Region:North America

Author(s):Shubham

Product Code:KRAC0663

Pages:92

Published On:August 2025

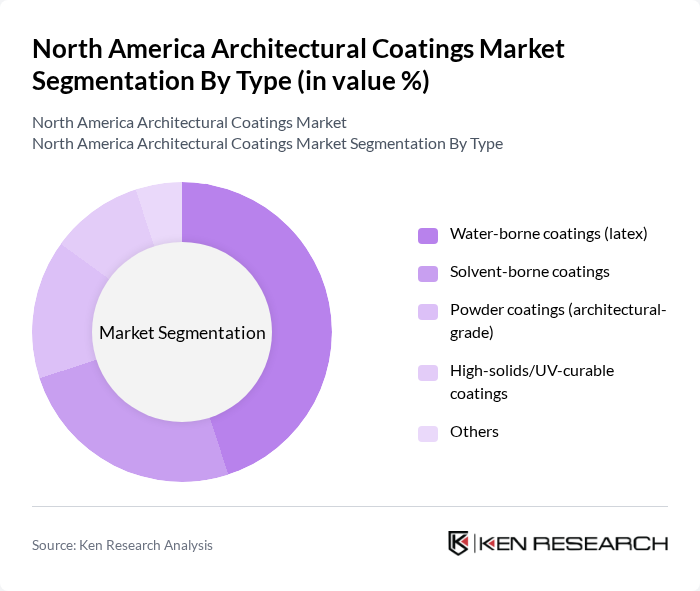

By Type:The market is segmented into various types of coatings, including water-borne coatings (latex), solvent-borne coatings, powder coatings (architectural-grade), high-solids/UV-curable coatings, and others. Among these, water-borne coatings are gaining significant traction due to their eco-friendliness and ease of application, making them the leading subsegment in the market.

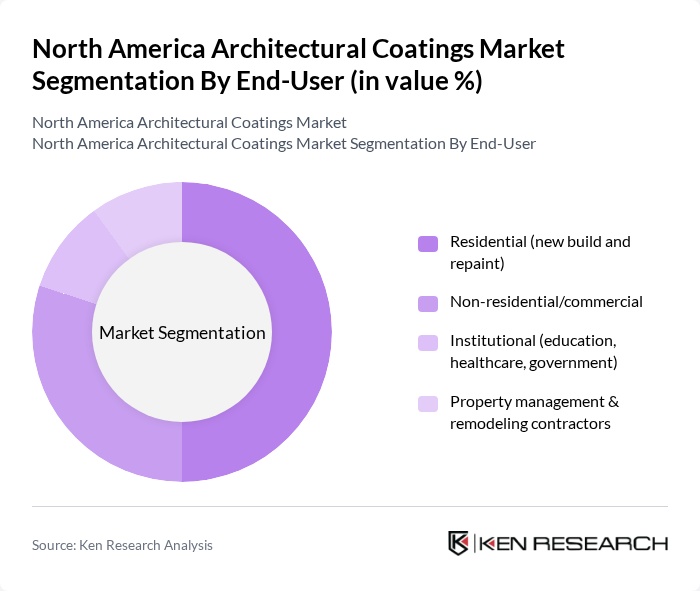

By End-User:The end-user segmentation includes residential (new build and repaint), non-residential/commercial, institutional (education, healthcare, government), and property management & remodeling contractors. The residential segment is the most significant, driven by a surge in home renovations and new constructions, reflecting changing consumer preferences towards personalized living spaces and ongoing retrofit activity.

The North America Architectural Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Sherwin-Williams Company, PPG Industries, Inc., Benjamin Moore & Co. (Berkshire Hathaway), Behr Process Corporation (Masco Corporation), RPM International Inc. (including Rust-Oleum, Zinsser), AkzoNobel N.V. (Dulux brand in Canada), Dunn-Edwards Corporation (Nippon Paint Holdings), Kelly-Moore Paints, Cloverdale Paint Inc., Nippon Paint Holdings Co., Ltd., Jotun A/S, Diamond Vogel Paints, PPG’s Valspar (now part of Sherwin-Williams) — legacy brand, MasterChem Brands LLC (KILZ), Axalta Coating Systems Ltd. (architectural powder coatings) contribute to innovation, geographic expansion, and service delivery in this space.

The North American architectural coatings market is poised for transformative growth, driven by a strong emphasis on sustainability and technological innovation. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest heavily in R&D to develop advanced formulations. Additionally, the ongoing expansion in the construction sector will create new opportunities for coatings applications. Companies that adapt to these trends and leverage digital marketing strategies will be well-positioned to capture market share in the evolving landscape of future and beyond.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-borne coatings (latex) Solvent-borne coatings Powder coatings (architectural-grade) High-solids/UV-curable coatings Others |

| By End-User | Residential (new build and repaint) Non-residential/commercial Institutional (education, healthcare, government) Property management & remodeling contractors |

| By Application | Interior wall & ceiling paints Exterior façade & siding paints Primers & sealers Wood finishes & stains Roof, masonry, and elastomeric coatings |

| By Distribution Channel | Company-owned stores (brand stores) Home improvement retail (DIY big-box) Independent dealers E-commerce/direct online Distributors/wholesale |

| By Price Range | Economy Mid-range Premium Super-premium |

| By Region | United States Canada Mexico |

| By Product Formulation (Resin) | Acrylic/latex Alkyd Epoxy Polyurethane Vinyl acetate/Vinyl acrylic (PVA/VA) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Architectural Coatings | 150 | Homeowners, Contractors, Interior Designers |

| Commercial Architectural Coatings | 120 | Facility Managers, Architects, Project Managers |

| Industrial Coatings Applications | 90 | Manufacturing Engineers, Procurement Specialists |

| Eco-friendly Coatings Segment | 70 | Sustainability Officers, Product Development Managers |

| Coatings Distribution Channels | 90 | Distributors, Retail Managers, Supply Chain Analysts |

The North America Architectural Coatings Market is valued at approximately USD 21 billion, primarily driven by the robust construction sectors in the United States, Canada, and Mexico, along with a growing demand for sustainable and eco-friendly products.