Region:North America

Author(s):Geetanshi

Product Code:KRAB1668

Pages:87

Published On:October 2025

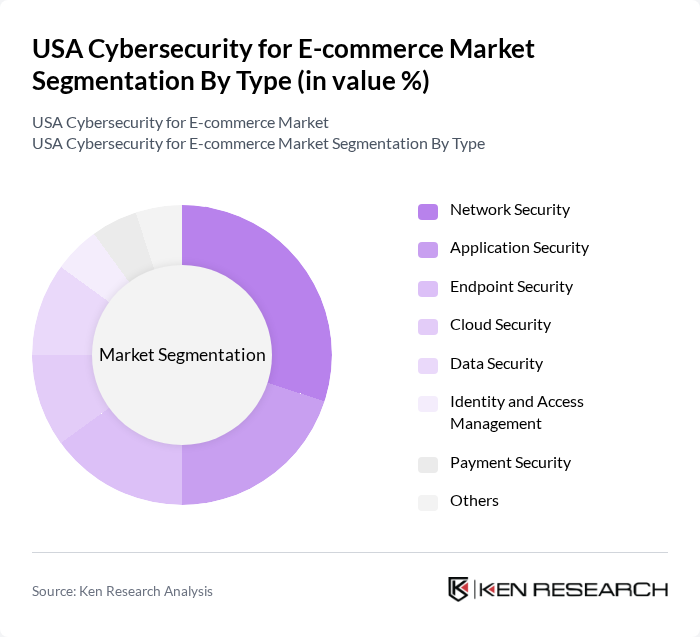

By Type:The cybersecurity market for e-commerce is segmented into Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, Payment Security, and Others. Each of these sub-segments plays a crucial role in safeguarding e-commerce platforms from diverse cyber threats. Network Security remains dominant, driven by the increasing reliance on secure network infrastructures and the need to protect sensitive data and transactions from advanced threats such as ransomware and phishing.

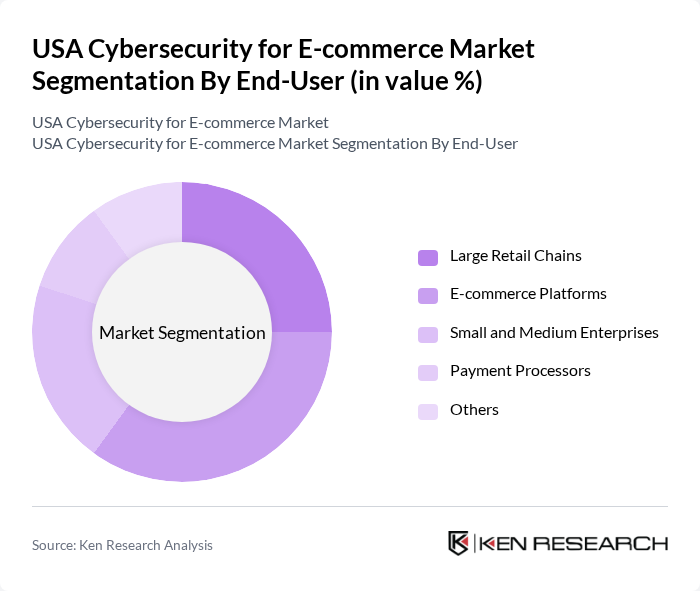

By End-User:The end-user segmentation of the cybersecurity market for e-commerce includes Large Retail Chains, E-commerce Platforms, Small and Medium Enterprises, Payment Processors, and Others. E-commerce Platforms are the leading segment, driven by the need for robust security measures to protect customer data and ensure secure transactions. The surge in online transactions and digital payment adoption has intensified demand for comprehensive cybersecurity solutions tailored for these platforms.

The USA Cybersecurity for E-commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Palo Alto Networks, Fortinet, CrowdStrike, Check Point Software Technologies, McAfee Corp., Cisco Systems, IBM Security, Trend Micro, Trellix, NortonLifeLock (Gen Digital), RSA Security, Splunk, Zscaler, CyberArk Software, Proofpoint, Akamai Technologies, Imperva, Securonix, Okta, and Ping Identity contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA cybersecurity for e-commerce market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As businesses increasingly adopt zero trust security models, the focus will shift towards proactive threat detection and response. Additionally, the rise of cyber insurance will encourage companies to invest in comprehensive cybersecurity solutions, fostering a more resilient e-commerce landscape. With heightened regulatory scrutiny, organizations will prioritize compliance, ensuring data protection and consumer trust remain at the forefront of their strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Payment Security Others |

| By End-User | Large Retail Chains E-commerce Platforms Small and Medium Enterprises Payment Processors Others |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | Fashion Retail Electronics Retail Grocery Retail Health and Beauty Retail Others |

| By Compliance Standards | PCI DSS HIPAA GDPR CCPA Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail E-commerce Cybersecurity | 100 | IT Security Managers, E-commerce Directors |

| Financial Services E-commerce Security | 60 | Risk Management Officers, Compliance Managers |

| Travel and Hospitality Cybersecurity | 50 | Operations Managers, IT Directors |

| Consumer Electronics E-commerce Security | 40 | Product Security Managers, Customer Experience Leads |

| Digital Services Cybersecurity | 50 | Chief Technology Officers, Cybersecurity Analysts |

The USA Cybersecurity for E-commerce Market is valued at approximately USD 30 billion, driven by increasing cyber threats, the growth of online shopping, and rising consumer awareness regarding data privacy.