Region:Africa

Author(s):Geetanshi

Product Code:KRAA5301

Pages:93

Published On:September 2025

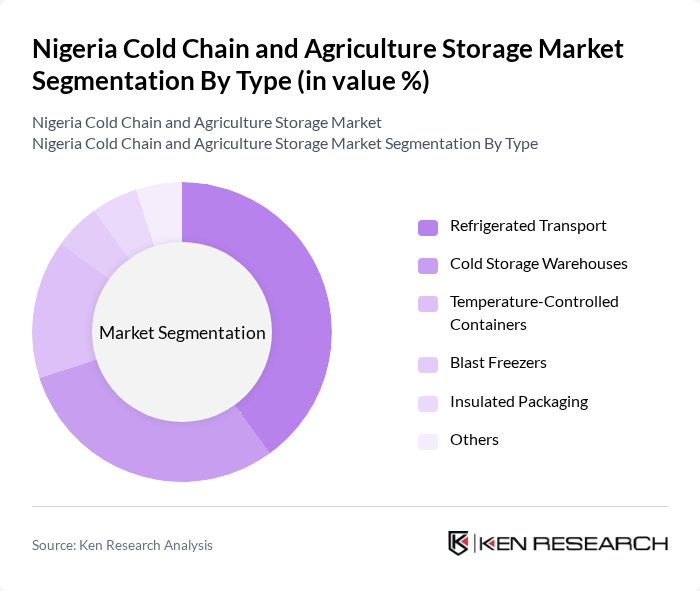

By Type:The cold chain and agriculture storage market is segmented into various types, including Refrigerated Transport, Cold Storage Warehouses, Temperature-Controlled Containers, Blast Freezers, Insulated Packaging, and Others. Among these, Refrigerated Transport is gaining significant traction due to the increasing demand for fresh produce and perishable goods. The need for efficient logistics solutions to maintain the quality of food products during transit is driving the growth of this segment. Cold Storage Warehouses also play a crucial role, providing essential storage solutions for agricultural products, thereby minimizing spoilage and extending shelf life.

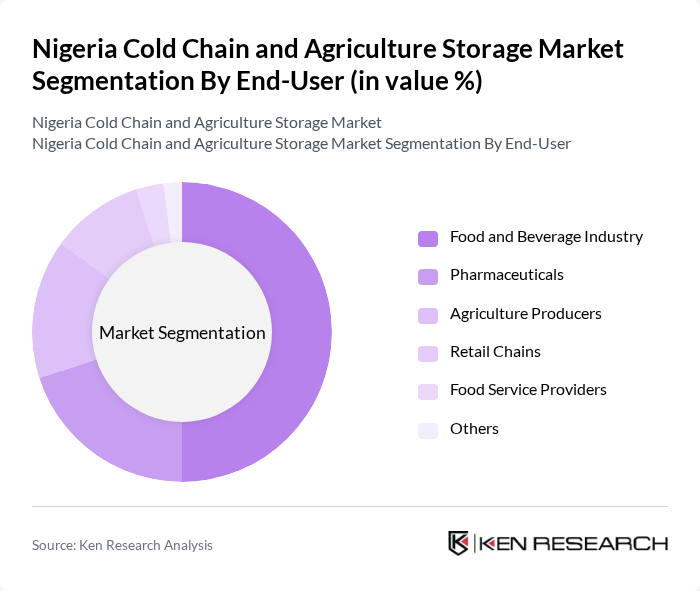

By End-User:The end-user segmentation of the cold chain and agriculture storage market includes the Food and Beverage Industry, Pharmaceuticals, Agriculture Producers, Retail Chains, Food Service Providers, and Others. The Food and Beverage Industry is the leading segment, driven by the increasing demand for fresh and processed food products. The growing trend of online grocery shopping and the need for efficient supply chain solutions are further propelling this segment. Pharmaceuticals also represent a significant end-user, as temperature-sensitive medications require stringent cold chain management.

The Nigeria Cold Chain and Agriculture Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cold Chain Solutions Nigeria Ltd., AgroCold Logistics, Chiller Systems Nigeria, FreshBox Nigeria, Cool Logistics Nigeria, FarmFresh Cold Storage, Nigeria Cold Chain Services, GreenCold Technologies, SafeCold Logistics, Iceberg Cold Storage, TempControl Nigeria, ColdLink Nigeria, Arctic Logistics Nigeria, FreshGuard Cold Chain, ColdChain Innovations contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's cold chain and agriculture storage market appears promising, driven by technological advancements and increased investment in infrastructure. The adoption of IoT solutions is expected to enhance monitoring and efficiency, while partnerships with local farmers will strengthen supply chains. Additionally, the government's commitment to improving agricultural policies and infrastructure will likely create a more conducive environment for growth, ultimately leading to reduced food waste and improved food security across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Warehouses Temperature-Controlled Containers Blast Freezers Insulated Packaging Others |

| By End-User | Food and Beverage Industry Pharmaceuticals Agriculture Producers Retail Chains Food Service Providers Others |

| By Application | Fresh Produce Dairy Products Meat and Seafood Processed Foods Pharmaceuticals Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Outlets Others |

| By Region | Northern Nigeria Southern Nigeria Eastern Nigeria Western Nigeria Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Training and Development Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facility Operators | 100 | Facility Managers, Operations Directors |

| Agricultural Producers | 80 | Farm Owners, Agricultural Cooperative Leaders |

| Logistics and Transportation Providers | 70 | Logistics Managers, Supply Chain Coordinators |

| Retailers and Wholesalers | 60 | Procurement Managers, Category Managers |

| Government and Regulatory Bodies | 50 | Policy Makers, Agricultural Development Officers |

The Nigeria Cold Chain and Agriculture Storage Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing demand for perishable goods and the expansion of the agricultural sector.