Region:Asia

Author(s):Geetanshi

Product Code:KRAB5819

Pages:81

Published On:October 2025

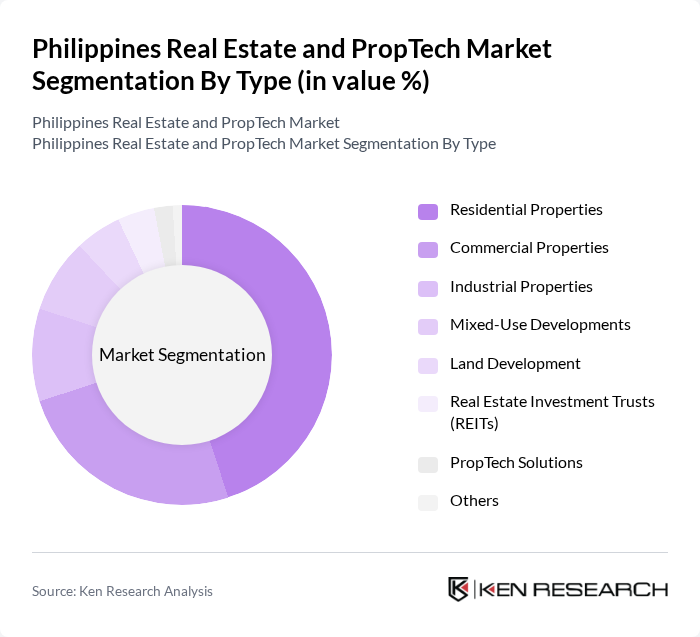

By Type:The market is segmented into Residential Properties, Commercial Properties, Industrial Properties, Mixed-Use Developments, Land Development, Real Estate Investment Trusts (REITs), PropTech Solutions, and Others.Residential Propertiesdominate the market, driven by strong urban migration, population growth, and the rising demand for affordable and mid-range housing. Developers are increasingly focusing on vertical developments and gated communities to meet the needs of urban residents, while mixed-use projects are gaining traction for their convenience and integration of living, working, and leisure spaces .

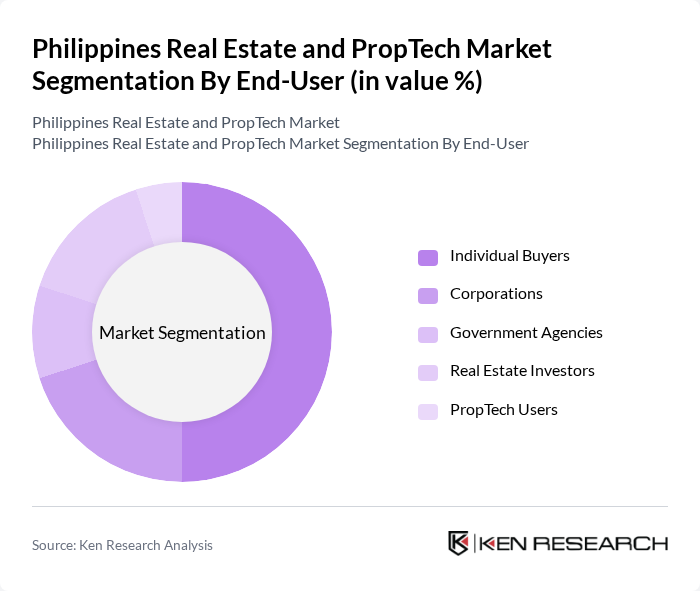

By End-User:The end-user segmentation includes Individual Buyers, Corporations, Government Agencies, Real Estate Investors, and PropTech Users.Individual Buyersare the leading segment, reflecting the increased number of first-time homebuyers and the persistent demand for affordable housing options. The growth is further supported by rising household incomes, government housing programs, and strong remittance inflows from overseas Filipino workers, which continue to fuel residential property acquisitions .

The Philippines Real Estate and PropTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ayala Land, Inc., SM Prime Holdings, Inc., Megaworld Corporation, Robinsons Land Corporation, DMCI Homes, Vista Land & Lifescapes, Inc., Federal Land, Inc., Rockwell Land Corporation, Century Properties Group, Inc., Property Company of Friends, Inc. (PRO-FRIENDS), Ortigas Land, Filinvest Land, Inc., Aboitiz InfraCapital, Inc., DoubleDragon Properties Corp., 8990 Holdings, Inc., Lamudi Philippines (PropTech), ZipMatch (PropTech), Property24 Philippines (PropTech), Ohmyhome Philippines (PropTech), KMC Savills, Inc. (Commercial Brokerage/PropTech) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines real estate market is poised for significant transformation driven by urbanization, technological advancements, and evolving consumer preferences. As the population continues to migrate to urban areas, demand for diverse housing options will rise. Additionally, the integration of smart technologies and sustainable practices in property development will likely attract environmentally conscious investors. The government’s commitment to infrastructure development will further enhance connectivity, making real estate investments more appealing and fostering a robust market environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Mixed-Use Developments Land Development Real Estate Investment Trusts (REITs) PropTech Solutions (e.g., property listing platforms, digital transaction services, smart building technologies) Others |

| By End-User | Individual Buyers Corporations Government Agencies Real Estate Investors PropTech Users (brokers, agents, developers adopting technology) |

| By Sales Channel | Direct Sales Online Platforms (Lamudi, DotProperty, Property24, ZipMatch) Real Estate Brokers Auctions |

| By Financing Type | Cash Purchases Mortgages Lease Financing |

| By Property Size | Small Scale Medium Scale Large Scale |

| By Geographic Location | Metro Manila Luzon Visayas Mindanao |

| By Investment Type | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Venture Capital/Private Equity in PropTech Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Buyers | 120 | First-time Homebuyers, Investors |

| Commercial Property Investors | 90 | Real Estate Investment Trust Managers, Corporate Buyers |

| PropTech Adoption Insights | 60 | Startup Founders, Chief Technology Officers |

| Rental Market Trends | 100 | Property Managers, Landlords |

| Urban Development Stakeholders | 50 | City Planners, Local Government Officials |

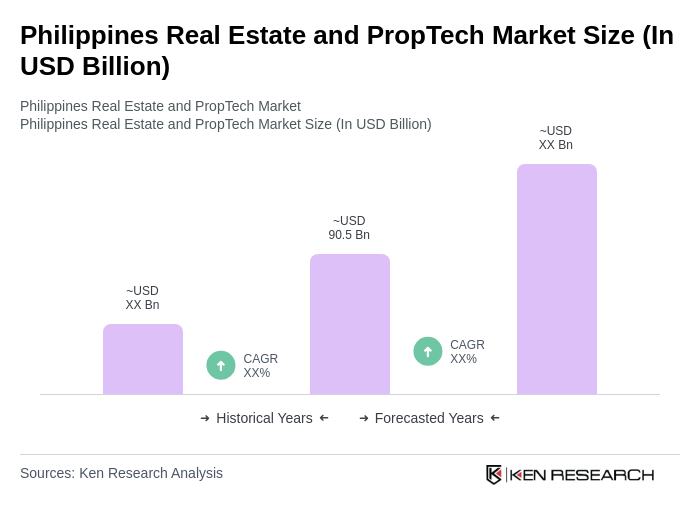

The Philippines Real Estate and PropTech Market is valued at approximately USD 90.5 billion, driven by urbanization, a growing middle class, and increased foreign investments in real estate and technology sectors.