Region:Africa

Author(s):Rebecca

Product Code:KRAA6365

Pages:83

Published On:September 2025

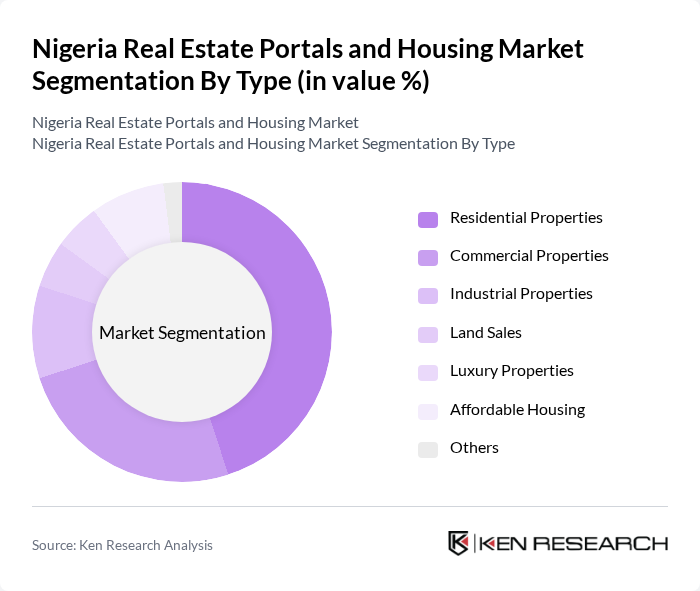

By Type:The market is segmented into various types, including Residential Properties, Commercial Properties, Industrial Properties, Land Sales, Luxury Properties, Affordable Housing, and Others. Among these, Residential Properties dominate the market due to the high demand for housing driven by urban migration and population growth. The trend towards urban living has led to a surge in demand for apartments and houses, making this segment the most significant contributor to market revenue.

By End-User:The end-user segmentation includes First-time Home Buyers, Real Estate Investors, Corporates, and Government Agencies. First-time Home Buyers represent the largest segment, driven by the increasing number of young professionals entering the housing market. This demographic is often looking for affordable options, which has led to a rise in demand for new developments and affordable housing projects.

The Nigeria Real Estate Portals and Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as PropertyPro.ng, Jumia House, Nigeria Property Centre, ToLet.com.ng, RentSmallSmall, MyProperty.ng, 247RealEstate, LandWey, Estate Intel, PropertyMall, Real Estate Mall, Property Finder Nigeria, Bungalow.ng, NairaLand, PropertyGurus contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's real estate market appears promising, driven by ongoing urbanization and technological advancements. As the population continues to grow, the demand for housing will likely increase, prompting further investment in affordable housing projects. Additionally, the integration of smart technologies and sustainable practices in construction will shape the market landscape. Real estate portals will play a crucial role in facilitating these developments, enhancing user engagement and streamlining property transactions across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Land Sales Luxury Properties Affordable Housing Others |

| By End-User | First-time Home Buyers Real Estate Investors Corporates Government Agencies |

| By Sales Channel | Online Portals Real Estate Agents Direct Sales Auctions |

| By Price Range | Low-End Properties Mid-Range Properties High-End Properties |

| By Location | Urban Areas Suburban Areas Rural Areas |

| By Property Condition | New Developments Resale Properties Foreclosed Properties |

| By Financing Type | Cash Purchases Mortgages Lease-to-Own Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time home buyers, Investors |

| Rental Market Participants | 100 | Tenants, Landlords |

| Real Estate Agents | 80 | Real estate brokers, Sales agents |

| Property Developers | 70 | Construction managers, Project developers |

| Government Housing Officials | 50 | Urban planners, Policy makers |

The Nigeria Real Estate Portals and Housing Market is valued at approximately USD 4.5 billion, driven by urbanization, population growth, and increasing demand for housing solutions. The market has seen significant growth due to the rise of digital platforms facilitating real estate transactions.