Region:Africa

Author(s):Shubham

Product Code:KRAA4706

Pages:88

Published On:September 2025

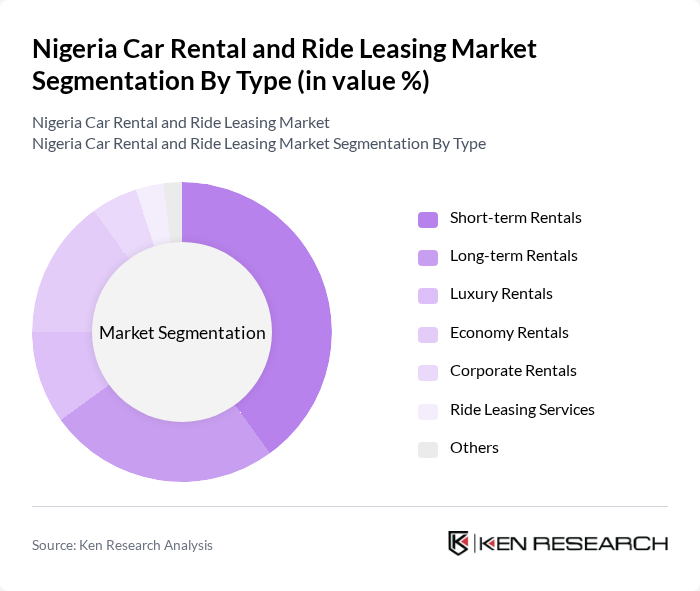

By Type:The market is segmented into various types, including Short-term Rentals, Long-term Rentals, Luxury Rentals, Economy Rentals, Corporate Rentals, Ride Leasing Services, and Others. Among these, Short-term Rentals are currently dominating the market due to the increasing number of tourists and business travelers seeking flexible transportation options. The convenience of booking vehicles for short durations aligns with the fast-paced lifestyle of urban consumers, making this segment particularly appealing.

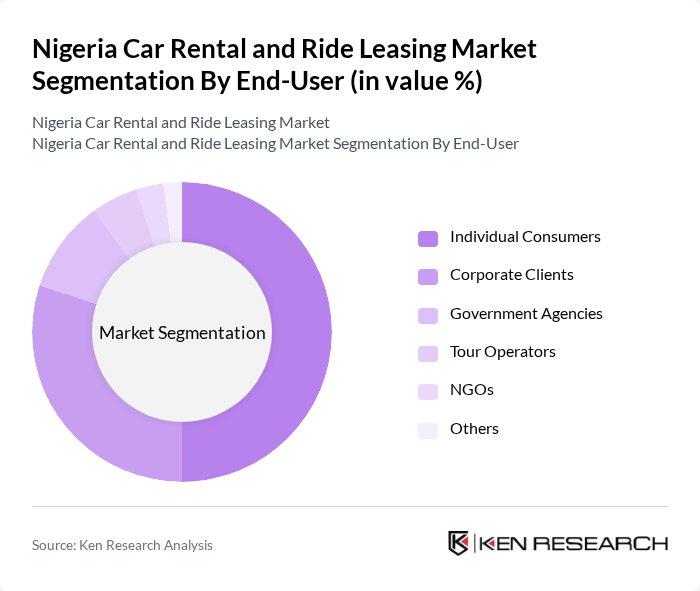

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, Government Agencies, Tour Operators, NGOs, and Others. Individual Consumers are the leading segment, driven by the growing trend of urban mobility and the increasing number of people opting for rental services instead of owning vehicles. This shift is largely influenced by the rising costs of vehicle ownership and maintenance, making rentals a more attractive option for many.

The Nigeria Car Rental and Ride Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Avis Nigeria, Hertz Nigeria, Sixt Nigeria, Car Rental Nigeria, EcoCar Nigeria, DriveMe Nigeria, GIGM, Uber Nigeria, Bolt Nigeria, Oride, Jumia Car Rentals, CarHire Nigeria, EasyCar Nigeria, Rent A Car Nigeria, Drive Nigeria contribute to innovation, geographic expansion, and service delivery in this space.

The Nigeria car rental and ride leasing market is poised for significant transformation in the coming years, driven by technological advancements and evolving consumer preferences. The integration of mobile applications for seamless booking and payment processes is expected to enhance customer experience. Additionally, the shift towards electric vehicles will likely gain momentum, aligning with global sustainability trends. As urbanization continues, the demand for flexible rental options will grow, creating new avenues for market players to innovate and expand their service offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-term Rentals Long-term Rentals Luxury Rentals Economy Rentals Corporate Rentals Ride Leasing Services Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tour Operators NGOs Others |

| By Vehicle Type | Sedans SUVs Vans Trucks Buses Others |

| By Rental Duration | Hourly Rentals Daily Rentals Weekly Rentals Monthly Rentals Others |

| By Payment Model | Prepaid Rentals Postpaid Rentals Subscription Models Others |

| By Distribution Channel | Online Platforms Offline Agencies Direct Corporate Contracts Others |

| By Region | Northern Nigeria Southern Nigeria Eastern Nigeria Western Nigeria Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Car Rental Services | 150 | Fleet Managers, Business Development Executives |

| Ride-Hailing Services | 120 | Operations Managers, Marketing Directors |

| Consumer Preferences | 200 | Frequent Renters, Occasional Users |

| Corporate Travel Management | 100 | Travel Managers, Procurement Officers |

| Regulatory Impact Assessment | 80 | Policy Makers, Industry Analysts |

The Nigeria Car Rental and Ride Leasing Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and a preference for flexible transportation options among consumers.