Region:Africa

Author(s):Dev

Product Code:KRAB4260

Pages:85

Published On:October 2025

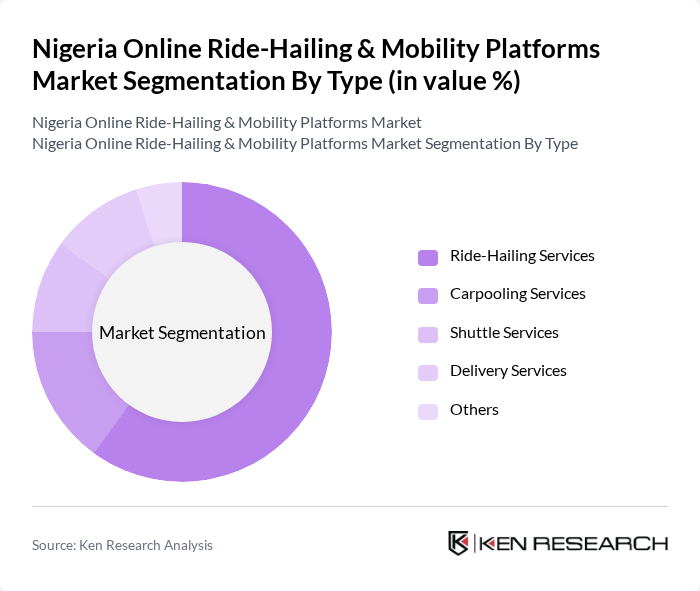

By Type:The market is segmented into various types of services, including Ride-Hailing Services, Carpooling Services, Shuttle Services, Delivery Services, and Others. Among these, Ride-Hailing Services dominate the market due to their convenience and flexibility, catering to a wide range of consumer needs. The increasing preference for on-demand transportation solutions has led to a surge in the adoption of ride-hailing apps, making them the most popular choice among users.

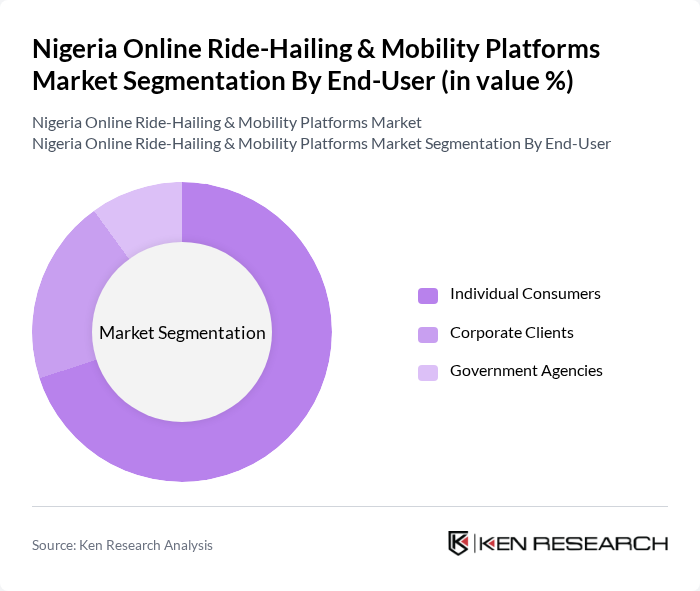

By End-User:The market is segmented into Individual Consumers, Corporate Clients, and Government Agencies. Individual Consumers represent the largest segment, driven by the growing trend of urban mobility and the need for convenient transportation options. The rise in the number of working professionals and students in urban areas has significantly contributed to the demand for ride-hailing services, making this segment a key driver of market growth.

The Nigeria Online Ride-Hailing & Mobility Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Uber Technologies, Inc., Bolt Technology OÜ, OPay, Lyft, Inc., Gokada, Taxify, Jumia Ride, Easy Taxi, RideMe, InDriver, SafeBoda, GIGM, Zola Cab, Trike, Koko Networks contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's online ride-hailing market appears promising, driven by technological advancements and evolving consumer preferences. As urbanization continues, the demand for efficient transportation solutions will likely increase. Additionally, the integration of electric vehicles and sustainable practices will become more prevalent, aligning with global trends towards eco-friendliness. Companies that adapt to these changes and invest in innovative technologies will be well-positioned to thrive in this dynamic market landscape, enhancing user experience and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Ride-Hailing Services Carpooling Services Shuttle Services Delivery Services Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies |

| By Vehicle Type | Sedans SUVs Motorcycles Vans |

| By Payment Method | Cash Payments Mobile Wallets Credit/Debit Cards |

| By Service Model | On-Demand Services Pre-Booked Services |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | Students Professionals Tourists Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ride-Hailing User Experience | 150 | Regular Users, Occasional Users |

| Driver Satisfaction and Challenges | 100 | Active Drivers, Former Drivers |

| Market Trends and Innovations | 80 | Industry Analysts, Technology Experts |

| Regulatory Impact Assessment | 70 | Policy Makers, Transportation Authorities |

| Urban Mobility Solutions | 90 | Urban Planners, Mobility Consultants |

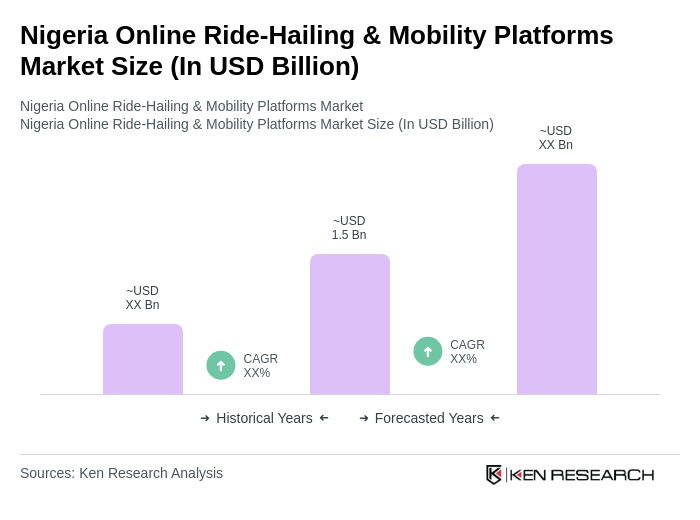

The Nigeria Online Ride-Hailing & Mobility Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by urbanization, smartphone penetration, and the demand for convenient transportation solutions among the population.