Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1298

Pages:86

Published On:November 2025

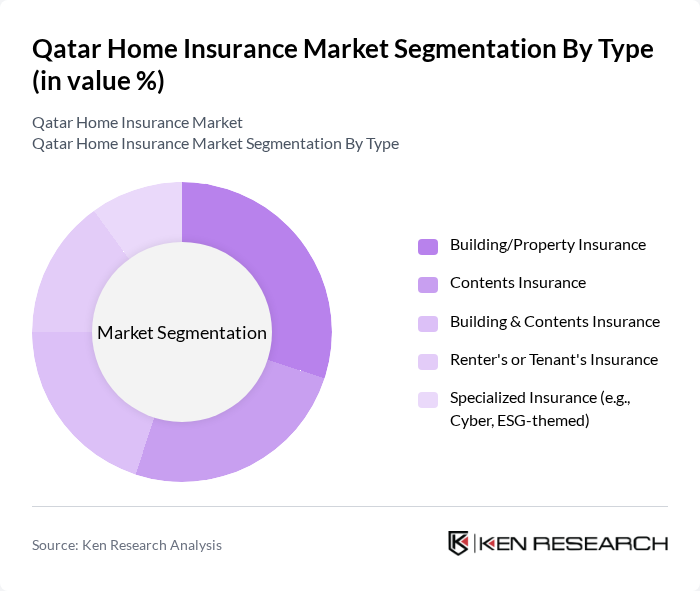

By Type:This segmentation includes various types of home insurance products that cater to different consumer needs.

TheBuilding/Property Insurancesegment is the leading sub-segment in the market, driven by the increasing number of homeowners and the rising value of residential properties. Consumers are increasingly recognizing the importance of protecting their physical structures against risks such as fire, natural disasters, and vandalism. This trend is further supported by regulatory requirements for minimum coverage standards, which have led to a surge in policy uptake. The growing awareness of property value preservation and the adoption of digital insurance platforms are also contributing to the dominance of this segment .

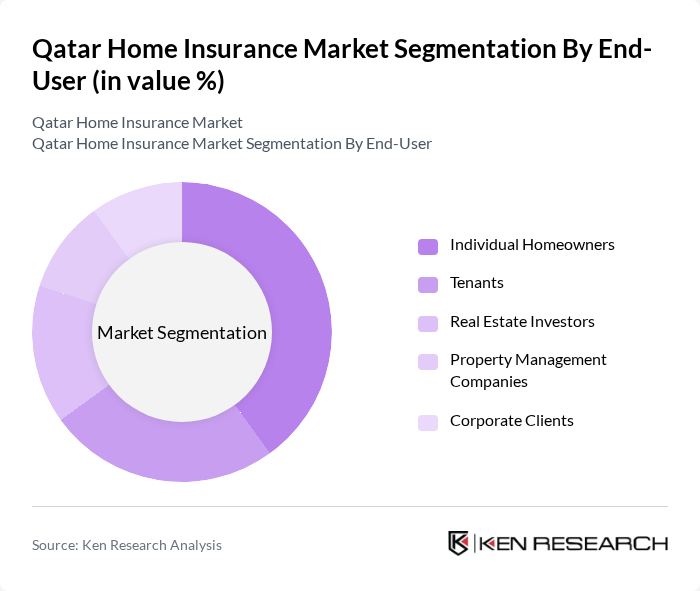

By End-User:This segmentation focuses on the different types of consumers purchasing home insurance.

Individual Homeownersrepresent the largest segment of end-users in the market, driven by the increasing number of home purchases and the growing awareness of the need for insurance. This demographic is particularly focused on protecting their investments and ensuring financial security against potential risks. The rise in property values, digitalization of insurance services, and regulatory requirements for minimum coverage have further solidified the position of individual homeowners as the dominant end-user segment .

The Qatar Home Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Insurance Company (QIC Group), Doha Insurance Group, Al Khaleej Takaful Insurance, Qatar General Insurance & Reinsurance Company, Qatar Islamic Insurance Company, Damaan Islamic Insurance Company (Beema), Gulf Insurance Group (GIG Qatar), QNB Insurance (Qatar National Bank), AIG Qatar, AXA Gulf (now part of GIG Gulf), Allianz Qatar, MetLife Qatar, Zurich Insurance Group Qatar, RSA Insurance Group Qatar, Orient Insurance Qatar contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Qatar home insurance market appears promising, driven by increasing consumer awareness and government support. As urban property values continue to rise, the demand for comprehensive insurance coverage is expected to grow. Additionally, the integration of technology in policy management will enhance customer experience, making insurance more accessible. Insurers that adapt to these trends and focus on customer-centric solutions will likely thrive in this evolving landscape, ensuring sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Building/Property Insurance Contents Insurance Building & Contents Insurance Renter's or Tenant's Insurance Specialized Insurance (e.g., Cyber, ESG-themed) |

| By End-User | Individual Homeowners Tenants Real Estate Investors Property Management Companies Corporate Clients |

| By Property Type | Villas Apartments Townhouses Condominiums Others |

| By Coverage Type | Fire and Natural Disaster Coverage Theft and Vandalism Coverage Liability Coverage Additional Living Expenses Coverage Cyber Risk Coverage ESG/Sustainability Coverage Others |

| By Distribution Channel | Direct Sales Insurance Brokers Online Platforms Agents Bancassurance Others |

| By Customer Demographics | Age Group (18-30, 31-45, 46-60, 60+) Income Level (Low, Middle, High) Family Size (Single, Couple, Family) Nationality (Qatari, Expatriate) Others |

| By Policy Duration | Short-term Policies Long-term Policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Homeowners in Urban Areas | 120 | Homeowners, Property Managers |

| Insurance Agents and Brokers | 60 | Insurance Agents, Brokers |

| Real Estate Developers | 40 | Real Estate Developers, Project Managers |

| Insurance Regulatory Bodies | 40 | Regulatory Officials, Policy Makers |

| Financial Advisors | 50 | Financial Advisors, Wealth Managers |

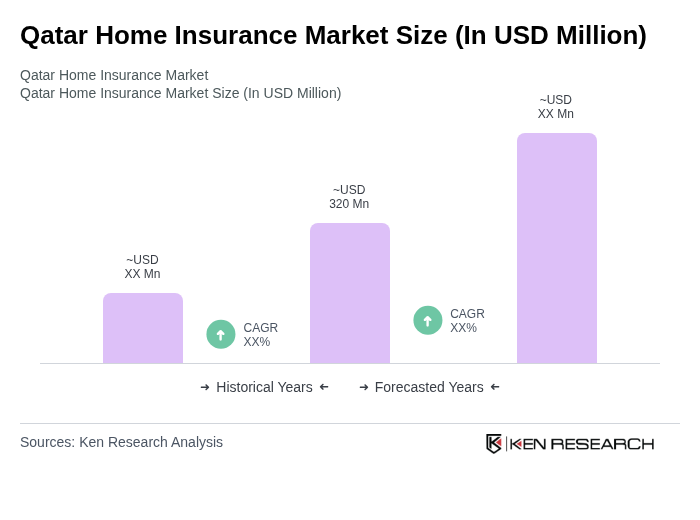

The Qatar Home Insurance Market is valued at approximately USD 320 million, based on a five-year historical analysis. This figure represents a significant portion of the broader general insurance market, which is valued at around USD 3.0 billion.