Region:Africa

Author(s):Shubham

Product Code:KRAB6156

Pages:92

Published On:October 2025

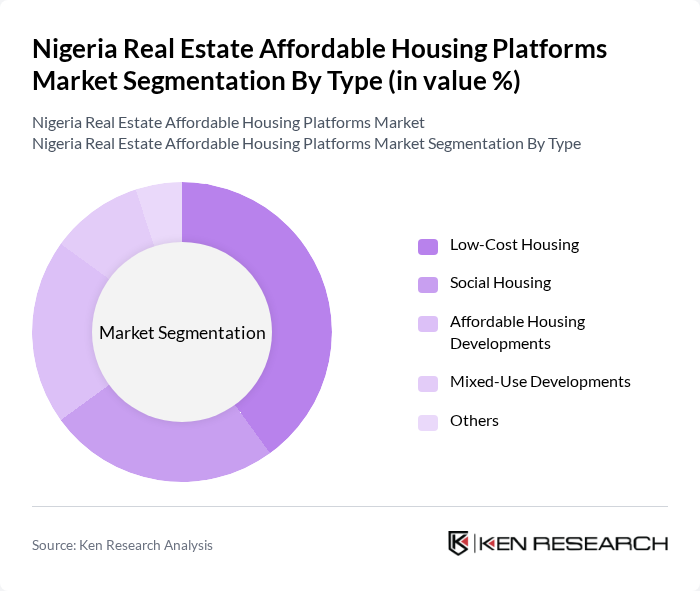

By Type:The market is segmented into various types, including Low-Cost Housing, Social Housing, Affordable Housing Developments, Mixed-Use Developments, and Others. Among these, Low-Cost Housing is currently the leading sub-segment due to its affordability and accessibility for the majority of the population. The increasing focus on providing basic housing solutions for low-income families has driven demand in this category, making it a significant contributor to the overall market growth.

By End-User:The end-user segmentation includes First-Time Home Buyers, Real Estate Investors, Government Agencies, and Non-Governmental Organizations. First-Time Home Buyers dominate this segment, driven by the increasing number of young professionals and families seeking affordable housing options. This demographic is particularly focused on securing their first homes, which has led to a surge in demand for affordable housing solutions tailored to their needs.

The Nigeria Real Estate Affordable Housing Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Landmark Africa, Nigeria Mortgage Refinance Company, Family Homes Funds, UACN Property Development Company, Alpha Mead Group, Eko Atlantic City, Adron Homes & Properties, FBNQuest Merchant Bank, Mixta Africa, Urban Shelter Limited, St. Augustine's Housing Development, Jide Taiwo & Co., Propertymart Real Estate Investment, Broll Property Group, The Nigerian Institution of Estate Surveyors and Valuers contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's affordable housing market appears promising, driven by increasing urbanization and supportive government policies. As the middle-class population expands, the demand for affordable housing solutions will intensify. Additionally, technological advancements in construction and financing are expected to enhance efficiency and reduce costs. The collaboration between public and private sectors will likely play a pivotal role in addressing the housing deficit, fostering innovation, and improving access to affordable housing options across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Low-Cost Housing Social Housing Affordable Housing Developments Mixed-Use Developments Others |

| By End-User | First-Time Home Buyers Real Estate Investors Government Agencies Non-Governmental Organizations |

| By Financing Model | Mortgage Financing Rent-to-Own Schemes Government Subsidies Private Equity Investments |

| By Location | Urban Areas Suburban Areas Rural Areas Others |

| By Sales Channel | Online Platforms Real Estate Agents Direct Sales Others |

| By Price Range | Below ?5 Million ?5 Million - ?10 Million ?10 Million - ?20 Million Above ?20 Million |

| By Property Type | Single-Family Homes Multi-Family Units Townhouses Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Developers | 100 | Project Managers, Business Development Executives |

| Potential Homebuyers | 150 | First-time Buyers, Low-Income Families |

| Housing Finance Institutions | 80 | Loan Officers, Financial Analysts |

| Government Housing Officials | 60 | Policy Makers, Urban Planners |

| Community Leaders and Advocates | 50 | NGO Representatives, Local Government Officials |

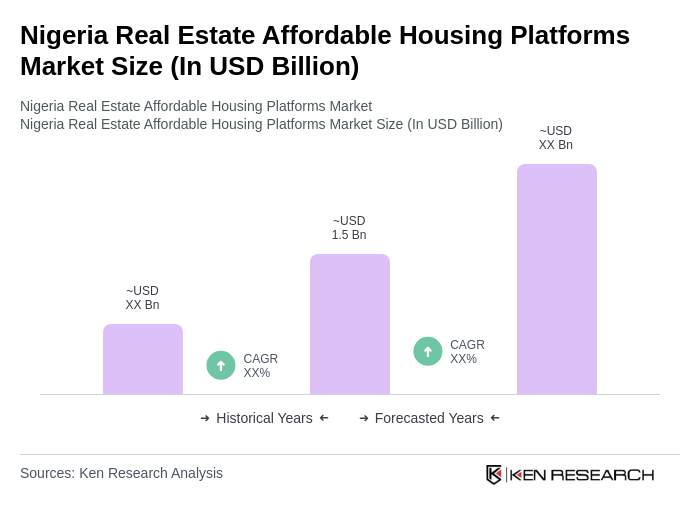

The Nigeria Real Estate Affordable Housing Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by urbanization, population increase, and government initiatives aimed at enhancing housing accessibility for low- and middle-income families.