Region:Asia

Author(s):Shubham

Product Code:KRAA0690

Pages:98

Published On:August 2025

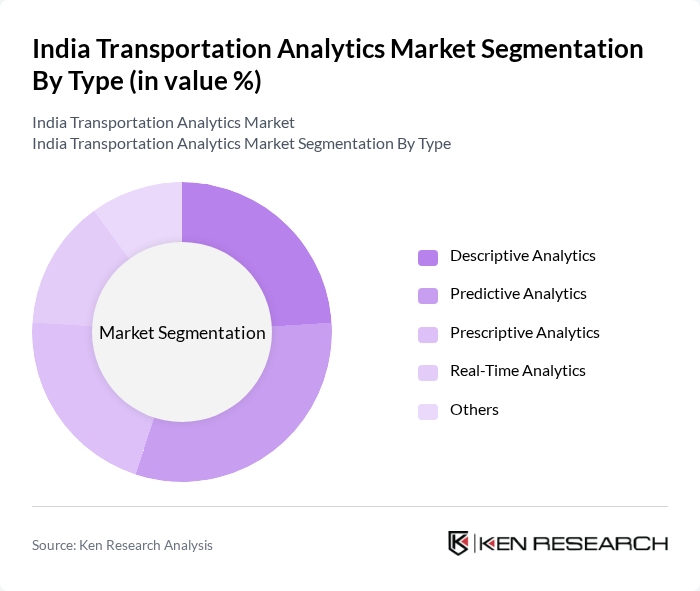

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Real-Time Analytics, and Others. Each of these sub-segments plays a crucial role in enhancing transportation efficiency and decision-making. Descriptive analytics helps stakeholders understand historical trends, predictive analytics forecasts future scenarios, prescriptive analytics recommends optimal actions, and real-time analytics enables immediate response to dynamic transportation challenges .

The Predictive Analytics sub-segment is currently dominating the market due to its ability to forecast future trends and behaviors based on historical data. This capability is particularly valuable for logistics companies and government agencies, as it allows for proactive decision-making and resource allocation. The increasing adoption of machine learning and AI technologies further enhances the effectiveness of predictive analytics, making it a preferred choice among stakeholders in the transportation sector .

By Component:The market is divided into Solutions and Services. Solutions include Traffic Management Systems, Parking Management, Integrated Supervision Systems, and more, while Services encompass Business Services, Professional Services, and Cloud Services. Solutions focus on the deployment of hardware and software for real-time data collection and analysis, while Services provide ongoing support, consulting, and cloud-based analytics capabilities .

The Solutions segment is leading the market, primarily due to the increasing demand for integrated systems that enhance traffic management and optimize parking solutions. As urban areas continue to grow, the need for effective traffic control and management systems becomes critical. Additionally, advancements in IoT and smart technologies are driving the adoption of these solutions, making them indispensable for modern transportation infrastructure .

The India Transportation Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Consultancy Services, Wipro Limited, Infosys Limited, Tech Mahindra, L&T Technology Services, Capgemini, IBM India, Accenture, Siemens India, Oracle India, Cognizant Technology Solutions, HCL Technologies, ZS Associates, Mu Sigma, Fractal Analytics, NEC Corporation India, Hitachi India, Bosch India, KPIT Technologies, Cubic Transportation Systems India contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India Transportation Analytics Market appears promising, driven by technological advancements and increasing investments in smart infrastructure. The integration of AI and machine learning is expected to enhance predictive analytics capabilities, improving operational efficiency. Furthermore, the rise of electric vehicles and the development of smart cities will create new avenues for analytics applications, fostering innovation and collaboration among stakeholders. As urbanization continues, the demand for data-driven solutions will likely intensify, shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Real-Time Analytics Others |

| By Component | Solutions (Traffic Management Systems, Parking Management, Integrated Supervision Systems, etc.) Services (Business Services, Professional Services, Cloud Services) |

| By Mode of Transportation | Roadways Railways Airways Maritime |

| By Application | Traffic Management Logistics Management Planning & Maintenance Mobility as a Service Public Transport Optimization Route Optimization Supply Chain Management |

| By End-User | Government Agencies Logistics Companies Public Transport Operators E-commerce Platforms |

| By Region | North India South India East India West India |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies for Technology Adoption Tax Incentives for Startups Grants for Research and Development |

| By Pricing Strategy | Subscription-Based Models Pay-Per-Use Models Tiered Pricing Structures |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Analytics | 100 | Fleet Managers, Logistics Coordinators |

| Rail Freight Management | 60 | Railway Operations Managers, Supply Chain Analysts |

| Air Cargo Analytics | 40 | Airline Cargo Managers, Freight Forwarders |

| Maritime Logistics Solutions | 50 | Port Authorities, Shipping Line Executives |

| Urban Mobility Solutions | 70 | City Planners, Transportation Policy Makers |

The India Transportation Analytics Market is valued at approximately USD 1.3 billion, driven by the increasing demand for data-driven decision-making, urbanization, and efficient logistics solutions, alongside government investments in digital infrastructure and smart city initiatives.