, reduce operational costs, and enhance service delivery. The commercial fleet segment also holds a significant share, driven by the need for businesses to manage their vehicles effectively and comply with regulatory requirements.

The UAE Fleet Management Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as MiX Telematics Middle East, Trakker Middle East LLC, Location Solutions LLC, Fleet Complete, Geotab, Gurtam, TomTom Telematics, Omnix International, Gulf Data International (GDI), Verizon Connect, Omnicomm, Teletrac Navman, Microlise, Chevin Fleet Solutions, Samsara contribute to innovation, geographic expansion, and service delivery in this space.

The UAE fleet management industry is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As businesses increasingly prioritize sustainability, the shift towards electric and hybrid vehicles will reshape fleet compositions. Additionally, the integration of AI and machine learning for predictive maintenance will enhance operational efficiency. With government support for smart transportation initiatives, the industry is expected to embrace innovative solutions that improve safety, reduce costs, and promote environmental responsibility, fostering a more resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (GPS Devices, Sensors, Dashcams) Software (Route Optimization, Vehicle Diagnostics, Fleet Analytics) Services (Installation, Maintenance, Consulting) |

| By Fleet Type | Commercial Fleet Government Fleet Rental & Leasing Fleet Logistics & Transportation Fleet Construction & Mining Fleet Delivery & E-commerce Fleet Marine Fleet Others |

| By End-User Industry | Transportation and Logistics Construction Oil & Gas Government & Municipal Retail & FMCG Healthcare Education Others |

| By Fleet Size | Small Fleet (1-10 vehicles) Medium Fleet (11-50 vehicles) Large Fleet (51+ vehicles) |

| By Service Type | Fleet Tracking & Telematics Maintenance Management Fuel Management Driver Behavior & Safety Management Compliance & Regulatory Management Route Optimization Others |

| By Technology Adoption | Basic/Traditional Fleet Management Advanced Telematics & IoT AI-Driven & Predictive Analytics Solutions Cloud-Based Fleet Management Others |

| By Geographic Coverage | Urban Areas Rural Areas Cross-Border Operations |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Purchase Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 100 | Fleet Managers, Operations Directors |

| Construction Vehicle Fleet | 60 | Project Managers, Equipment Supervisors |

| Public Transport Fleet Operations | 50 | Transport Planners, Fleet Coordinators |

| Technology Solutions for Fleet Management | 40 | IT Managers, Product Development Leads |

| Government Fleet Compliance and Regulations | 40 | Regulatory Officers, Compliance Managers |

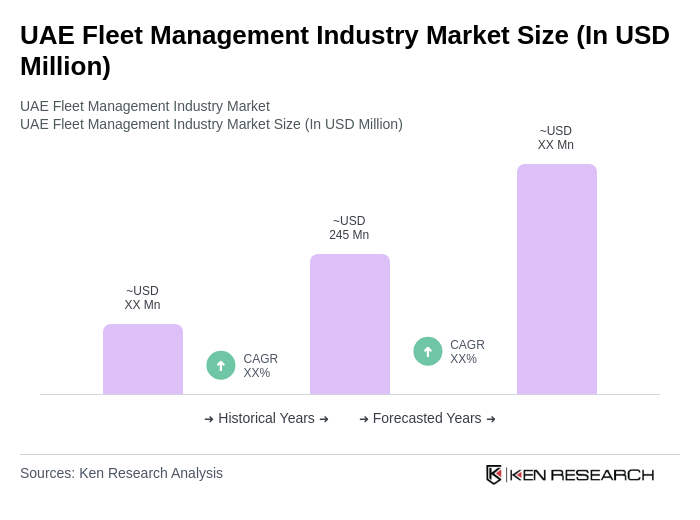

The UAE Fleet Management Industry Market is valued at approximately USD 245 million, reflecting a five-year historical analysis. This growth is driven by the demand for efficient fleet operations and technological advancements in telematics.