Region:Africa

Author(s):Geetanshi

Product Code:KRAA0175

Pages:85

Published On:August 2025

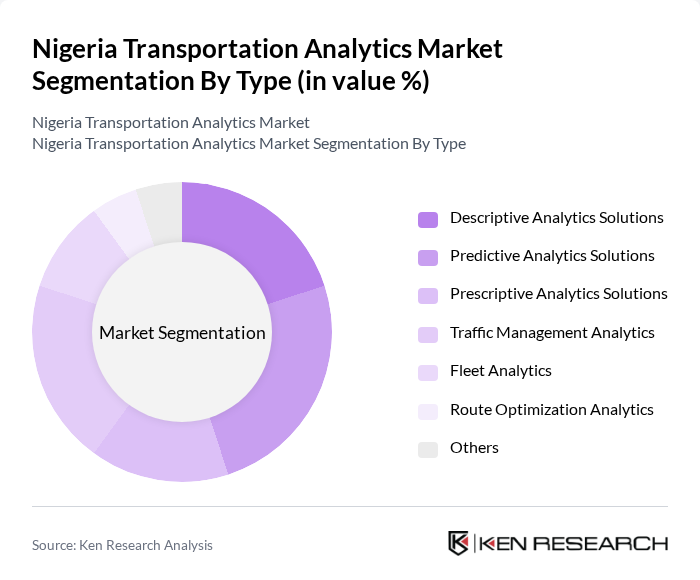

By Type:The market is segmented into various types of analytics solutions that address different operational and strategic needs within the transportation sector. The subsegments include Descriptive Analytics Solutions (for historical data analysis and reporting), Predictive Analytics Solutions (for forecasting demand and disruptions), Prescriptive Analytics Solutions (for recommending optimal actions), Traffic Management Analytics (for real-time congestion and flow optimization), Fleet Analytics (for monitoring and optimizing vehicle performance), Route Optimization Analytics (for improving delivery and travel efficiency), and Others (including safety and compliance analytics). Each of these subsegments plays a vital role in enhancing operational efficiency, reducing costs, and supporting data-driven decision-making .

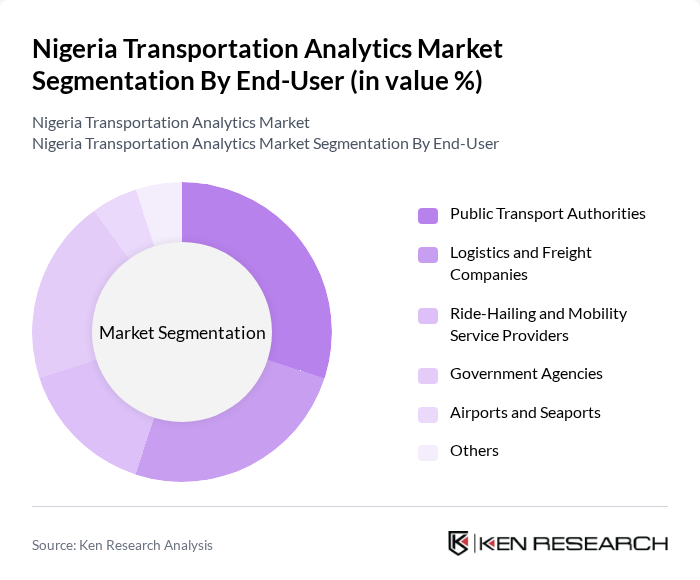

By End-User:The end-user segmentation includes diverse stakeholders in the transportation sector, such as Public Transport Authorities (for city and regional transit systems), Logistics and Freight Companies (for supply chain and delivery optimization), Ride-Hailing and Mobility Service Providers (for real-time demand and route analytics), Government Agencies (for policy and infrastructure planning), Airports and Seaports (for passenger and cargo flow management), and Others (including private fleet operators and infrastructure developers). Each of these end-users leverages transportation analytics to improve service delivery, operational efficiency, regulatory compliance, and customer satisfaction .

The Nigeria Transportation Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Interswitch Group, GIG Logistics, Max.ng, Kobo360, Uber Nigeria, Bolt Nigeria, Nigerian Railway Corporation, Lagos State Traffic Management Authority (LASTMA), DHL Nigeria, FedEx Red Star Express, Jumia Logistics, OPay, Konga, NIPOST (Nigerian Postal Service), Transport Services Limited (TSL) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigeria transportation analytics market appears promising, driven by ongoing urbanization and government initiatives aimed at infrastructure improvement. As the demand for smart transportation solutions grows, the integration of advanced technologies such as AI and IoT will become increasingly vital. Additionally, the rise of e-commerce and smart city projects will further propel the need for data-driven decision-making, enabling stakeholders to optimize logistics and enhance overall transportation efficiency in the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Solutions Predictive Analytics Solutions Prescriptive Analytics Solutions Traffic Management Analytics Fleet Analytics Route Optimization Analytics Others |

| By End-User | Public Transport Authorities Logistics and Freight Companies Ride-Hailing and Mobility Service Providers Government Agencies Airports and Seaports Others |

| By Region | Northern Nigeria Southern Nigeria Eastern Nigeria Western Nigeria |

| By Technology | IoT-based Analytics Cloud-based Analytics Big Data Analytics AI and Machine Learning Analytics Edge Computing Analytics Others |

| By Application | Traffic Flow Optimization Freight and Logistics Management Public Transport Optimization Incident and Emergency Response Analytics Infrastructure Planning and Asset Management Others |

| By Investment Source | Private Investments Government Funding International Aid Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Research and Development Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Services | 100 | Fleet Managers, Logistics Coordinators |

| Rail Freight Operations | 60 | Railway Operations Managers, Supply Chain Analysts |

| Air Cargo Services | 40 | Airline Cargo Managers, Freight Forwarders |

| Maritime Transport Sector | 50 | Port Authorities, Shipping Line Executives |

| Urban Public Transport Systems | 70 | City Transport Planners, Public Transit Managers |

The Nigeria Transportation Analytics Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by urbanization, government initiatives, and the adoption of advanced technologies in logistics and public transport.