Region:Africa

Author(s):Geetanshi

Product Code:KRAB1394

Pages:91

Published On:October 2025

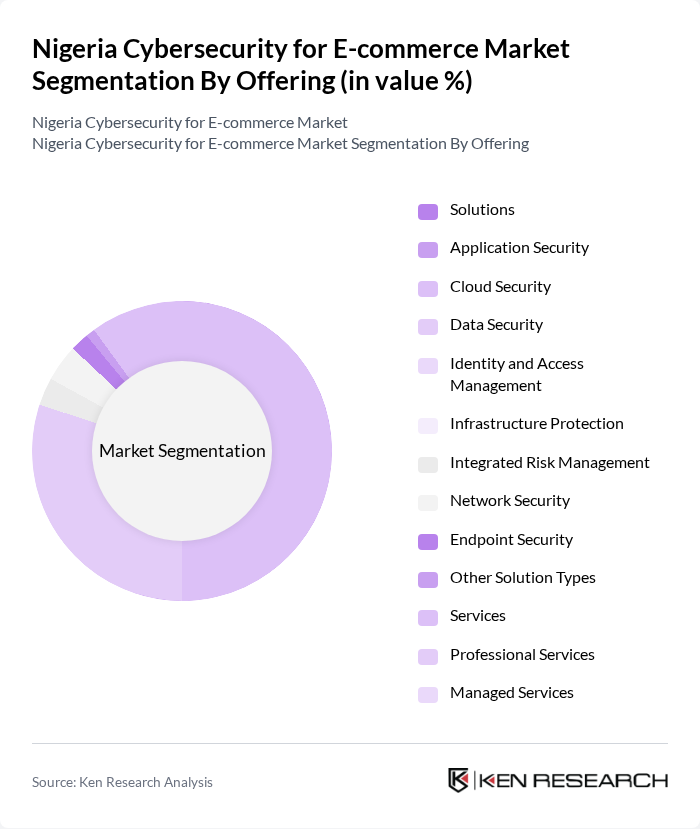

By Offering:The market is segmented into various offerings, including solutions and services. The solutions segment encompasses application security, cloud security, data security, identity and access management, infrastructure protection, integrated risk management, network security, endpoint security, and other solution types. The services segment includes professional services and managed services.

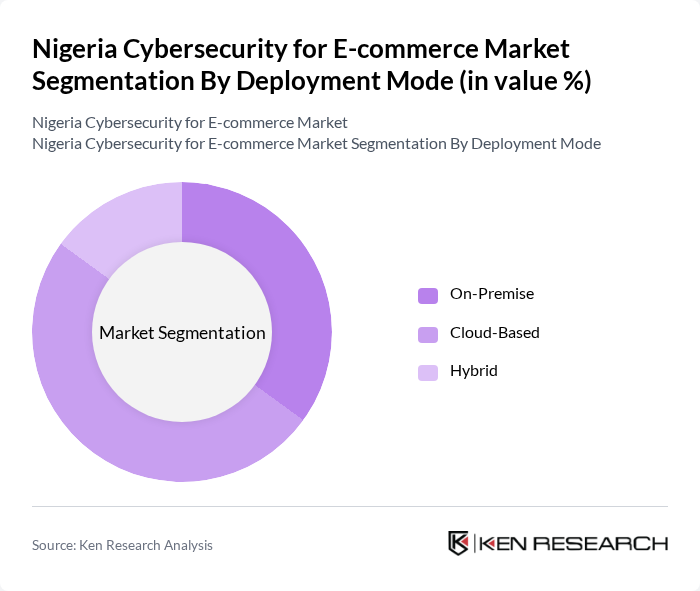

By Deployment Mode:The market is segmented based on deployment modes, which include on-premise, cloud-based, and hybrid solutions. Each deployment mode offers unique advantages, catering to different organizational needs and preferences.

The Nigeria Cybersecurity for E-commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as CyberDome Nigeria, Jireh Technologies Limited, Digital Encode Limited, Inits Limited, Infoprive Nigeria, Signal Alliance Technology Holding, Soft Alliance and Resources Limited, IBM Security Nigeria, Cisco Systems Nigeria, Check Point Software Technologies, Kaspersky Lab Nigeria, Sophos Nigeria, Trend Micro Nigeria, ESET Nigeria, CrowdStrike Nigeria contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's cybersecurity for e-commerce market appears promising, driven by technological advancements and increasing regulatory focus. As businesses adopt artificial intelligence and machine learning for threat detection, the efficiency of cybersecurity measures will improve significantly. Additionally, the rise of managed security services will enable companies to outsource their cybersecurity needs, allowing them to focus on core operations while ensuring robust protection against evolving cyber threats. This trend is expected to shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Offering | Solutions Application Security Cloud Security Data Security Identity and Access Management Infrastructure Protection Integrated Risk Management Network Security Endpoint Security Other Solution Types Services Professional Services Managed Services |

| By Deployment Mode | On-Premise Cloud-Based Hybrid |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By End-User Industry | BFSI Retail and E-commerce Healthcare IT and Telecom Industrial and Defense Energy and Utilities Manufacturing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Platforms | 100 | IT Managers, Security Officers |

| Payment Gateway Providers | 60 | Product Managers, Compliance Officers |

| Logistics and Delivery Services | 50 | Operations Managers, Risk Management Heads |

| Consumer Electronics Retailers | 40 | E-commerce Managers, Customer Experience Leads |

| Small and Medium Enterprises (SMEs) | 80 | Business Owners, IT Consultants |

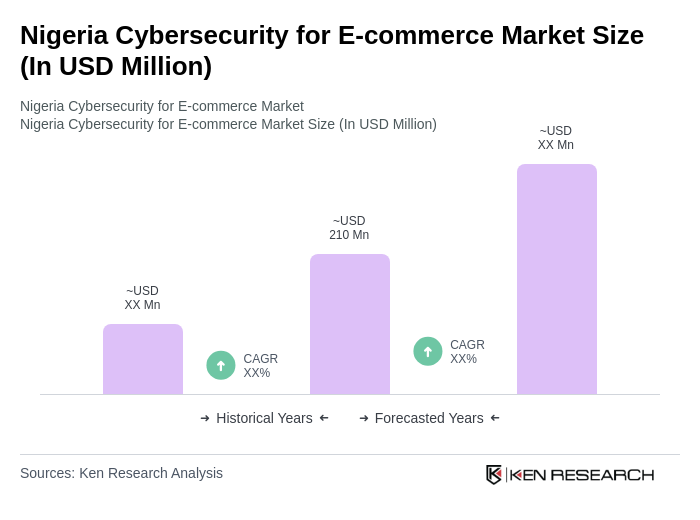

The Nigeria Cybersecurity for E-commerce Market is valued at approximately USD 210 million, reflecting significant growth driven by the expansion of the e-commerce sector, increased internet penetration, and rising cyber threats.