Region:Africa

Author(s):Geetanshi

Product Code:KRAA5023

Pages:88

Published On:September 2025

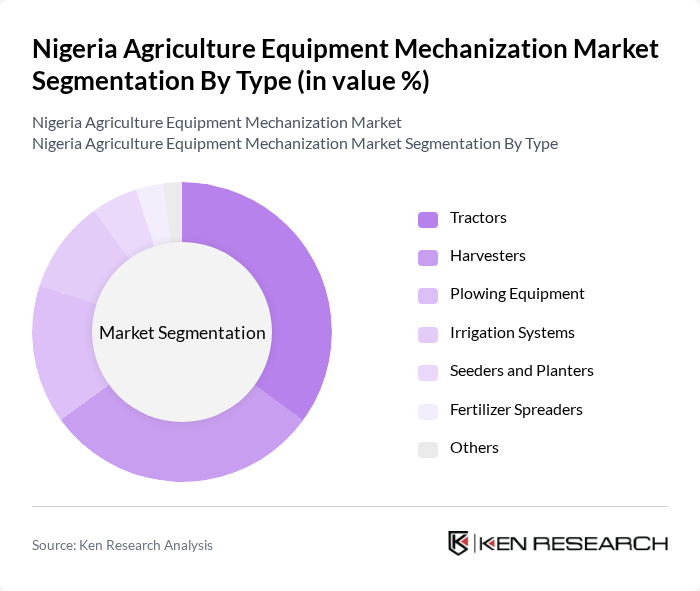

By Type:The market is segmented into various types of agricultural equipment, including tractors, harvesters, plowing equipment, irrigation systems, seeders and planters, fertilizer spreaders, and others. Among these, tractors and harvesters are the most widely used due to their essential roles in enhancing productivity and efficiency in farming operations.

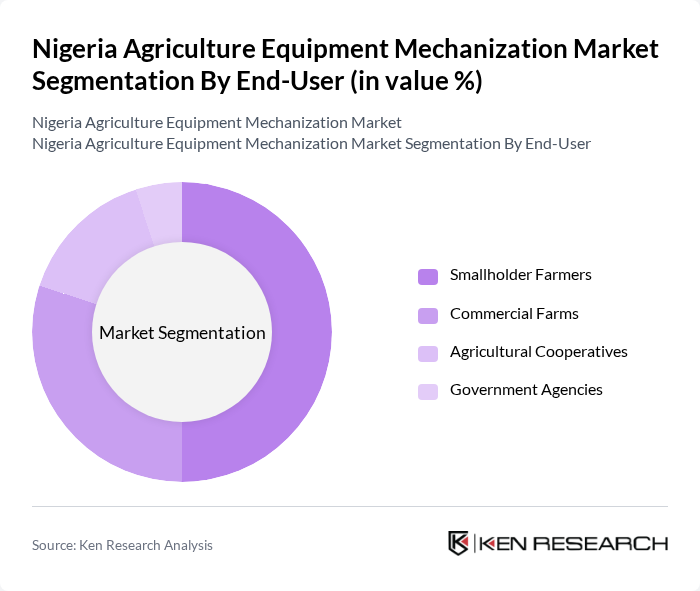

By End-User:The end-user segmentation includes smallholder farmers, commercial farms, agricultural cooperatives, and government agencies. Smallholder farmers represent the largest segment, driven by the need for affordable and efficient farming solutions to increase their yield and income.

The Nigeria Agriculture Equipment Mechanization Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere, AGCO Corporation, CNH Industrial, Kubota Corporation, Mahindra & Mahindra, Case IH, New Holland Agriculture, Yanmar Co., Ltd., TAFE (Tractors and Farm Equipment Limited), SDF Group, AG Leader Technology, Trimble Inc., CLAAS Group, JCB, Landini contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's agriculture equipment mechanization market appears promising, driven by increasing government support and technological innovations. As rural electrification expands, more farmers will gain access to modern machinery, enhancing productivity. Additionally, partnerships with NGOs and private sectors are likely to facilitate knowledge transfer and resource sharing. The focus on sustainable practices and precision agriculture will further shape the market, ensuring that mechanization aligns with environmental goals while meeting the growing food demands of the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors Harvesters Plowing Equipment Irrigation Systems Seeders and Planters Fertilizer Spreaders Others |

| By End-User | Smallholder Farmers Commercial Farms Agricultural Cooperatives Government Agencies |

| By Application | Crop Production Livestock Farming Agroforestry Aquaculture |

| By Distribution Channel | Direct Sales Online Retail Distributors and Dealers Auctions |

| By Financing Source | Bank Loans Microfinance Institutions Government Grants Private Investments |

| By Price Range | Low-End Equipment Mid-Range Equipment High-End Equipment |

| By Brand Preference | Local Brands International Brands Emerging Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor Sales and Usage | 150 | Farm Owners, Equipment Dealers |

| Harvesting Equipment Adoption | 100 | Agricultural Cooperatives, Farm Managers |

| Irrigation Systems Implementation | 80 | Farm Technicians, Agricultural Engineers |

| Government Mechanization Programs | 60 | Policy Makers, Agricultural Extension Officers |

| Market Trends in Agricultural Equipment | 90 | Industry Analysts, Market Researchers |

The Nigeria Agriculture Equipment Mechanization Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing food security demands, government initiatives, and the adoption of modern farming techniques among local farmers.