Region:Africa

Author(s):Shubham

Product Code:KRAB3886

Pages:80

Published On:October 2025

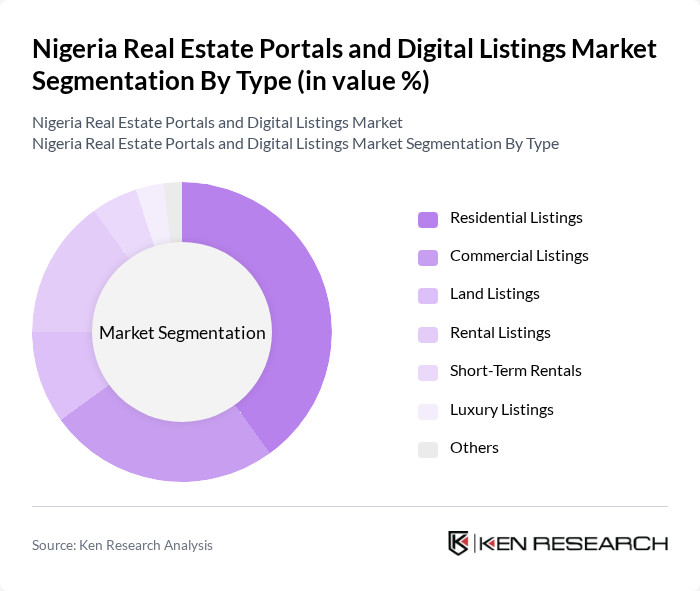

By Type:The market is segmented into various types, including Residential Listings, Commercial Listings, Land Listings, Rental Listings, Short-Term Rentals, Luxury Listings, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse nature of the real estate market.

Among these segments, Residential Listings dominate the market due to the high demand for housing solutions in urban areas. The increasing population and urban migration have led to a surge in residential property searches, making this segment the most significant contributor to market growth. Additionally, the rise of digital platforms has made it easier for individuals to access residential listings, further driving consumer engagement and transactions.

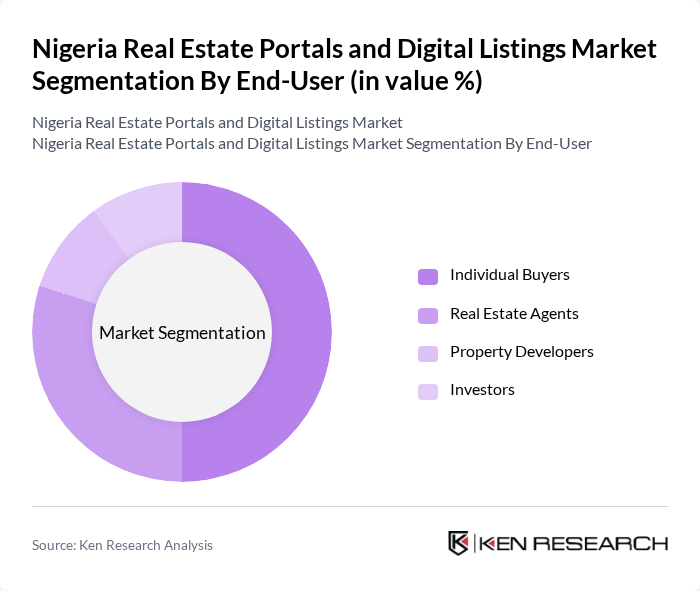

By End-User:The market is segmented by end-users, including Individual Buyers, Real Estate Agents, Property Developers, and Investors. Each group has distinct needs and preferences, influencing their engagement with digital listings.

Individual Buyers represent the largest segment in the market, driven by the increasing number of first-time homebuyers and the growing trend of digital property searches. The convenience of online listings allows buyers to compare properties easily, making this segment crucial for market dynamics. Real Estate Agents also play a significant role, leveraging digital platforms to reach potential clients and streamline their operations.

The Nigeria Real Estate Portals and Digital Listings Market is characterized by a dynamic mix of regional and international players. Leading participants such as PropertyPro.ng, Jumia House, Nigeria Property Centre, ToLet.com.ng, RentSmallSmall, MyProperty.ng, Property24, Landlord.ng, Real Estate Mall, Estate Intel, 247RealEstate, NairaLand, Property Finder, Homes.ng, Bungalow.ng contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's real estate portals and digital listings market appears promising, driven by technological advancements and increasing consumer acceptance of online transactions. As mobile applications become more prevalent, users will benefit from enhanced accessibility and convenience. Additionally, the integration of artificial intelligence in property listings will streamline the search process, making it easier for buyers to find suitable options. These trends indicate a shift towards a more digital-centric real estate landscape, fostering growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Listings Commercial Listings Land Listings Rental Listings Short-Term Rentals Luxury Listings Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors |

| By Sales Channel | Online Portals Mobile Applications Social Media Platforms Offline Agencies |

| By Pricing Model | Subscription-Based Pay-Per-Listing Freemium Models |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By User Demographics | Age Groups Income Levels Family Size |

| By Customer Engagement Level | Active Users Occasional Users New Users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time Home Buyers, Investors |

| Commercial Property Investors | 100 | Real Estate Developers, Corporate Buyers |

| Real Estate Agents | 80 | Licensed Real Estate Professionals, Brokers |

| Property Renters | 120 | Young Professionals, Families |

| Digital Listing Platform Users | 90 | Frequent Users, Casual Browsers |

The Nigeria Real Estate Portals and Digital Listings Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, internet penetration, and demand for affordable housing solutions.