Region:Africa

Author(s):Geetanshi

Product Code:KRAB5840

Pages:82

Published On:October 2025

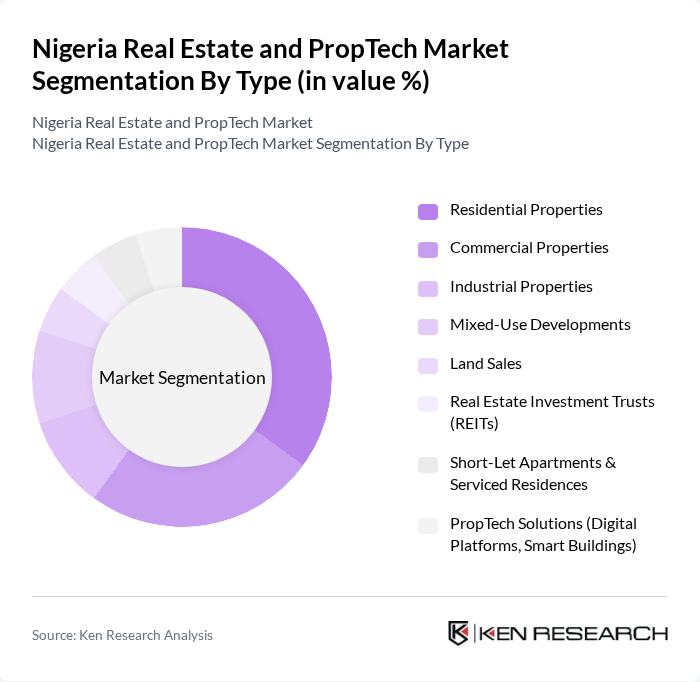

By Type:This segmentation includes various property types that cater to different market needs. The subsegments are Residential Properties, Commercial Properties, Industrial Properties, Mixed-Use Developments, Land Sales, Real Estate Investment Trusts (REITs), Short-Let Apartments & Serviced Residences, and PropTech Solutions (Digital Platforms, Smart Buildings). Each subsegment plays a crucial role in shaping the market dynamics.

The Residential Properties subsegment is currently dominating the market, driven by the increasing demand for housing due to urban migration and population growth. This segment caters to a diverse range of consumers, from first-time homebuyers to luxury property seekers. The trend towards affordable housing has also led to a surge in developments targeting middle-income earners, making it a key focus for investors and developers alike. The rise of short-let apartments and serviced residences is also notable, reflecting changing consumer preferences and the impact of digital platforms .

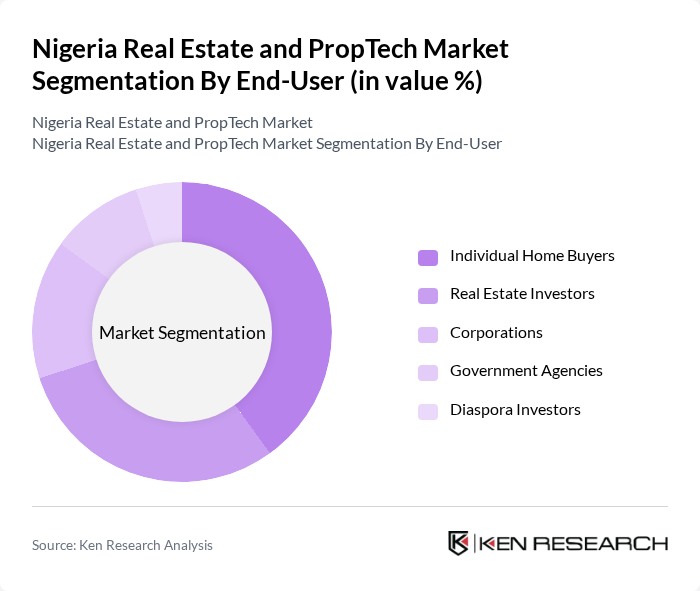

By End-User:This segmentation focuses on the various types of consumers in the market. The subsegments include Individual Home Buyers, Real Estate Investors, Corporations, Government Agencies, and Diaspora Investors. Each end-user group has distinct needs and preferences that influence their purchasing decisions.

Individual Home Buyers represent the largest end-user segment, driven by the growing middle class and the need for affordable housing. This demographic is increasingly seeking properties that offer value for money, leading to a rise in demand for new developments and housing schemes. The focus on home ownership is further supported by government initiatives aimed at making housing more accessible. Diaspora investment is also playing a growing role, particularly in the residential and short-let segments .

The Nigeria Real Estate and PropTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as PropertyPro.ng, LandWey Investment Limited, Estate Intel, Nigerian Property Centre, Adron Homes & Properties, RevolutionPlus Property, Alpha Mead Group, 3Invest, FBNQuest, Knight Frank Nigeria, Broll Nigeria, Mixta Africa, Eko Atlantic City, Urban Shelter Limited, Octo5 Holdings, Northcourt Real Estate, RentSmallSmall, Fibre.ng, Muster, Shelternest contribute to innovation, geographic expansion, and service delivery in this space.

The Nigeria real estate and PropTech market is poised for significant transformation as urbanization accelerates and technology adoption increases. In future, the integration of smart technologies and sustainable practices is expected to reshape property development, catering to the evolving needs of urban dwellers. Additionally, the government's commitment to improving infrastructure and regulatory frameworks will likely enhance investor confidence, fostering a more conducive environment for growth. As these trends unfold, the market is set to attract further investments and innovation, driving long-term sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Mixed-Use Developments Land Sales Real Estate Investment Trusts (REITs) Short-Let Apartments & Serviced Residences PropTech Solutions (Digital Platforms, Smart Buildings) |

| By End-User | Individual Home Buyers Real Estate Investors Corporations Government Agencies Diaspora Investors |

| By Sales Channel | Direct Sales Online Platforms Real Estate Agents Auctions PropTech Marketplaces |

| By Financing Type | Mortgages Cash Purchases Government Loans Private Equity Crowdfunding & FinTech Solutions |

| By Property Management Type | Self-Managed Properties Third-Party Managed Properties Institutional Management Tech-Enabled Management Services |

| By Geographic Distribution | Urban Areas (Lagos, Abuja, Port Harcourt) Suburban Areas Rural Areas |

| By Investment Size | Small Investments Medium Investments Large Investments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Buyers | 100 | First-time Homebuyers, Real Estate Investors |

| Commercial Property Investors | 60 | Corporate Real Estate Managers, Investment Analysts |

| PropTech Startups | 40 | Founders, Product Managers, Technology Officers |

| Real Estate Agents and Brokers | 80 | Licensed Real Estate Agents, Brokerage Owners |

| Government Housing Officials | 40 | Policy Makers, Urban Planners, Housing Authority Representatives |

The Nigeria Real Estate and PropTech Market is valued at approximately USD 2 trillion, driven by rapid urbanization, a growing population exceeding 220 million, and increasing demand for housing and commercial spaces.